Rebounding markets help Active Income Portfolio

23rd August 2013 17:22

by Nick Louth from interactive investor

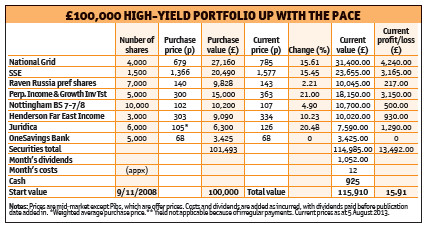

There will be plenty to celebrate when the active income portfolio reaches its first anniversary shortly. Despite worry that the US Federal Reserve would start to taper off quantitative easing, most parts of the portfolio have rebounded from the market falls that accompanied that concern. Overall, it is up almost 16%, which is certainly more than could reasonably have been expected at inception.

When interest rates start to rise, as they must in the next few years, the prospect of capital losses on bonds is obviously a pertinent one. Investors in gilts have enjoyed phenomenal gains in the past decade or two on the back of falling rates. But if you are only being paid 2.44% for lending money to the UK Treasury (which is the current ten-year yield), you're likely to be concerned about price falls erasing those slim pickings.

Distant worry

You would have thought that if PIBS were to get the jitters, a far more relevant threat was the capital hole revealed by the Co-operative Bank and the losses to be imposed on bondholders. Yet, although these are clearly more of a real threat to the PIBS and subordinated bond sector, little actually happened to most issues for the first two weeks or so after the Co-op news.

If the market is mispricing risk and worrying about the wrong things, there are clearly decent opportunities for investors. The portfolio had less than £6,000 in cash, but the arrival of latest dividend added more than £1,000 of firepower.

High risk, high reward

It has been a good time to add one very cheap but quite high-risk security from the world of subordinated bonds. pay a great deal more than the apparent coupon yield. With an offer price of 68.5p, we are getting a 9.62% running yield, and on full repayment on the call date, that would rise to 23.4%. I have bought 5,000 for the portfolio.

If an issuer decides not to repay the bond in full on a call date (in OneSave's case March 2016), the bond reverts to a floating-rate note, paying the five-year gilt yield plus 350 basis points. At the moment, that is 4.96%. However, I would be very surprised indeed if in two years' time five-year gilts were yielding as little as they do now.

The big unknown over OneSavings Bank is not the reset, but the ownership structure. The bank is a private equity joint venture between Kent Reliance Building Society and investment bank JC Flowers. The group continues to be weighed down by a back book of floating-rate mortgages issued years ago, which are now unprofitable at current rates.

However, the net interest margin has improved in the past year. Although it is still thin at 63 basis points, it should increase significantly once rates rise. The bank is now narrowly profitable, and is gradually growing. I wouldn't expect the bonds to get anywhere near par, but they should make up half the difference once the economy improves. It is as a recovery play that I decided to buy this small stake.

I also took the opportunity to top up the rather small stake in , with another 2,000 shares at 128.5p. This is much higher than the 94p we paid just a few months ago for the initial stake, but still an 11% discount to an estimated net asset value of 143p.