Reasons for Laura Ashley's 36% share price surge

22nd August 2018 14:15

by Lee Wild from interactive investor

Retailers are having a tough time and Laura Ashley is no different, but are these full-year results its nadir? Lee Wild runs through the numbers and what's driving demand for the shares.

Laura Ashley was once perceived by many shoppers as a stuffy relic of a bygone age when floral patterns were all the rage. It underwent a renaissance as stores were updated and designs brought more in line with consumer tastes, but the shares have been a terrible investment over the past few years.

The retailer is not alone in feeling the pinch as consumers struggle with little or no growth in real wages and belt-tightening ahead of a possibly painful Brexit next year. Even if wages growth accelerates, there is a risk that people choose to put the extra money away for a rainy day rather than bankroll a spending spree.

• Mulberry crash attracts wave of buying

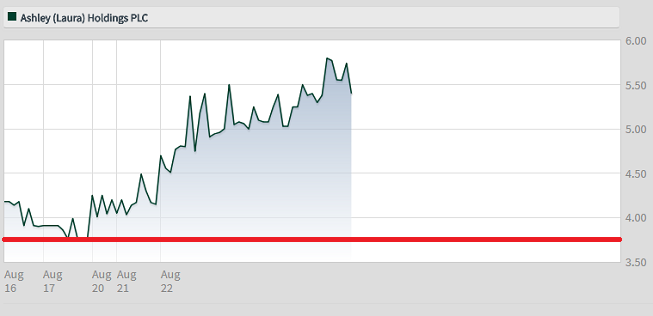

After peaking at 36p in 2015, Laura Ashley shares bottomed out two weeks ago at 3.65p. However, they spiked by more than a third Wednesday to 5.88p following full-year results and the sale of commercial property in Singapore for £30 million cash.

Might this be a turning point for the company and investors?

Source: interactive investor Past performance is not a guide to future performance

Well, a crash in statutory profit before tax from £6.3 million in 2017 to just £0.1 million indicates just how terrible trading conditions have been. Sales fell by £20 million, or 7%, to £257 million in the 52 weeks to 30 June and by 0.4% on a like-for-like (LFL) basis.

Even house broker Cantor Fitzgerald admitted it was "another challenging year" for the business, but there were some bright spots.

"Whilst disappointing, there are some positive signs emerging, including strong LFL growth in Fashion," writes analyst Mark Photiades. With a new head of fashion reviving the clothing business, the division improved on first half growth in sales of 1.2% to 9.7% for the 12 months.

The Singapore deal will also give the firm's financial position a significant boost. Remember, too, that the £0.1 million profit includes £5.5 million of exceptional charges including a £4.7 million write-down on the Singapore property. While adjusted pre-tax profit still fell to £5.6 million from £8.4 million, the number did beat forecasts.

We also hear that trading in the seven weeks to 18 August is in line with management expectations, and, although Cantor's Photiades errs on the side of caution and trims estimates for adjusted profit in 2019 from £8 million to £6.5 million, that still implies a 16% improvement on 2018.

Source: interactive investor Past performance is not a guide to future performance

"Whilst the trading environment will continue to be challenging, we remain resolutely confident in the underlying strength of this much-loved Brand," said chairman Tan Sri Dr Khoo Kay Peng Wednesday.

Shareholders will hope his confidence is not misplaced. Photiades thinks the shares are worth 8.3p, which implies upside from the current 5.3p of 38%.

While economies in key global markets look strong, and expansion into the Asian market "continues to be a priority", there are clear threats to growth and the next six months will be crucial if Ashley is to achieve ambitious profit forecasts.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.