Seven principles for investing through volatile times

The coronavirus has clobbered global markets and unnerved investors, but Danny Knight has a guide to cal…

25th March 2020 09:58

The coronavirus has clobbered global markets and unnerved investors, but Danny Knight has a guide to calm worried minds.

With the global economy in the middle of a crisis following the rapid spread of coronavirus, Quilter Investors has produced a guide for investors based on seven principles.

“It’s natural at these times for some investors to get twitchy, which only serves to make the situation even less predictable,” says Danny Knight, head of investment directors at Quilter Investors.

He adds: “The truth is that share prices invariably rise and fall, but for the long-term investor, this shouldn’t need to be the primary concern. Historically, over the long term, markets have trended higher, quickly forgetting periods of weakness. Investors should, therefore, seek out opportunities in weaker markets and focus on their financial plans and the reasons for being invested.”

Below, he outlines the seven principles of investing so that people can keep their head when all about others are losing theirs.

1) Get advice

Every investor’s needs are different and while the points below are good general tips, there’s no substitute for a plan that’s tailored specifically for you.

The role of a financial adviser is to get to know you and your attitude to risk versus reward; and then to navigate you through your investment journey. What’s more, in turbulent times, advice helps take the emotion out of investing and provides an objective view. It may just be the best investment you ever make.

2) Make a plan and stick to it

It is one thing to have a target, but a sound financial plan can be the difference between simply hoping for the best and actually achieving your goals.

It helps you to stay focused on your long-term aims without being distracted by short-term market changes. The best way to formulate a plan and ensure that it stays on track is with a professional financial adviser. They will talk to you about what you want to achieve and your attitude to risk versus potential rewards. As well as tailoring a plan for you, they can monitor its progress and recommend ways to keep it on course.

3) Invest as soon as possible

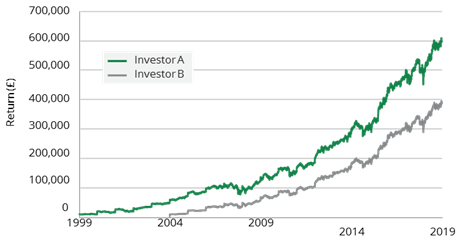

The earlier you invest, the better. The magic of compounding allows investors to generate wealth over time and this requires only two things: the re-investment of earnings and time. The difference of just a few years can make a massive difference to the end result.

The chart below shows two investors who both invest £10,000 every year into global equities. However, Investor A began in December 1999 and Investor B started five years later. Over 20 years, Investor A has accumulated savings of £595,763 compared to savings of £386,190 for Investor B – more than £209,573 more. If Investor B wanted to accumulate the same pot, they would need to invest £15,427 every year.

4) Don't just invest in cash

When markets are volatile it’s a big temptation to put all your investments in the relative safety of cash. It may seem like a safe bet. However, at just 2.5% inflation, an investor would lose nearly half of their purchasing power over 25 years. So, £10,000 today would only have the purchasing power of £5,394 in 25 years’ time.

Every investor does need at least some part of their funds in liquid investments in case of an emergency, but low risk usually leads to lower returns. For anyone with longer-term investment plans, it needs to be supplemented with investments in other asset classes that offer better capital growth potential and beat the perils of inflation.

5) Diversify your investments

When markets are fluctuating wildly, it’s all too easy to worry about the performance of certain investments while forgetting about the bigger picture.

Similarly, when one asset class is performing poorly, others may be flourishing. A diversified portfolio including a range of different assets can help to iron out the ups and downs and avoid exposing your portfolio to undue risk.

6) Invest for the long-term

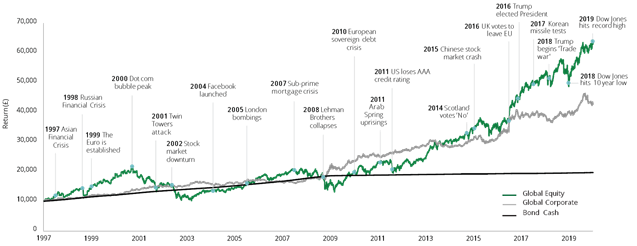

Many people believe that knowing when to buy and when to sell is the secret of successful investing. The truth is that no one knows with certainty when markets will rise or fall. Trying to time the market is not only stressful, it is very seldom successful.

It‘s far better to use time to your advantage. The sooner you start investing, and the longer you can invest, the more likely you are to have the potential for healthy returns and achieve your financial goals, regardless of short-term blips.

7) Stay invested

When markets are volatile, it is often tempting to exit the market or switch to cash in an attempt to reduce further expected losses.

However, it is impossible to time these movements correctly as no one has a crystal ball to predict future movement, so being out of the market for just a few days can have a devastating effect on returns. Make a plan, stick to it, and don’t try to time the market.

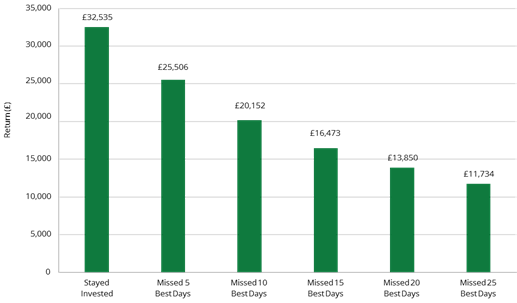

Using global equities as an example, the chart below shows how missing just a few of the best days can have a big impact on returns.

Danny Knight is head of investment directors at Quilter Investors.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.