Relief for Debenhams investors after funding lifeline

Winning vital breathing space from lenders sent shares up 35%, but should investors stay on board?

12th February 2019 14:56

by Graeme Evans from interactive investor

Winning vital breathing space from lenders sent shares up 35%, but should investors stay on board?

The high-risk strategy of investors betting on Debenhams (LSE:DEB) to survive its current crisis was rewarded today when the department store chain revealed a funding lifeline.

Its additional £40 million credit facility for the next 12 months ensures that the chain will be able to meet quarterly rent payments due next month, as well as progress talks with lenders about a broader refinancing and recapitalisation of the ailing business.

It's a small but significant step, particularly as it highlights that Debenhams' banks and bondholders remain supportive while the more substantive talks concerning the company's £520 million debt facilities take place.

The update was enough to trigger a relief rally of 35% for the battered Debenhams share price, although that's small consolation for investors who have stayed loyal only to see the retailer lose 90% of its value in the space of a year. Its market value has plunged below £40 million.

For more recent investors, the challenge will be to judge whether it's worth staying on board to ride out the inevitable volatility of the coming months, or if today's sharp share price rise represents an appropriate exit point.

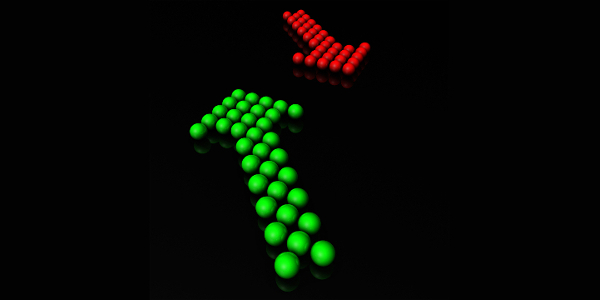

Source: TradingView (*) Past performance is not a guide to future performance

Laid low by having too many stores on long leases, the company is likely to need landlords to support a potential Company Voluntary Arrangement so it can reduce the significant rent burden. However, any agreement is certain to be accompanied by more shareholder pain, possibly through a rights issue or debt-for-equity swap. All this will have to be achieved against the background of Brexit-driven retail uncertainty and intense retail competition.

In striking today's interim deal, Debenhams continues to keep major shareholder and Sports Direct International owner Mike Ashley at arm's length. His offer in December to provide a £40 million loan was snubbed by the business, although the tycoon subsequently succeeded in voting chief executive Sergio Bucher off the board.

Bucher described today's announcement as the "first step in our refinancing process". He added: "The support of our lenders for our turnaround plan is important to underpin a comprehensive solution."

In a further boost, Bucher unveiled a new strategic sourcing partnership with leading supply chain solutions partner Li & Fung.

This will cover a material part of Debenhams' own-brand sourcing and should deliver benefits through improved product quality and lead-times, as well as higher achieved margins and better working capital efficiency. Initial orders under the agreement are due to commence soon.

Many of the retailer's woes stem from its controversial period in private equity ownership, which left it with stores on long, onerous leases. It is now cutting costs and capital expenditure, having reported a 27% slide in underlying earnings to £157.3 million for the year to September 1. Exceptional items meant it reported a bottom-line loss of £491.5 million.

*Horizontal lines on charts represent levels of previous technical support and resistance. Trendlines are marked in red.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.