Saving for children at Christmas

Parents tend to actively limit Junior ISA contributions in December, according to our data.

7th December 2020 16:44

by Myron Jobson from interactive investor

Parents tend to actively limit Junior ISA contributions in December, according to our data.

Far from giving children the gift of investments for Christmas, parents and guardians actively reduce Junior ISA contributions in the month of December, new data from interactive investor, the UK’s second largest consumer investment platform, suggests.

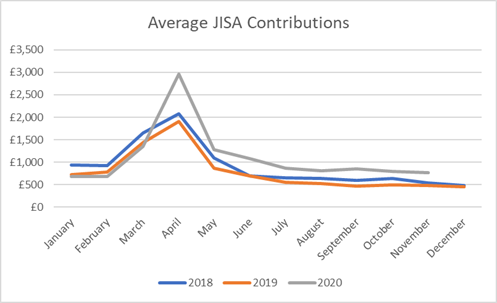

The average lump sum contribution to Junior ISAs among interactive investor customers was at its lowest in December than for any other month of the year in both 2018 and 2019. The average lump sum contribution in December 2019 was £454 - some 78% less than the combined average for the preceding 11 months that year (£808). 2018 tells a similar story.

The trend of waning Junior ISA contributions following the tax year end, and in the months leading up to December is also present this year. However, since April 2020 through to November, parents have been consistently making higher contributions into Junior ISAs this year than the previous two years (see table below).

Myron Jobson, Personal Finance Campaigner, interactive investor, says: “The dramatic reduction in Junior ISA contributions among our customers in December suggests parents use cash that would otherwise be used to top up investments in the account towards tangible Christmas gifts for children.

“But while the gift of investments is unlikely to feature in a child’s wish list to Santa, it shouldn’t be scoffed at. Many parents may be in a fortunate position to do both this year thanks to savings made on the cost of travel and entertainment costs during the months of full lockdown. They’ll thank you in years to come – think of the gift of investments as a stocking filler – even modest contributions can grow over time.”

Becky O’Connor, Head of Pensions and Savings at interactive investor, says: “Saving in general has risen this year and Junior ISAs have also experienced this trend, with parents contributing more to Junior ISAs since the first lockdown than the year before. It’s good to see parents thinking of their children’s futures and contributing more to their stocks and shares Junior ISAs with any spare cash they might have set aside through lower spending this year.

“It can be hard to choose the right investments for your children, as it feels so important that they do well from their Junior ISAs. But the same rules apply as with normal investing – that risk level should be linked to goals and the timeframe you have and it’s a good idea to diversify.”

Investment ideas

For the child who likes technology: Scottish Mortgage

Dzmitry Lipski, Head of Funds Research, interactive investor, says: “We like Scottish Mortgage (LSE:SMT) which has a healthy exposure to technology - accounting for almost a fifth of the portfolio. It is an adventurous option, with a preference for innovative and disruptive businesses which comes at the price of increased volatility. James Anderson, who co-manages the portfolio with Tom Slater, is a long-term believer in the power of technology and fiercely committed to running a high-conviction portfolio of companies that will change the world.

“The trust has a boast a stellar performance record and a record as the most-purchased investment trust on the interactive investor platform every month bar one since February 2014.”

For the child who wants to make the world a better place: Royal London Sustainable Diversified Trust

Dzmitry Lipski adds: “Managed by highly experienced Mike Fox, who spent most of his investing career assessing environmental, social and governance issues and how they influence investment decisions, the ethical multi-asset fund, filters out companies involved in common ethical investing no-nos, including tobacco, armaments and animal testing.

“In addition to a negative screen, a positive screen is also conducted. The manager assesses whether the company, through its products and services, provides a net benefit to society and/or whether it is a sector leader in terms of its ESG management. Sectors considered more favourably for the funds include healthcare and technology.

“The fund is a great example of why investing for good does not mean investors will miss out on returns. It has consistently outperformed both its benchmark and IA sector average and ranks within the 1st quartile for cumulative performance over three and five years.”

Average lump sum contributions into Junior ISAs

| Month | 2018 | 2019 | 2020 |

|---|---|---|---|

| January | £935 | £717 | £685 |

| February | £921 | £780 | £675 |

| March | £1,652 | £1,436 | £1,346 |

| April | £2,083 | £1,914 | £2,970 |

| May | £1,094 | £864 | £1,276 |

| June | £699 | £698 | £1,073 |

| July | £654 | £548 | £865 |

| August | £634 | £515 | £807 |

| September | £586 | £460 | £849 |

| October | £632 | £488 | £787 |

| November | £529 | £473 | £766 |

| December | £477 | £454 |

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.