Poll: here’s what you think about stocks and a coronavirus second spike

We asked investors whether or not they were worried about further capital loss and dividend cuts.

21st July 2020 13:13

by Jemma Jackson from interactive investor

Our latest poll asked investors whether or not they were worried about further capital loss and dividend cuts. Here’s what they said.

Despite the race for a coronavirus vaccine, there are no guarantees, and the timeline is uncertain. While coronavirus is first and foremost a human tragedy, it has also added to financial insecurity - and that goes for DIY private investors, too.

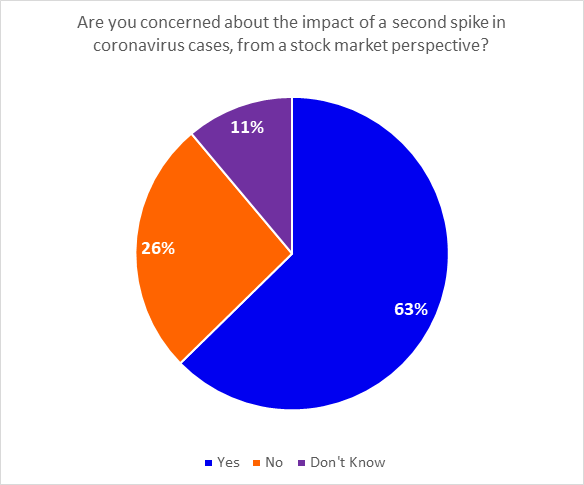

A poll of 1,872 investors by interactive investor, the UK’s second-largest direct-to-consumer investment platform, of website visitors between 17 and 20 July 2020, found that almost two thirds (63%) are worried about a coronavirus second spike from a stock market perspective.

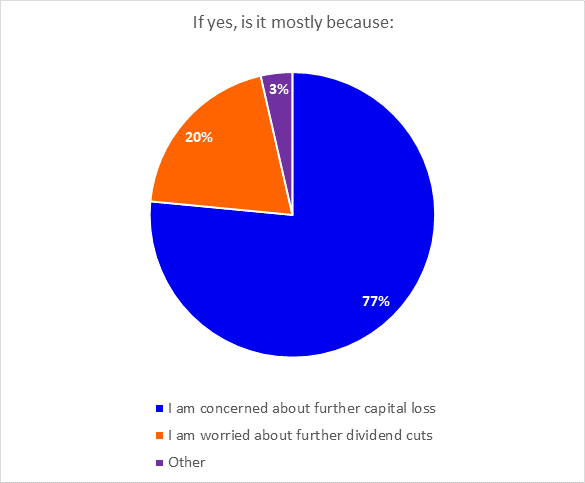

Of those worried, 77% are concerned about further capital loss to their portfolios, and with the FTSE All Share down 17.1% over the year to date, despite the 27.6% bounce back from the 23 March 2020 low, it is easy to understand why. A further 20% are worried about further dividend cuts.

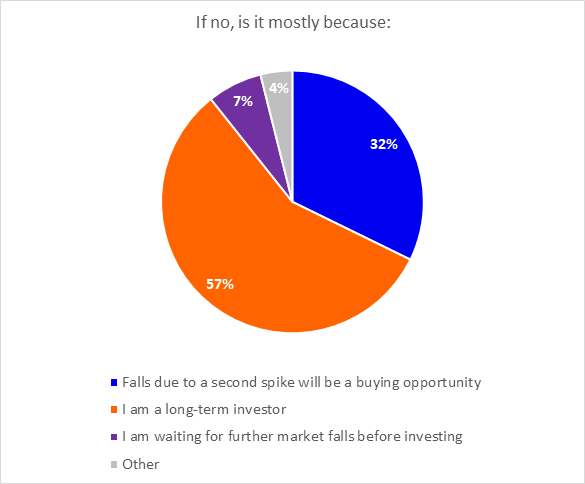

Not everyone is pessimistic, however: 26% of investors are not worried about a second spike from a stock market perspective, and 11% don’t know. Of those not worried, 32% say they will view any further falls as a buying opportunity, whilst 57% say they take a long-term approach.

Some 7% of investors are actively waiting for another market fall before investing.

Lee Wild, Head of Equity Strategy, interactive investor, says: “Despite the optimism around a possible vaccine and other drugs to help combat the pandemic, almost two-thirds of investors are still worried about the prospect of a ‘second spike’, possibly during the autumn and winter months.

“It perhaps explains the current impasse that we see in the domestic stock market where dividends have been a major casualty of lockdown. The FTSE 100 has moved largely sideways since breaking back above 6,000 in May, as more bullish investors remain wary about chasing the market too high during a deep recession that could last through 2020.”

Moira O’Neill, Head of Personal Finance, interactive investor, says: “We have to remember that while over the long term markets tend to rise, the long term is made up of lots of short-term periods – and we need to learn to hold our nerve through these.

“Markets can’t reach new highs all the time, and as in life, great years can often follow terrible ones. In other words, we need to be able to hold our nerve. By drip feeding your money into markets monthly, so you buy less shares when prices are high, and more when prices are low. That way, market fluctuations can become your friend, not your foe – which is useful for more cautious investors.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.