A share on track to exceed pre-Covid records

22nd December 2021 09:20

by Rodney Hobson from interactive investor

This sector has been a victim of the pandemic, but the long-term trend at this major player is upwards and there are good reasons to back it now.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

This month’s decision by UK’s Civil Aviation Authority to allow Heathrow to increase its passenger levy by 37% is good news for the airport’s largest shareholder Ferrovial SA (XMAD:FER), but there are plenty more clouds hovering over transport infrastructure groups and an extra £8 per passenger is pretty small beer.

Despite the protestations from the owners of Heathrow that the increase from £22 to £30.19 per passenger is too little, they will be privately well pleased with the extra cash that could add up to £700 million a year if flights return to something like normal.

Heathrow is already the most expensive major airport in the world, but Ferrovial needs all the revenue it can get after taking a hefty knock in 2020, when travel ground to a halt in many parts of the world. Despite a 5% rise in revenue from €6.05 billion to €6.34 billion, quite an achievement in the circumstances, it swung from a €504 million pre-tax profit in 2019 to a €384 million loss.

Ferrovial is a Spanish multinational company that designs, builds, finances, operates and maintains transport infrastructure. It is one of the largest companies quoted on the Madrid Stock Exchange. Its operations are spread across Europe, the United States and Canada as well as the UK. The US contributes most revenue, followed by Poland.

Revenue is consistently topping analysts’ forecasts, with the figure for the first nine months of the year reaching €4.81 billion compared with €4.64 billion at the same stage of 2020. The construction business continues to thrive and air traffic is recovering from the depths. Toll road traffic performed strongly.

However, losses are still being racked up, albeit at a much lower level, with the nine-month deficit reduced from €513 million to €100 million.

Source: interactive investor. Past performance is no guide to future performance

The shares have shown signs of recovery after slumping to €18.50 in October but appear to have stalled at €27.50 last month and are currently around €25.50. The yield is 2%, although investors should worry about whether a payout can be maintained unless the operations return to profit early in the new year.

An alternative transport infrastructure investment is French outfit Vinci SA (EURONEXT:DG), which owns 45 airports including Gatwick, where some British Airways services have been lured back. Other assets include toll roads in France. Airports and toll roads account for only about a fifth of revenue but contribute more than half of operating profit.

Vinci is busy winning construction work that augurs well for the immediate future. Recent wins include an €82 million contract to upgrade Noisy-Champs station into a major hub on the new Metro system in Paris, the western bypass around Strasbourg which is the most extensive motorway project undertaken in France for several years, and a €79 million logistics hub and regional headquarters for supermarket chain Lidl in Pas-de-Calais.

Order intake is down only fractionally on that achieved in the same period of 2020, when figures were inflated by several particularly large contract wins.

Revenue rose 16% in the first nine months of this year to €35.8 billion to stand 3% ahead of the pre-pandemic level in 2019. Vinci claimed there was good momentum in most parts of the business in the third quarter, with 54% of total revenue being earned in France.

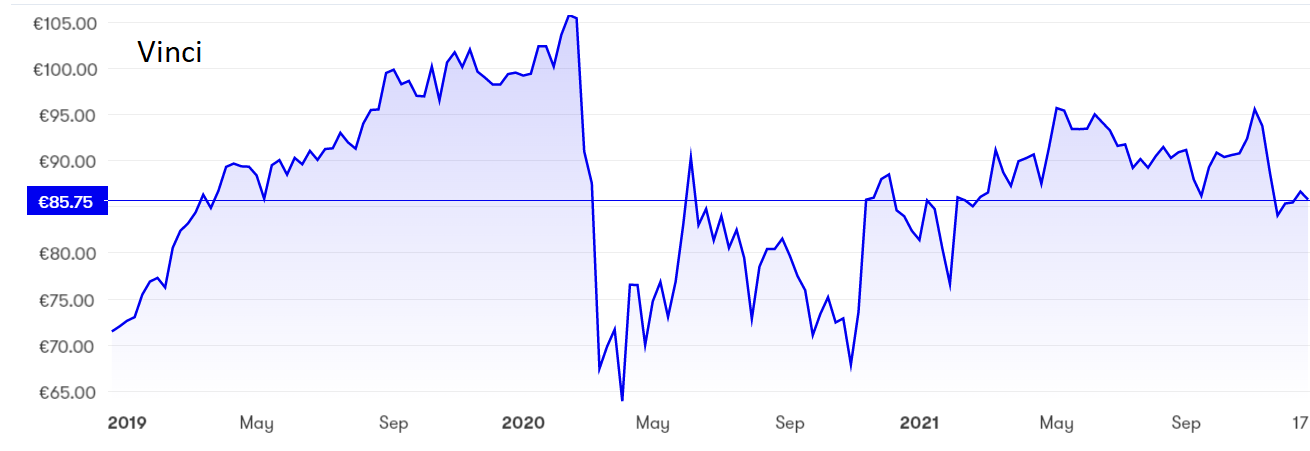

Source: interactive investor. Past performance is no guide to future performance

Vinci has bounced back into profit this year, although not yet to 2019 levels, and it has reduced debt, so the dividend looks more secure than at Ferrovial. The yield is better, too, at 3.1%. However, the shares have slipped to around €87 after pushing above €95 several times over the past 20 months.

Hobson’s choice: I tipped Vinci a year ago at around €85, believing that it represented a potential recovery play. The pandemic has lingered longer than I hoped and still casts a shadow, but my buy advice up to €90 still stands. Ferrovial rates no better than a hold.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.