My favourite cannabis stock to tuck away

After plunging from record highs, our overseas investing expert looks for bargains in this new sector.

2nd October 2019 10:15

by Rodney Hobson from interactive investor

After plunging from record highs, our overseas investing expert looks for bargains in this new sector.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

My advice to investors last December to avoid the medicinal cannabis sector looked badly misplaced in the first three or four months of 2019 when shares shot up across the board. However, the gains were only for those with a short-term perspective. Stocks are now back to pre-Christmas levels or lower, opening up the question of whether they are worth considering again.

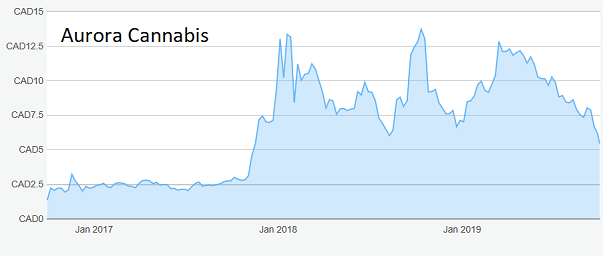

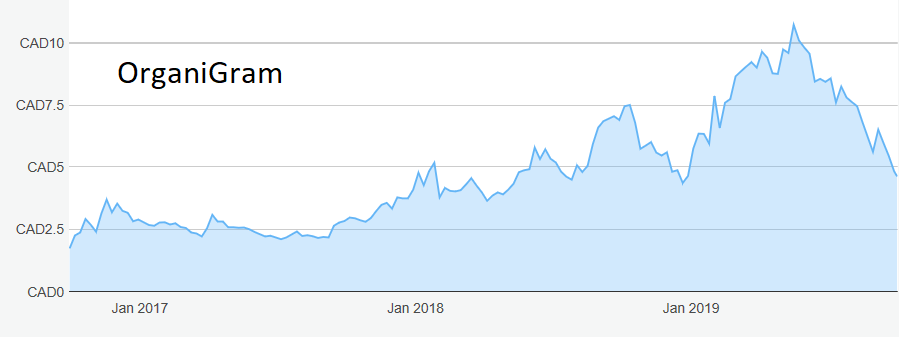

Let's take three popular examples: OrganiGram Holdings (TSE:OGI) shot from around C$4.40 to C$10.70 before collapsing just as rapidly back to C$4.65; Aurora Cannabis (TSE:ACB) more than doubled from C$6.20 to C$13.20 before sliding all the way back and a bit further to C$5.50; Canopy Growth (TSE:WEED) followed a similar pattern from C$36 to C$70 but is now trading below C$30.

Source: interactive investor Past performance is not a guide to future performance

Medicinal cannabis is a great growth market that is only in its early stages. It has also attracted a number of smaller players, so there will be great opportunities for the big boys to buy established revenue as well as pursuing organic growth.

An aging population will undoubtedly demand increased access to pain relief, and the stigma around cannabis as a recreational drug will gradually lessen as governments, doctors and patients come to accept that cannabis as a medication is a very different substance from the stuff you can buy on a dimly lit street corner.

Medicinal cannabis cuts out the psychedelic extract tetrahydrocannabinol and uses safer chemical compounds known as cannabinoids. More than 100 have been identified. Possible treatments include chronic pain, multiple sclerosis, epilepsy, Parkinson's disease, schizophrenia and arthritis.

Based on pre-clinical evidence, there are more than 37 disorders that could benefit from treatment with cannabis oil. That's a big range of possible uses. The potential market can be counted in billions of dollars.

However, there are many caveats. These are early days and much more research and clinical trials are needed. This is an expensive process with no guarantee that new drugs will pass stringent tests to demonstrate they are safe and effective.

Shareholders could also be called on to put up extra cash through rights issues to fund this research or, as has tended to happen so far, face dilution through the issuing of new shares. Dividends are low on the agenda at this stage.

Expensive security measures have to be taken to ensure drug dealers cannot gain access to the crops, while the manufacturing process, which extracts only a small amount of cannabinoid from each plant, must be carried out in strictly controlled sterile conditions.

Aurora has been particularly successful in growing revenue, partly through acquisitions, and that was reflected in the second quarter when takings multiplied five times to C$98.9 million, but there was a net loss of C$193,000, not a vast sum but a negative nonetheless and one that is heading further in the wrong direction. The C$172.7 million cash pile at the end of June is dwindling.

Source: interactive investor Past performance is not a guide to future performance

OrgamiGram saw sales soar a remarkable 784% in the latest quarter compared with the same period last year but, like Aurora, it has seen margins squeezed. Canopy Growth raised revenue by 250% in the latest quarter to C$90.5 million but operating losses quadrupled to C$123.1 million.

Source: interactive investor Past performance is not a guide to future performance

Hobson's choice: OrgamiGram looks the best bet for long-term investors. At least it is making a profit and, while the rise in revenue will tail off sharply, forecasts for the next financial year suggest profits will double to C$40 million. Canopy Growth is probably best avoided until there is news of a replacement for chief executive Bruce Linton, who departed in July after spearheading the group's spectacular growth.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.