The most dangerous phrase in finance!

9th October 2018 11:53

by Graeme Evans from interactive investor

It might not be what you expect, but one top analyst warns that this favourite piece of advice could ruin your financial health. Graeme Evans reports.

"Buy low, sell high" sounds like common sense, but is this catchy, oft-repeated stockmarket adage actually good advice for investors?

Not according to UBS investment strategist Justin Waring, whose damning verdict on this "buying the dips" maxim goes as far as to label it the most dangerous phrase in finance.

Striking a blow at many of those "10 ways to make a fortune" type videos on YouTube, Waring wrote: "It's actually terrible advice in most situations".

He says the chief problem is that waiting for a market drop and selling out at all-time highs means that you're invested during the bulk of each bear market but also miss out on most of the bull market gains.

Waring points out that a symmetry of returns - up 50% of the time, down 50% of the times - simply doesn't match up with reality.

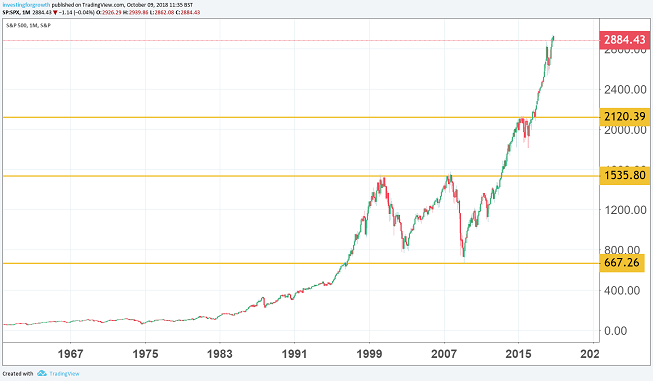

In fact, bull markets are more common and persistent than we probably think. Going as far back as 1960, the S&P 500 has set record highs on a monthly basis for a third of the time and is within 5% of its all-time high about 26% of the time.

Source: TradingView Past performance is not a guide to future performance

And even if markets do provide a higher return after a drop, the cost of waiting is likely to negate any benefit.

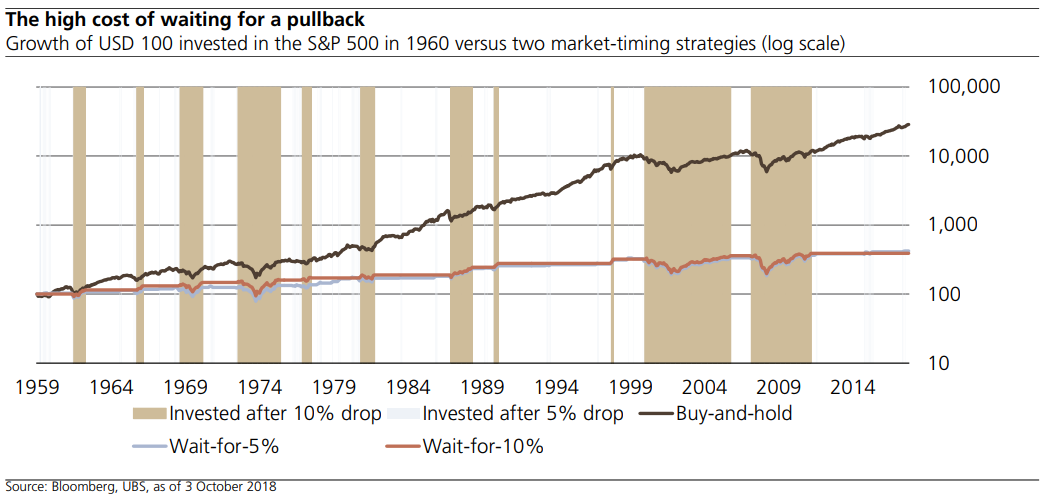

Waring underlines his point in emphatic fashion by crunching the numbers on three different scenarios. The first is the classic "buy-and-hold" approach, while the second involves selling with the S&P 500 at a new all-time high and buying back into the market after a 5% drop.

The third strategy is similar to the second, but with a 10% correction before buying back.

Starting in 1960 and based on a US$100 investment, the "wait-for-5%" strategy would now be worth $422, while the 10% strategy would be just $390. In contrast, the S&P 500 investment grew 10% a year, turning $100 into $28,645.

While Waring concedes that most investors don't do this with their whole portfolio, he recognises that they do tend to hesitate on putting savings to work due to the mental accounting bias.

He said:

"Trying to avoid the feeling of "bad timing" can be costly, and diversification already offers protection. We recommend putting deposits to work quickly, and avoid waiting for a 'dip'".

This advice is worth remembering at a time when we're in the midst of the longest bull market since the war and investors are turning increasingly jittery about how and when the market will turn.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.