Second bitcoin boom show no sign of going bust

Our award-winning crypto writer discusses plenty of developments positively impacting the crypto space.

30th May 2019 13:55

by Gary McFarlane from interactive investor

Our award-winning crypto writer discusses plenty of developments positively impacting the crypto space.

Bitcoin initially made heavy weather holding above $8,000, trading as low as $7,285 on 19 May, but came out of the weekend roaring, with another $1,000-plus pump.

The digital currency traded as high as $8,900 on Monday with Asian buying again to the fore and is currently priced at $8,743.

'Buy the dips' is back in vogue as lows attract buyers, with the pullback to $7,562 on 23 May bolstering subsequent buying momentum.

Although a correction has been predicted to hit before the price reaches $10,000, there is no obvious indication such a reversal will be turning up soon in any meaningful way.

Sentiment is firmly bullish and, besides, the technical analysis points to a sustained uptrend in play, with bitcoin clearly both its 50, 100 and 200-day moving averages on both the one-day and 4-hour charts (red line = 50, blue = 100, white 200).

(Chart: 1-day BTC/USD candles, courtesy TradingView)

Institutional fear of missing out (FOMO)?

Institutional buying of bitcoin appears to have been strong all year. For example, Grayscale Investments has doubled its assets under management to $2.1 billion in less than two months, with 94% of that accounted for by bitcoin.

One analyst estimates that Grayscale has been buying up around a fifth of the new supply of bitcoin, which is currently being mined at the rate of 54,000 per month.

With the halving in block rewards paid to miners due to take place in May next year (falling from 12.5 to 6.25 bitcoin), Grayscale's percentage share will rise to 42% at the current rate of accumulation.

The Grayscale Bitcoin Trust trades at a substantial premium but has the advantage for institutions of being a regulated entity by virtue of trading on public markets.

With impeccable timing, Grayscale, founded by Barry Silbert who is also the founder and chief executive of the Digital Currency Group, has been running "Drop Gold" ads in the US targeting millennials. The pitch is that bitcoin is "digital gold" and a more portable and easily accessible store of value than the precious metal.

AT&T accepts bitcoin, Facebook taps Bank of England and Coinbase

There have been plenty of other developments positively impacting the crypto space since our last roundup.

US phone network AT&T Inc (NYSE:T) announced last week that it was teaming up with BitPay to start accepting bitcoin for bill payments.

BitPay, one of the largest bitcoin payments processor, provides services to merchants who want to handle bitcoin.

AT&T is not extending the bitcoin payments option to its other goods and services such as buying a phone.

The US phone network's vice-president Kevin McDorman said:

"We're always looking for ways to improve and expand our services. We have customers who use cryptocurrency, and we are happy we can offer them a way to pay their bills with the method they prefer."

Bitcoin's volatility has held back its usage as a means of payment but AT&T’s move comes on the back of other household names in the US accepting bitcoin, such as Starbucks and the bookshop chain Barnes & Noble.

Even bigger news, perhaps, saw further details about Facebook's crypto plans emerge.

The BBC reported that Facebook’s Mark Zuckerberg met with Bank of England governor Mark Carney in April. Officials at the US Treasury have also been consulted in order to flesh out some of the regulatory issues surrounding the "GlobalCoin" it is building.

A launch date of the first quarter of 2020 has been pencilled, according to the BBC.

The social network platform has also been in discussions with regulated US crypto exchanges Coinbase and Gemini, which chimes with previous reports from Bloomberg that Facebook’s digital currency would be tradeable.

The Gemini exchange is owned by the Winklevoss twins, Cameron and Tyler, who famously sued Zuckerberg for allegedly stealing the idea for Facebook from them.

Interestingly, Facebook has also been talking to Chicago trading firms.

The company is reaching out to existing players in payments and plans to launch an association based in Switzerland, for which it is raising $1,000 billion. Project Libra, as it is known internally, appears to be designed to, at least partially, plug Facebook’s payments product into existing payments infrastructure.

Two big barriers to surmount for Facebook are regulation and trust, given its issues with privacy and data security.

But with 2.4 billion users of its products worldwide, Facebook’s move, even if only partially successful, could introduce hundreds of millions to the world of crypto, especially if the new system proves cheaper and easier to use than existing transaction methods.

Those companies not partnering with Facebook will likely be dusting down their crypto plans that were quietly retired when the crypto market appeared to implode and interest in blockchain tech waned.

Facebook's coin is not just about attacking the remittance and wider payments landscape. It is also a "tokenisation" play, which will see it open up the possibility of rewarding platform users for content creation and other activity such as watching advertising.

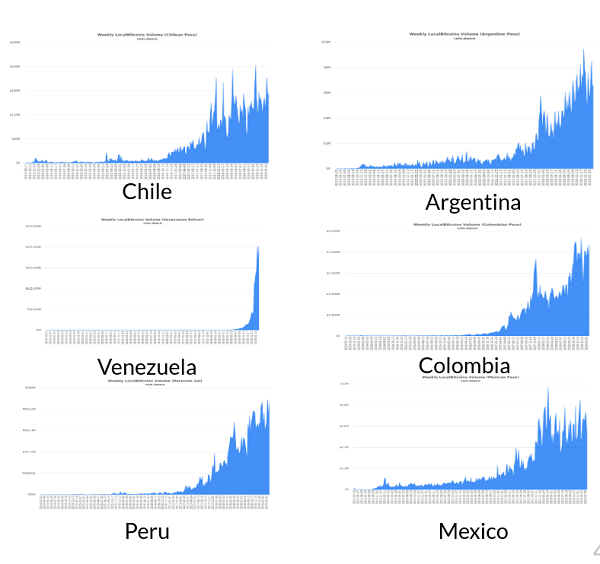

Latin America and South Korea bitcoin growth

Brian Armstrong, the chief executive of Coinbase, pointed out yesterday that while major markets were languishing in the "crypto winter" bear market, this was not the story in Latin America.

Looking at data on localbitcoins, an over-the-counter exchange matching retail buyers and sellers, activity has steadily increased and currently stands at all-time highs in countries such as Colombia, Peru and Argentina.

In the case of Venezuela, volume has come from nowhere to all-time highs in response to the economic collapse in the country and the accompanying hyper-inflation that has made the bolivar worthless.

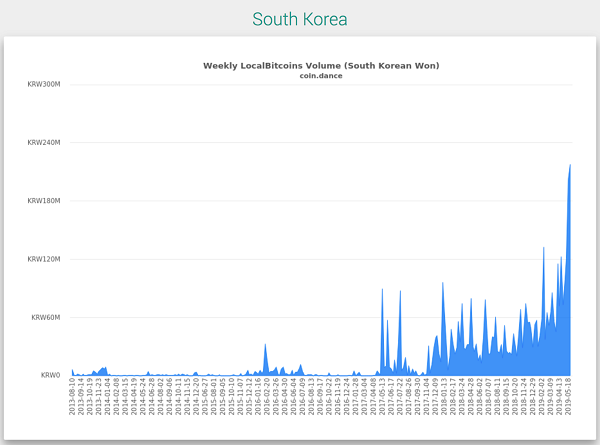

Staying with localbitcoins, activity on the exchange shows crypto fever on the rise in South Korea, where volume has hit an all-time high.

More doubts on reported trading volumes

Localbitcoins data is more reliable than that from many other exchanges, a fact we are reminded of by yet more research showing most reported data to be fake.

Crypto site The Block looked at monthly website traffic to 48 exchanges and compared their traffic to reported volume. It concluded that those with the highest claimed volumes per website were likely "engaging in significant volume faking".

It named the following as the top culprit: Coineal, Fatbtc, BW, BitMax, LBank, DOBI Exchange, Bit-Z, DigiFinex, Idcm, DragonEX, ZB, CoinTiger, IDAX, Bibox, CoinBene, BitForex, Bithumb, Negocie Coins, Liquid and OKEx.

The Block thinks 86% of volume is fake.

Bitwise, which compiles a number of widely followed crypto indices, published a report last Friday in which it claimed 95% of volume was fake. It “scraped” site data at 80 exchanges over several months.

Ten exchanges got the Bitwise seal of approval, so it’s worth knowing which ones they are: Binance, Bitfinex, Coinbase, Kraken, Bitstamp, bitFlyer, Gemini, itBit, Bittrex, and Poloniex.

The Block analysis of website visits in the past six months places Binance top on 185 million, followed by Coinbase on 150 million.

The vast majority of exchanges are unregulated and have a commercial interest in reporting high volumes as it implies plentiful liquidity, which would mean traders can quickly execute orders across a range of cryptoassets.

Taking all the analysis and research to date together, it means that volume data reported on sites such as coinmarketcap needs to be treated carefully.

New data site openmarketcap explicitly excludes suspect data. For example, today it reports 24-hour trading volume for bitcoin of $2.19 billion, less than a tenth of the $24 billion stated by coinmarketcap.

Altcoins on a tear – watch Bitcoin SV go

Even though it is bitcoin that is leading the market higher, investor bullishness has spread to other coins.

Recent standout is Bitcoin SV, the fork from Bitcoin Cash which was in turn a fork from bitcoin. Computer scientist Dr Craig Wright is behind the BSV project and the London-based company he owns – nChain – its key developer.

Australian Wright is suing Peter McCormack in the UK High Court after the podcaster said his claims to be Satoshi Nakamoto were not true. That hasn’t endeared Wright to the crypto community.

Wright is also at the centre of another court case ongoing in Florida in which he is being sued by the estate of claimed former partner David Kleiman. At stake is 1 million bitcoin.

BSV’s recent surge began last week when Wright registered the copyright for the bitcoin whitepaper and source code with the US Copyright Office. Although this does not mean that the US copyright authorities agrees that Wright is Satoshi, the news nevertheless saw the BSV spike more than 100% and it hasn’t looked back since.

Another boost arrived yesterday, courtesy of Calvin Ayre, the billionaire supporter of the BSV project and owner of CoinGeek, which is holding a conference in Toronto this week.

He tweeted in typically bombastic fashion on 26 May that when the Florida court case is won, the 1 million bitcoin will be sold for BSV, to the detriment of bitcoin (BTC) and Bitcoin Cash (BCH).

Here's the tweet in his own words:

"Wonder what happens to #Bitcoin (#BSV), Segwit Coin BTC and alphabet Soup coin (ABC/BCH/BAB) when #CraigisSatoshi gets his million coins once Tulip trust vests Jan 2020 and he dumps Segwit and Alphabet and buys Bitcoin? Things that make you go hummmm? :-)"

Whereas bitcoin has risen an impressive 63% since the beginning of May, Bitcoin SV has rocketed 279%, and is currently priced at $219. BSV is attempting to solve the bitcoin scaling problem by dramatically increasing block sizes.

A press release dated 23 May, said the nChain BSC Node Team had succeeded in achieving block size of 1.42GB on its testnet, with one said to have handled 359,993 transactions.

Bitcoin has a block size of just 1MB, BSV 128MB and BCH 32MB.

Defend Crypto campaign wants to take US SEC to court

In other news, frustrated by the slow pace of the US Securities and Exchange Commission (SEC) in regulating crypto, Kik, the messaging app within which the Kin (KIN) token is used, has started the "Defend Crypto" campaign to take the SEC to court.

The SEC is yet to rule on whether the KIN token is a currency or security and the uncertainty is thought to have damaged the valuation of the token.

As a result, Kik is crowdfunding a legal fund after donating $5 million itself. Payments start-up Circle is an early supporter of the campaign as fears mount that lack of regulatory clarity is holding back the industry in the US.

Kik founder Ted Livingston, in comments to crypto news outlet CoinDesk, said: "In the last month alone, over a million people earned kin from 40 different apps, from 40 different companies. Over a quarter million people used kin, making it the most-used cryptocurrency in the world, and they're not even willing to say that's not a security."

Mark Mobius has a change of heart on crypto

Emerging markets investment guru Mark Mobius, founder of Mobius Capital Partners, has had a change of mind on crypto, which he had previously written off.

In an interview with Bloomberg a couple of weeks ago he said he saw the worth of bitcoin:

"There's definitely a desire among people around the world to be able to transfer money easily and confidentially… and that is really the backing to bitcoin and other cryptocurrencies of that type."

He added, "So I believe it's going to be alive and well."

But that doesn't mean he is investing at this point.

"Whether I would invest in it is another question – there's incredible volatility, and at the end of the day you can’t trace one individual or group… one organization that’ll keep track of what's going on."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.