Qinetiq shares advance to record high

After a remarkable run, the military supplier has delivered massive profits to loyal shareholders.

14th November 2019 14:32

by Graeme Evans from interactive investor

After a remarkable run, the military supplier has delivered massive profits to loyal shareholders.

QinetiQ (LSE:QQ.) shares advanced into new territory today as the bounce triggered by October's deal to more than double its size in the world's biggest defence market continued.

The FTSE 250 index group, which joined the stock market in 2006, kept investor excitement on the boil this morning by reporting strong first-half results, including a 30% jump in orders and an upgrade to full-year revenues guidance.

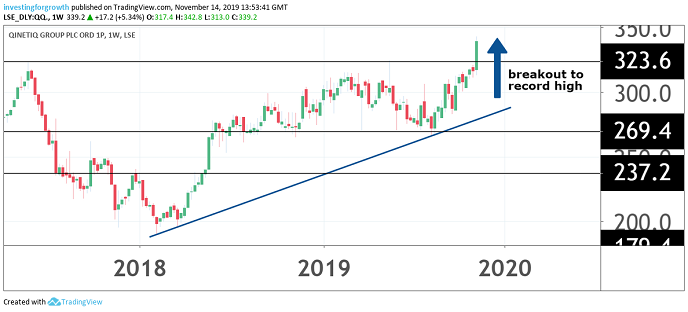

Shares rose another 6% to a fresh all-time high of 342p. They have now risen 27% this year and by 17% since the start of October, when Hampshire-based Qinetiq announced the proposed acquisition of sensors business MTEQ on a cash-free, debt-free basis for US$105 million.

Source: TradingView Past performance is not a guide to future performance

The deal - subject to US Government approval - should deepen the company's US Army relationship and broaden its customer base in the world's key defence and security market. The Qinetiq US operation will expand to about £300 million of sales with 750 employees combining MTEQ's expertise in advanced sensors and Qinetiq's own capabilities in robotics and autonomy.

Qinetiq was formed in 2001 when the Ministry of Defence (MoD) split its Defence Evaluation and Research Agency in two. It was widely described at the time as the real-life version of agent Q from the James Bond films.

The relationship with the MoD remains close following a modernisation of the Long Term Partnering Agreement that secures revenues until 2028. During the half year, Qinetiq was awarded a further £19 million contract to reduce the electromagnetic and acoustic signatures of the UK Royal Navy's submarines and ships, enhancing their operational effectiveness.

But the international side of the business also continues to grow, with the MTEQ acquisition set to mean that Qinetiq's US presence will soon account for 25% of total revenues.

Total turnover for the six months to September 30 was £487 million, amounting to 10% organic growth on a year earlier and £40 million higher than analysts at UBS had expected. Company guidance for revenues growth in the year is now in the high single digits, compared with mid-single digit growth forecast in July.

Operating profits of £59.7 million were 16% higher than 2018 and £3 million ahead of UBS's forecast, although Qinetiq has not changed its full-year guidance.

Chief executive Steve Wadey, who has been at the helm since April 2015, said the strong first-half result had been driven by good performances across businesses in the UK and internationally.

He added:

"Our focus for the remainder of the year is to win further campaigns globally, successfully deliver key programmes, and complete the acquisition of MTEQ to transform the scale of our US operations as we build an integrated, global defence and security company."

Cash generation continues to be strong, with cash flows from operations of £77 million up from £54.9 million a year earlier. The interim dividend was increased to 2.2p from 2.1p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.