One of the major recovery stocks, even before crisis ends

We still have to eat whatever happens, and these shares may have bottomed out already.

1st April 2020 13:18

by Rodney Hobson from interactive investor

We still have to eat whatever happens, and these shares may have bottomed out already, writes our overseas investing expert.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

It has been out of the furnace and into the frying pan for agriculture specialist Corteva (NYSE:CTVA) in less than a year of existence. After the baptism of fire, life could become a lot easier long before the coronavirus crisis is over.

Corteva was formed in tortuous fashion in May 2019 from the agriculture division of DowDuPont, a conglomerate that had been built from the merger of two massive chemicals company, reorganised into three specialities then split up again. Corteva brought together the materials science division of Dow, and the specialty products division of DuPont, to form the largest purely agricultural group in the world with many of the best-known brands in the sector.

It is a leader in the development of new seeds, which generates approximately half of total company profits, and chemicals to protect crops. It operates globally, with revenue split fairly evenly between North America and the rest of the world.

An early worry after its formation was possible disruption from trade wars, particularly between the United States and China and also the escalation of tension between the US and Europe.

Food was likely to be a key factor, with China cutting back on imports from the US and President Trump and European Union leaders threatening tit-for-tat barriers.

That all seems ancient history now, although it was in full flood only last year. In the event, all parties pulled back from an all-out conflict, but the issue could re-emerge as countries rebuild their battered economies.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Corteva should get away lightly if that happens. It produces all its seeds locally so is less vulnerable to any disruption to supply chains. The production of chemicals is more diverse but again Corteva is not over-reliant on any particular country. In any case it has 12 month’s supply of chemicals in stock.

The coronavirus outbreak should be less of a worry. US farmers did cut back last year, planting the lowest number of acres since just after the financial crisis, but they are planning to ramp up the growing of crops this year and those plans should not be scaled back heavily, if at all, in the current economic uncertainty. Increased agricultural production is good news for a company such as Corteva with a well-balanced and diverse range of seeds. Planting should also hold up well in the rest of the world. We still have to eat.

Another positive is a project to attack the dominance of Bayer (XETRA:BAYN) in the $4 billion a year US soybean seed market, beginning this year. Corteva expects its Enlist E3 seed to make up 20% of the US crop in 2020.

Demand will also hold up for chemicals to control weeds, pest and disease as farmers seek to increase yields. Corteva has launched new chemical products that should boost revenue and margins, not just in 2020 but over the coming years as innovation continues.

It has a well-established pipeline for new products and last week it announced a collaboration with AgPlenys, a subsidiary of Evogene (NASDAQ:EVGN) to tackle the spread of weed resistance to herbicides.

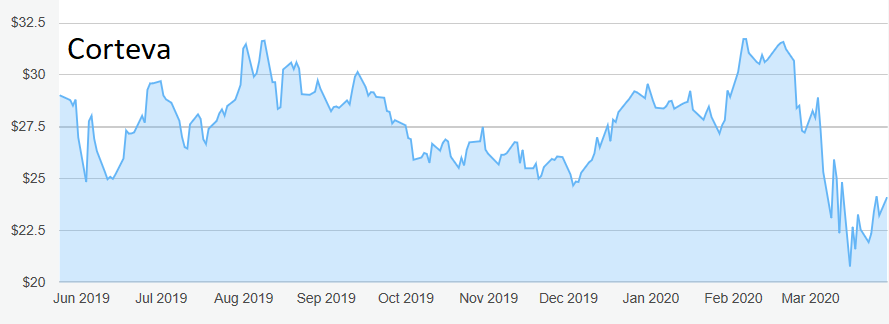

Source: interactive investor Past performance is not a guide to future performance

Corteva stock began trading last May at $29. It peaked at $31.63 in August, but the shares have been dragged down in the general market carnage, slumping from $31.22 on 20 February to a low of $22.50 on 19 March.

They have come off the bottom but only as far as $23.50. Some analysts reckon their underlying value is nearer to $40, which admittedly looks wildly optimistic at this point, although that level could well be reached some time next year.

Hobson’s choice: Buy Corteva up to the original level of $29. The shares look to have bottomed out and this should be among the major recovery stocks when markets eventually pick up again.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.