New coronavirus poll: what investors are thinking and doing right now

Our research reveals more new money than ever is entering the stock market, and not just the UK.

2nd April 2020 17:07

by Jemma Jackson from interactive investor

Research by interactive investor reveals more of you than ever are committing new money to the stock market, and not just in the UK.

In the closing days of the 2019/20 ISA season, interactive investor has published its latest Wave 4 poll of 2,337 DIY investors, taken between 25 March and 1 April 2020. The poll aims to gauge how investors are responding to the stock market uncertainty and volatility amidst the coronavirus pandemic.

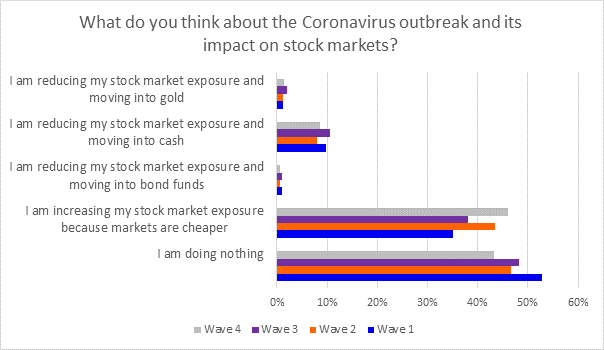

Since the first wave of research was conducted between 28 February and 2 March 2020, more investors than ever are now committing new money to the stock market (46% compared to 35% just over a month ago) “because markets are cheaper.”

Last week’s short-lived rally, combined with tax year end is also likely to be a factor as investors rush to use it, or lose it (although investors can put money into their investment ISAs without having to invest it straight away). Fewer investors than ever say they are doing nothing (43% - some 10 percentage points fewer than in Wave 1).

Lee Wild, Head of Equity Strategy, interactive investor, says: “The big takeaway from this latest round of research is the 10 percentage-point drop in people ‘doing nothing’ compared with our first poll a month ago, and that is reflected in the 11 percentage-point increase in respondents increasing market exposure.

“It’s possible that some of this enthusiasm may have come during last week’s brief rally, but not all – there are still plenty of buyers around it seems.

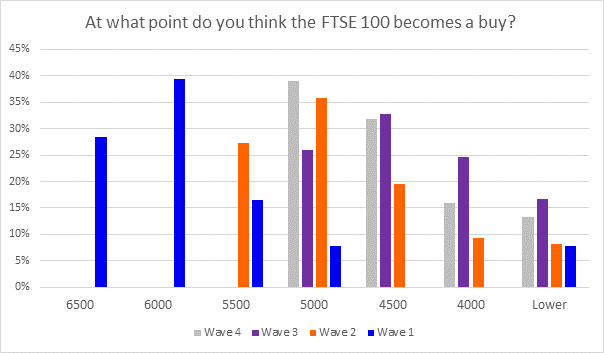

“In just a week, we have seen a 13 percentage-point jump to 39% in respondents thinking the FTSE 100 becomes a buy at 5,000. This likely reflects last week’s brief rally, with investors perhaps wishing for a second bite of the cherry at 5,000. With the market bottom impossible to call, they may get their wish.”

Broadening horizons

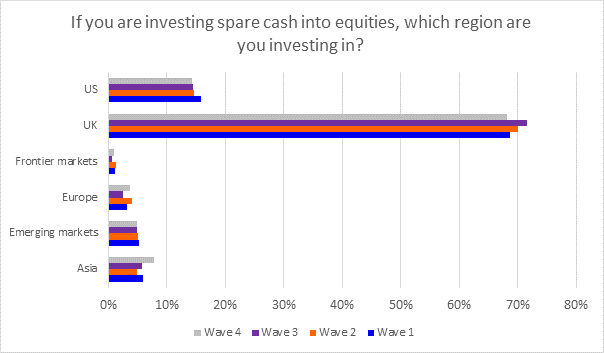

With a UK dividend drought, and some Asia countries arguably seeming to handle the pandemic better than many parts of the West, it is interesting to see a slight increase in the number of investors looking to Asia, which is up two percentage points to 8% in the latest Wave 4 round of research. This compares to 6% in Waves 1 and 3 of the research and 5% between 1-16 March in Wave 2.

Whilst just a week ago, Wave 3 of the research showed UK bias peaking at 72%, the latest Wave 4 poll sees investors starting to broaden their horizons, with 68% of investors now looking to the UK – whilst still a clear favourite, it is the lowest score the UK has seen yet.

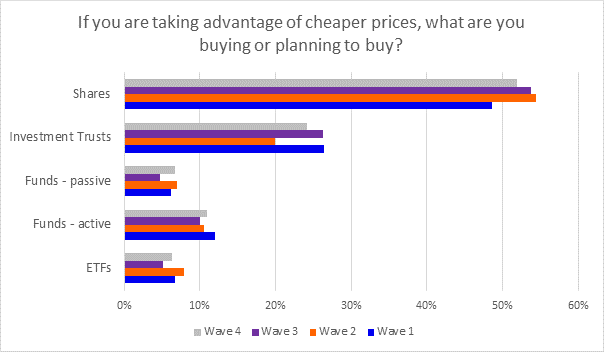

Investors are still tending to favour direct shares to take advantage of buying opportunities (52%), followed by investment trusts (24%).

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.