Palantir Technologies: about time it started making money

17th November 2021 09:17

by Rodney Hobson from interactive investor

Palantir is suffering from overhyped expectations that are clouding what is still a stellar performance. Our overseas investing expert gives his view on the stock.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Surging growth in sales and revenue, with figures beating analysts’ forecasts and leading to upgraded guidance for the full year, plus strong free cash flow sounds like a recipe for success. Yet quarterly results from Palantir Technologies (NYSE:PLTR) have been badly received. As the company has been a big favourite with interactive investor customers since it floated just over a year ago, this is a cause for concern.

Palantir has been operating from Denver, California, for nearly 20 years, building software platforms handing and analysing data for companies and for governments, mainly agencies of the United States federal government, including an important new contract with the US Army. Revenue comes largely from subscriptions to services hosted by Palantir.

Third-quarter revenue rose 36% year-on-year to $392 million, with sales to non-government entities double the level of 12 months ago. An additional 34 customers were recruited and, though that may not sound a lot, it is worth remembering that each contract is likely to be sizable as Palantir specialises in handling larger-scale data. The company now expects revenue to hit $318 million in the fourth quarter and to continue to grow by at least 30% a year until the end of 2025.

- Why I’m buying ‘value’ stocks and other top tips

- Ian Heslop's outlook for the US stock market in 2022

- Bill Ackman: hot sectors and the economy in 2022

A lot of issues surrounding Palantir boil down to whether investors see the pot as half empty or half full. One worry about the latest figures is that sales to government customers, by far the larger side of the business, actually declined compared with the particularly strong second quarter. Annual growth in government sales was still an impressive 34% but is seen as decelerating from a peak of 66%.

Palantir is suffering from overhyped expectations that are clouding what is still a stellar performance. It is clear that the commercial side is catching up and offers more scope for the future, even though some rivals have done better in this area so far. That would leave the group less vulnerable to losing any government contracts.

Then there are the strategic investments designed to identify and profit from sales opportunities. These brought in contracts worth $22 million in the first nine months and the trend is accelerating. Good news for the optimists; the pessimists worry that other sales are slowing down, possibly to below the 30% target.

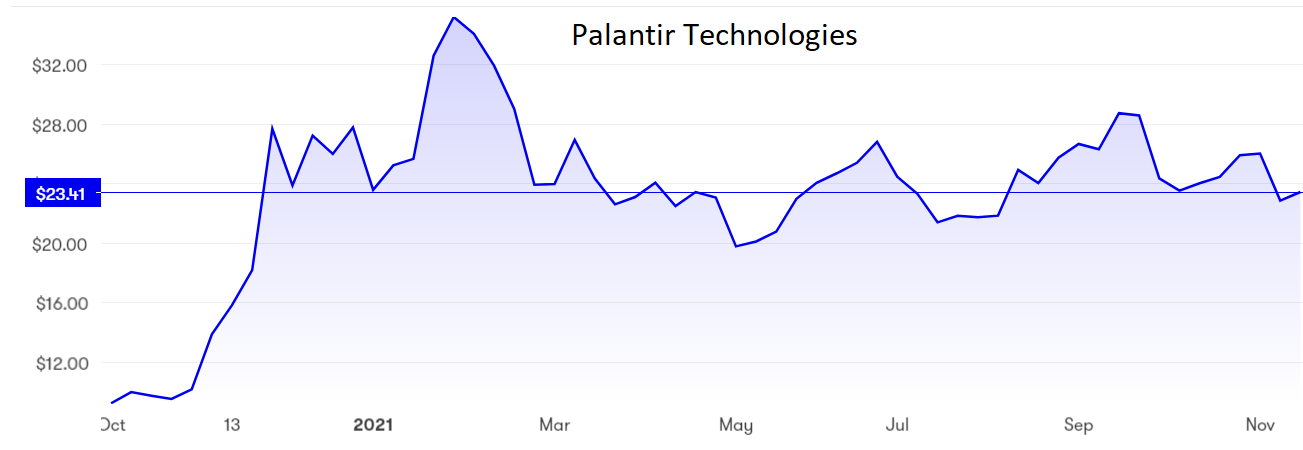

Source: interactive investor. Past performance is no guide to future performance

A sensible view is that if the strategic investments strategy is paying off then this argument comes down heavily on the side of the optimists. Sales are sales however they are achieved. What matters is the total picture.

Another concern is that employees are motivated by hefty allocations of shares which may be pushing the sales growth, but do mean that existing shareholders find their holdings are being continuously diluted. Palantir is stepping up investment in its sales teams and needs to deliver growth to justify this extra cost. It admits that average revenue per customer is likely to be squeezed.

These potential problems are swept aside by the Palantir board, which now suggests sales of $418 million in the fourth quarter, with 22% operating margins. That would take full-year revenue to $1.53 billion, representing annual growth of 40%. The guidance for free cash flow has been adjusted upwards significantly, from $300 million to $400 million.

- Bill Ackman: an industry as certain as food and oxygen

- Bill Ackman: why I've bet $100 billion on this event

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The biggest negative factor for shareholders is that Palantir continues to make a loss each quarter, $102 million this time. The figure is admittedly a big improvement on the $853 million loss in the third quarter of 2020 but it really is time that the company moved decisively into profit. The price/earnings ratio is so high it is meaningless.

Hobson’s choice: This is a tough call that depends heavily on whether Palantir can succeed in accelerating growth in its commercial division. Back in May I warned investors not to pay more than $22 for the stock and that still stands. On balance, though, the statistics favour selling given the uncertainties surrounding the company’s near-term prospects. At least consider taking some profits if you got in early.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.