Neil Woodford's Allied Minds has topsy-turvy session

4th December 2018 14:51

by Graeme Evans from interactive investor

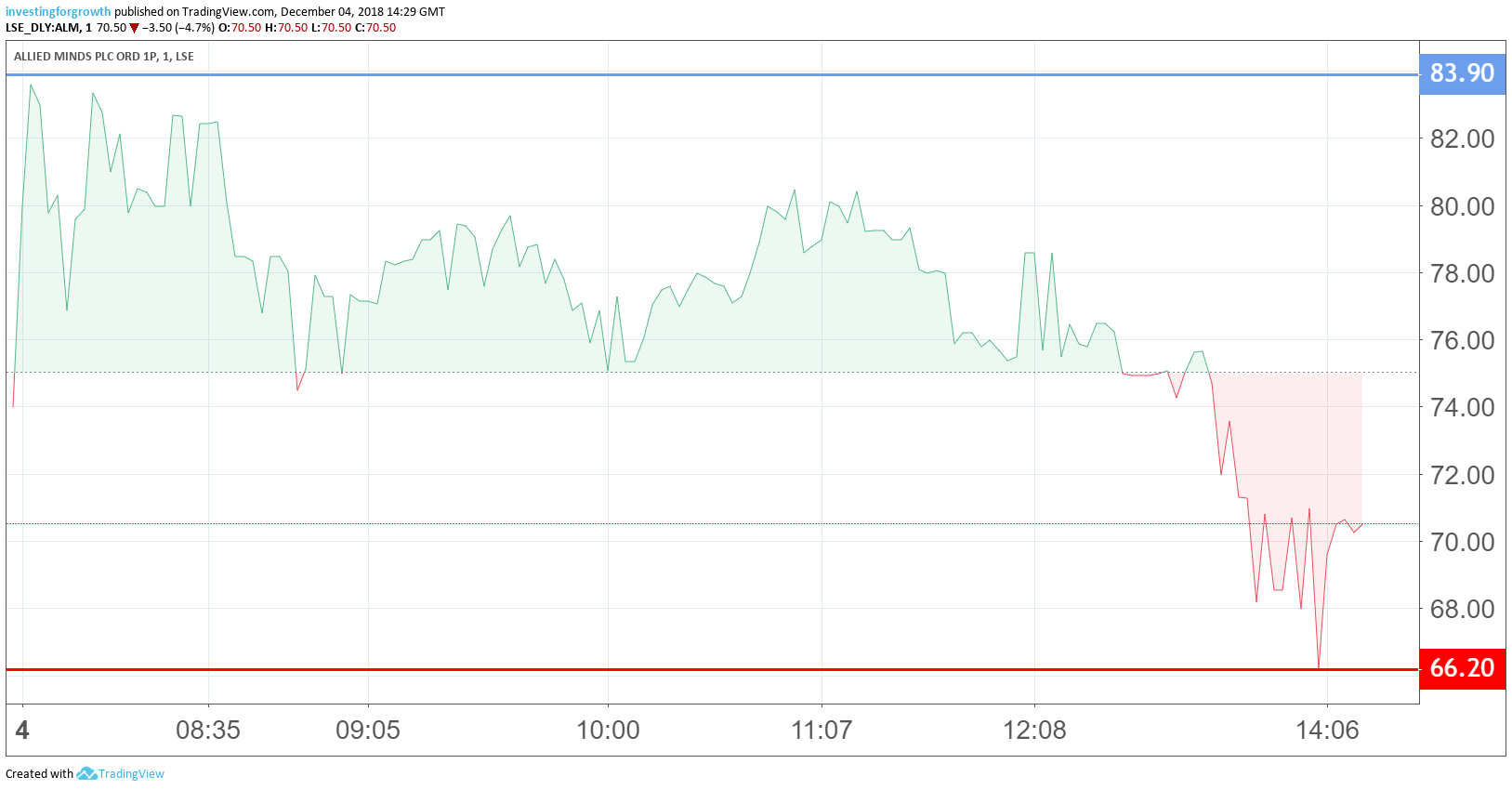

They've more than doubled in one week, but are all over the place during the latest session. Graeme Evans reveals what's causing this volatility.

Even though today's share price surge for Allied Minds became a damp squib, a positive update from one of its portfolio companies still serves as a welcome confidence boost for the listed business and its backer Neil Woodford.

Boston, US-based Allied, which funds technology and healthcare start-ups, saw its shares rocket 13% in early deals, taking a rally from last week's new low at 36.5p to 129%. However, the shares were down 10% on the day by mid-afternoon.

Allied shares are currently worth less than half the level of the firm’s highly-anticipated IPO in 2014, when shares were listed at 190p before jumping as high as 725p a year later.

Ever since 2015, Allied shares have been in a downward spiral after an activist New York hedge fund argued some of its start-ups were significantly overvalued. Write-downs and a restructuring under new chief executive Jill Smith have followed, with Allied now built around 12 portfolio companies.

Source: TradingView (*) Past performance is not a guide to future performance

One of the leading six ventures in this line-up is HawkEye 360, which is developing radio frequency (RF) technology to help monitor global activity across air, land and sea and assist with emergencies.

It is planning a constellation of small satellites in low Earth orbit that will collect information on specific radio signals worldwide to provide high-precision radio frequency mapping and analytics for clients' needs.

Today, it announced the successful launch of the company’s Pathfinder mission, which is its first cluster of three, formation-flying small satellites.

- FTSE reshuffle: Royal Mail and Neil Woodford in the thick of it

- Neil Woodford: A fresh look at Patient Capital trust

HawkEye 360 CEO John Serafini called the successful launch "the most biggest moment in our company's young history".

He added: "I am extremely proud of what our 30 person team has accomplished over the past three years. We combined our varied expertise in small satellites, signals processing, and data analytics to bring a new source of RF information to the market.

"This is the first time a commercial company has utilized formation flying satellites for RF detection."

Investors joined in the euphoria for a time as Allied Minds’ shares jumped by as much as 14% before settling back at just 2% higher at 75p.

Broker Jefferies, however, is more optimistic and has a ‘buy’ recommendation and target price of 99p. HawkEye 360 is not as closely watched or as big as other key investments in the portfolio, such as Spin Transfer technologies, but Jefferies said today’s update was potentially significant.

They said it could help validate HawkEye 360's technology and highlight potential user cases.

Jefferies added: "We see the launch paving the way for future commercialisation, and another boost to investors' confidence in Allied Minds, which remains deeply discounted despite validation and improved funding."

Woodford Investment Management is the biggest shareholder in Allied Minds, with a 27% stake. The fund manager, who has dismissed previous share price weakness as short-term noise, originally backed the company in 2007 when he was still at Invesco Perpetual.

*Horizontal lines on charts represent levels of previous technical support and resistance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.