Royal Bank of Scotland shares: Time to start celebrating?

Up 28% in two months, long-term holders should only pop champagne corks if the shares do this.

28th November 2019 08:47

by Alistair Strang from Trends and Targets

Up 28% in two months, long-term holders should only pop champagne corks if the shares do this.

We’re starting to wonder whether the slight, very slight, optimism present against the retail banks may be due to expectations against next month’s election result in the UK. If this is indeed the case, The Royal Bank of Scotland Plc (LSE:RBS) are carefully sticking their tartan bonnet above the parapet at present.

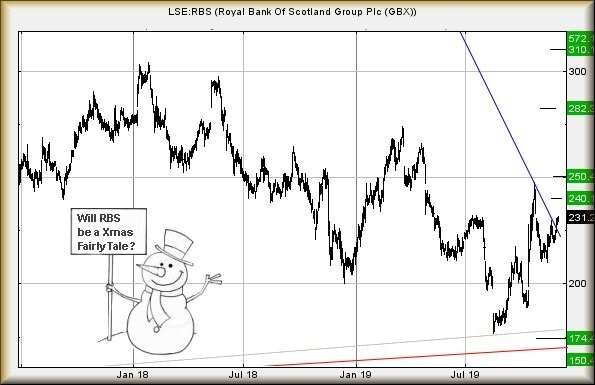

The immediate situation is pretty straightforward as moves above 232p look capable of achieving a near term 240p. In itself, a pretty useless movement, but greater interest is aroused if the price somehow betters 240p. A movement like this will be a solid nod in the right direction, calculating with a secondary target of 250p.

In a ‘back to school’ moment, achieving 250p shall prove important taking the price above the last point the downtrend (Blue line on the chart from 2009) was defined and, thus, officially creating a Higher High.

Stumbling into such territory risks truly stirring the pot from a Big Picture perspective. In fact, we’d strongly suggest shelving celebrations until the share actually closes around the 250p point. A miracle like this will tend to promise 282p and beyond for the longer term.

Of course, there’s a reasonable chance this optimism could be dashed, if politicians (or voters) do something exquisitely stupid. In the case of RBS, anything capable of driving the price below 210p is liable to have dire consequences, transporting the price back into a region where 174p is yet again calculating as a probable drop location. Secondary, if broken, remains at 150p.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.