Rate cuts seem like great news. This chart suggests otherwise

A little bit of caution could go a long way, says Finimize's Stéphane Renevier.

22nd December 2023 09:22

by Stéphane Renevier from Finimize

Last week the Federal Reserve (the Fed) made its big reveal: the central bank more or less admitted it was done hiking up interest rates and was now eyeing rate cuts. Investors took the hint and really ran with it: they’re betting on the Fed slashing rates by a whopping 1.5 percentage points in 2024, starting as early as March. And they’re buying up assets across the board, sparking rallies in stocks and bonds, on the widely shared assumption that lower interest rates make future cash flows more appealing today.

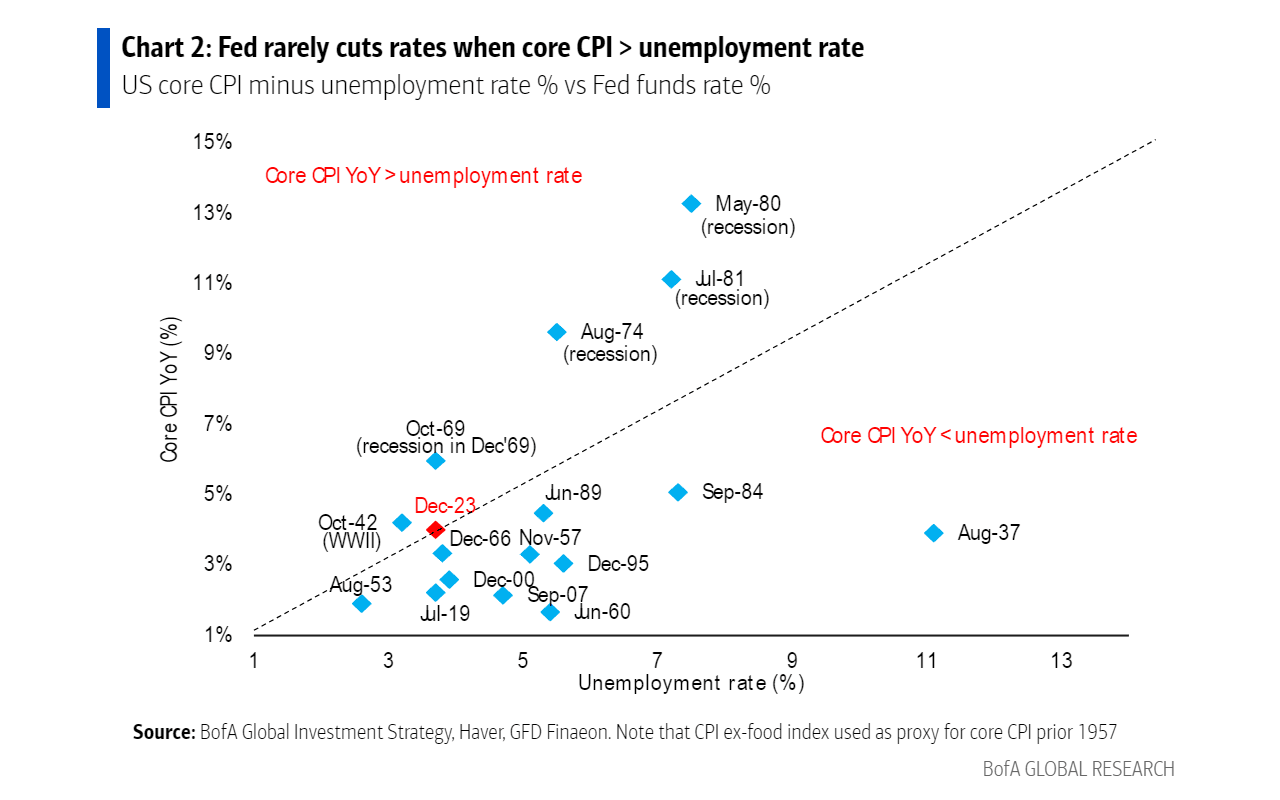

But, wait, there’s a catch: the Fed doesn’t usually go for rate cuts when the core consumer price index figure – that’s overall inflation minus food and energy prices – is higher than the unemployment rate. Take a look at the chart: most of the dots are below the dotted line, meaning the Fed cut rates when joblessness was higher than inflation. Those few dots above the dotted line represent more extreme scenarios: the drama of a recession (like in ’69, ’74, ’80, and ’81) or in the thick of war (cue ’42).

Right now, with core CPI at 4%, and the unemployment rate at 3.7%, it’s still not playing by the usual script.

So the chart’s whispering about three potential scenarios:

Scenario one, the “soft landing”: imagine core CPI gracefully slides below the already low unemployment rate, giving the Fed the green light to slash rates. It’s like the feel-good episode where everything aligns perfectly.

Two, the “hard landing”: core CPI does dip below unemployment – which allows the Fed to cut – but only because unemployment shoots up. This unexpected turn would reignite recession fears, putting a real damper on the stock market’s current high.

And, three, the “no landing”: here, core CPI stubbornly stays above the unemployment rate, and the Fed holds back on rate cuts. It’s the classic “good news is actually bad news” scenario and would ruffle the feathers of both stock and bond investors, since they’re betting on those rate cuts boosting asset prices.

Investors currently seem to be going all-in on the first scenario. If it materialises, stocks that were left out of this year’s rally – like small-cap companies and ones with weaker balance sheets – might hit the jackpot, since they’ve got some catching up to do.

But, with the market ignoring the other two outcomes, a little bit of caution could go a long way. It might be smart to sprinkle some Treasuries and gold into your portfolio, which should do well if the economy unexpectedly slams on the brakes. And don’t forget about commodities – they could be a smart choice if inflation does stay ahead of unemployment and the Fed plays it cool on the cuts.

Remember, investing is like a game of probabilities. When everyone’s banking on one outcome, it’s the perfect time to cover your bases for the surprises the market might throw at you.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.