Recession looms over the US despite market optimism

23rd January 2023 12:01

Recession looms over the US despite market optimism Markets are increasingly pricing in a soft landing for the US economy. But we remain sceptical.

Markets are increasingly pricing in a soft landing for the US economy. But we remain sceptical. Broad measures of wage growth have not softened sufficiently, and underlying inflation pressures remain elevated. Meanwhile, the full impact of tighter financial conditions has not been felt, and activity data is deteriorating. We continue to think this makes a recession more likely than not.

A mild recession is now consensus

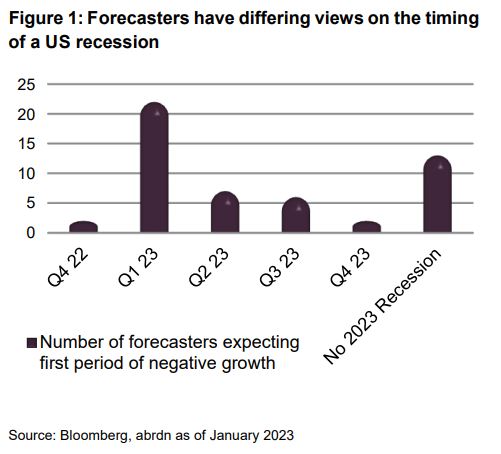

Our expectation that the US economy will enter a recession this year has become the consensus among the economic forecasting community. However, those forecasting recessions are largely factoring in a milder downturn than we are. Meanwhile, the consensus is split over the timing of the recession. Over 50% of those forecasting a recession expect this to begin in Q1 this year. 17% see the economy entering a recession in Q2, in line with our base case, and another 7% in the second half of the year. However, around 25% of forecasters do not expect a recession.

More importantly from an investment perspective, markets have become more optimistic about the economic outlook and are pricing in a benign unwinding of US macroeconomic imbalances. As such, we think it is important to set out the conditions that would need to be met for a soft landing to materialise.

Excess labour demand must be eliminated without a significant rise in unemployment

The labour market is currently exceedingly tight. Without a sharp recovery in labour supply (which has continued to disappoint), labour market rebalancing needs to occur through falling labour demand.

Excess labour demand is reflected both in the high ratios of job openings to hiring, and vacancies to unemployment. Wage pressures are very sensitive to these gaps.

It is plausible that this excess demand could cool largely via falling vacancies rather than falling hiring and rising unemployment.

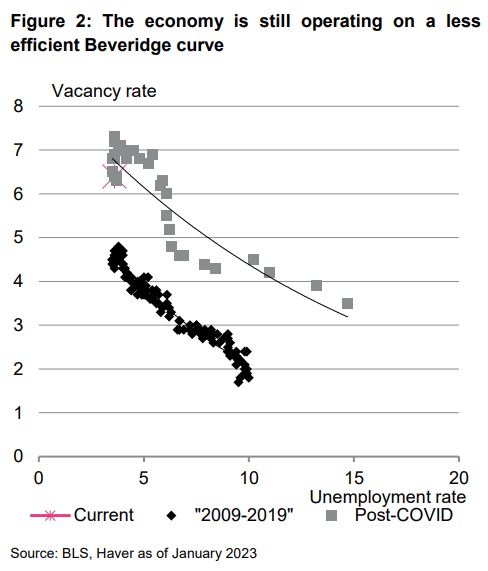

Figure 2 shows that the Beveridge curve – which maps the relationship between vacancies and unemployment – shifted outwards significantly during the pandemic. This is consistent with the labour market matching function becoming less efficient, as the labour market struggled to deal with the employment churn generated by changing patterns of production and consumption.

Recently, vacancies have been falling, and this looks set to continue. But the vacancy rate remains very high and the economy still seems to be operating on the post-pandemic Beveridge curve. Something fundamental appears to have shifted in the process through which firms and workers find each other.

Moreover, there don’t appear to be any cycles in history where vacancies have been destroyed on the scale now necessary without hiring and firing activity increasing significantly.

We therefore remain sceptical that the burden of adjustment can occur through this vacancies channel.

Wage growth needs to continue to moderate

A cooling labour market, then needs to feed through rapidly into much weaker growth in labour costs.

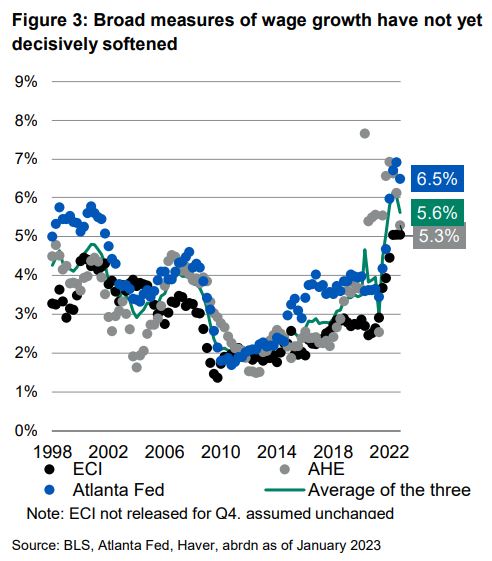

Once again, recent data has encouraged speculation about a soft landing. The December employment report showed a slowing in the growth of average hourly earnings (AHE), while also revising away some of the previous estimated strength in wage growth.

However, because AHE are not adjusted for changes in the composition of employment, we place more weight on other measures of labour costs.

Convincing evidence of a soft landing would require better adjusted series, such as the employment cost index (ECI) and Atlanta Fed wage growth tracker, to slow much more sharply. And so far, these series haven’t softened to the same degrees as AHE.

Underlying inflation needs to fall rapidly

Underlying goods price inflation seems to have peaked, with supply chains much improved and demand rotating away from goods towards services.

However, the dynamics on the services side are less supportive, with inflation appearing much stickier. While shelter costs are certainly part of this stickiness (and are set to reverse in time), core services inflation excluding rent prices was still up 0.3% in December.

More generally, attempts to strip out various components of the inflation index to measure underlying inflation pressure has to be done with care. For example, removing parts of the index that are rising strongly, like shelter, while retaining parts that are falling sharply, like used cars, introduces a significant bias.

That is why we prefer indicators like the Cleveland Fed’s trimmed-mean and weighted median CPI (and their PCE versions), which exclude the biggest outliers in both directions. Both increased by 0.4% in December, consistent with ongoing elevated underlying inflation pressures.

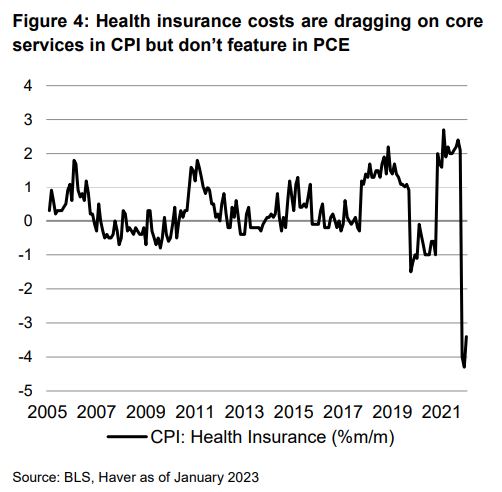

It is also important to note that the core services CPI is currently being depressed by a methodological quirk in the way that health insurance costs are measured. This is not present in the PCE series, which the Fed targets, and implies a smaller policy signal from core CPI inflation.

The pass through of tighter financial conditions to the real economy needs to be behind us

Financial conditions tightened significantly in 2022. But the lags in monetary policy transmission are hard to predict. In a more financialised economy it is plausible then that the full impact of this tightening has already been felt. The economy would then be facing smaller headwinds than we have factored in.

However, our research suggests that the maximum impact of policy tightening should be felt around four quarters after the shock peaks. With financial stress peaking in Q3 last year, it is unlikely the economy has absorbed the full impact of the previous tightening. There is also the potential for a re-tightening of conditions if the Fed pushes back against the current market narrative and the tightening put in place so far is insufficient to bring the economy back into balance.

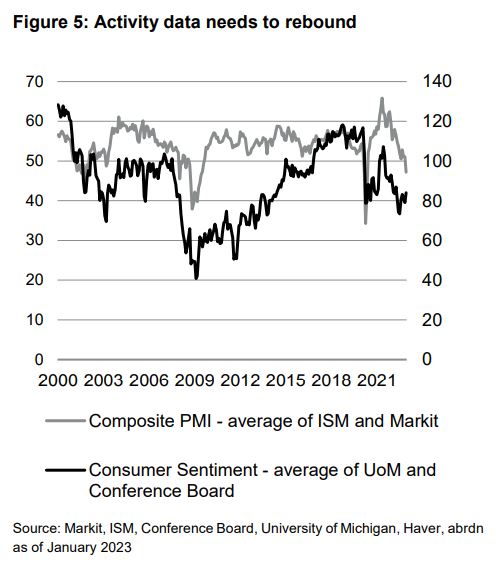

The weakness in the activity data needs to reverse

Many shorter-term measures of economic activity are nearing or already at recession consistent levels. Housing market-related indicators began to deteriorate last year, but in recent months we have seen a broader slowing in activity measures, with PMI surveys falling below 50.

There would need to be a clear improvement in the activity data for us to feel more confident that the US economy was headed for a soft landing.

Without this evidence, we continue to expect a US recession this year. Indeed, our recession probability models have all edged higher recently reflecting the deterioration in various measures of economic activity.

Were the timing of the recession to slip into Q3 rather than Q2, this would not be hugely surprising to us. But the key point remains that this cycle looks set to end in recession and that this recession is not priced into assets.

Abigail Watt is a Senior Analyst at Aberdeen Standard Investments (ASI) and Luke Bartholomew is an Economist in ASI’s Research Institute.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.