Royal Bank of Scotland: New share price forecast

RBS shares have outperformed in 2019, but are playing catch up. The charts say this will happen next.

11th February 2019 09:44

by Alistair Strang from Trends and Targets

RBS shares have outperformed in 2019, but are playing catch up. The charts say this will happen next.

The comedy bank Royal Bank of Scotland (LSE:RBS) continues to flounder around doing very little. At time of writing, the price is 239.1p which is, 23.91p in old money. Not the most scintillating increase since the gory days of 9p (in old money) a few years ago. We suspect we're not the only folk still dividing the price by 10 to return to the "real" share price.

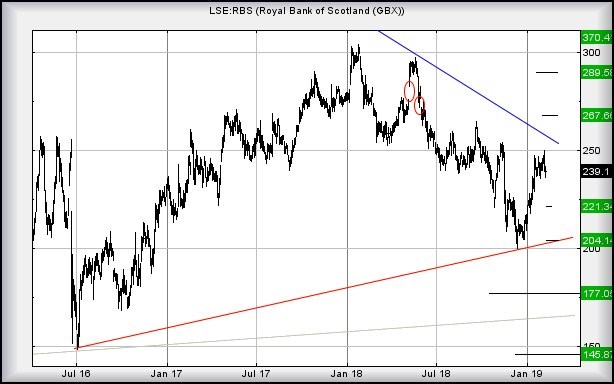

At present, we'd be justified in raising an eyebrow if it were to relax (again) below 230p as a return to 221p makes sense. Our secondary, with a break below 221p, calculates at 204p and hopefully a bottom.

As the chart highlights, there's a 'red' uptrend since the Brexit vote which would hopefully justify a bounce, should 204p make a guest appearance.

The real trouble would visit should the share price actually close a session below 204p, as some big picture reversals become extremely possible.

Initially, there's a fair chance of a visit to 177p followed by some sort of fake rebound. But our secondary, if such a level breaks, calculates at 145p (or 14.5p in old money) and ideally, a real bounce. The implications below such a level are too foul to list.

In our heads, we've been using the retail banks as our true market barometer, essentially failing to trust any movement the FTSE 100 index makes unless we see it echoed in the financial sector. Unlike politicians' brain cavity, there is not a lot of echoing going on at present.

We suspect the important downtrend on RBS is shown in 'blue' on the chart. This being the case, the share price currently must exceed 256p to be viewed as entering a phase toward an initial 267p. Our longer-term secondary, if exceeded, computes at 289p.

For now, we rather suspect 204p shall make itself known.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.