Shares to buy and avoid after the general election

26th May 2017 15:04

by David Brenchley from interactive investor

Theresa May's 'snap' general election is less than two weeks away, with campaigning well underway and manifestos have been released. Seems the result is in no doubt. Despite some Labour gains, a Conservative win is odds-on, yet there will be repercussions for investors whatever the result.

True, a Tory administration with a big majority could well improve the UK's position in Brexit negotiations, we just don't know. But what will happen to the stockmarket in the aftermath of the poll.

UK equities have already enjoyed a strong bull run this year and, while the has paused in recent days, it came within a whisker - four points - of a record high Thursday.

The meanwhile is currently running at an all-time high and missed out on the 20,000 barrier by less than six points. They are up a quarter and a third respectively since post-EU referendum lows back in June 2016.

So, how far can they go? Will they continue to rise after the election? We asked a selection of fund managers and investment experts their opinion.

What impact will the general election have on the stockmarket?

Markets hate uncertainty. Most political events, especially those difficult to forecast, tend to cause nervousness in the run up, but then sentiment typically picks up afterwards.

As Adrian Lowcock, investment director at Architas, says, markets usually dislike elections and tend to hold off a little until the result is known, after which they play catch up so performance gets a little pick up.

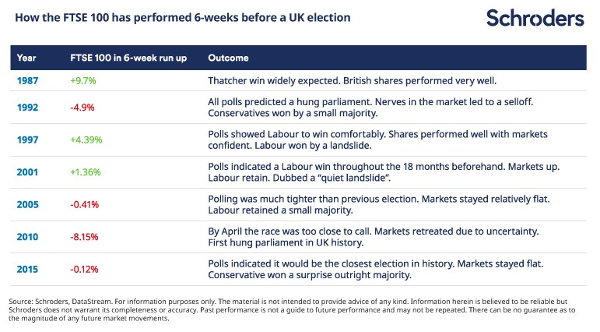

Further, research from Schroders found that in the six-week run up to the last seven elections, the FTSE 100 has been up when the outcome was widely expected, but down or flat when the race was tighter.

This time we're told it's a dead-cert. Most polls and experts alike are expecting a Tory victory. AXA's chief economist David Page attributes a healthy 70% probability to an increased Tory majority, with an 85% chance of any kind of outright win for May's party.

Hence, the market seems relatively relaxed. Indeed, Lowcock reckons the market could even be ignoring the election. That means "anything other than a strong victory for the Conservatives is likely to surprise markets and that could have a short-term detrimental effect", he told us.

"However, in the longer-term, elections have no lasting effects on markets," added Lowcock. And Page thinks the expected outcome is unlikely to spur a sharp market reaction.

How about the currency?

When the election was called, sterling rallied against the US dollar, tipping the FTSE 100 lower as over 70% of blue-chip earnings are generated overseas, and many of the top 100 companies here report in US dollars.

However, both Page and Mark Martin, the manager of Money Observer Rated Fund Neptune UK Mid Cap, doubt there will be any further strengthening of the pound after the election. In fact, Page believes the currency will weaken again.

There are still plenty of risks on the horizon, he says, pointing to the still-possible chance of a "chaotic" Brexit, a UK exit of the single market, domestic policy agenda surprises and a potential Scottish referendum.

Brexit uncertainty is likely to weigh on the UK's GDP outlook, he continues, and UK monetary policy will remain on hold for the rest of this year and next. "Only in expected low-probability scenarios might we see some support for sterling in 'softer-Brexit' scenarios (coalitions) or from a fiscal boost (Labour-led coalition)."

But sterling's prospects don't all hinge on whether we get a hard or a soft Brexit, according to Ed Smith, asset allocation strategist at Rathbones. "The pound's strength since the announcement more likely reflects the cyclical than the structural," he explains.

"In other words, it's not about a hard or soft Brexit, which affects the long-term fundamental drivers of exchange rates; rather that a new five-year term affords the political breathing space for an interim deal, permitting 'business as usual' for a little longer.

"This decreases the need for the Bank of England's loose monetary policy, closing the interest rate differential with other economies, and appreciating the pound."

Best and worst post-election sectors

Lowcock does not expect the election to be a big event, unless there's a shock result. "Investors should look at fundamentals now and, whilst the UK could be viewed as expensive, the weak pound makes us look cheap internationally."

He points out, in agreement with many commentators, that the UK economy remains healthier than expected. Due to this, consumer cyclical stocks - a basket of stocks including sectors like housebuilders, automotives and retailers - still look attractive, he adds.

However, Martin puts these stocks on the expensive side, relative to history at least, and is "generally cautious" on domestic cyclicals, particularly housebuilders, which is a sector his fund has no weighting in. However, he says, "we are finding select opportunities and have recently initiated a position in specialist lender Aldermore, which is currently trading on just 8 times next year's earnings and is valued at only slightly above book value".

The manager has preferred internationally facing UK mid-cap companies for a while now, though. One reason for this is that they have yet to benefit from sterling weakness since the vote.

"We have taken the opportunity to top up positions in some of these companies since Theresa May's [election] announcement and remain optimistic about their potential to generate attractive returns on a medium to long-term view."

For Lowcock, equity income stocks are looking expensive - not surprising considering these low interest rate and low growth times are prompting a rush to the higher yielders, particularly the defensive growth firms such as consumer staples. These provide investors with a predictable income stream from which to call upon.

"Demand for a good, reliable, growing income is still there," he explains, "and is likely to get stronger as the baby boomers continue to retire."

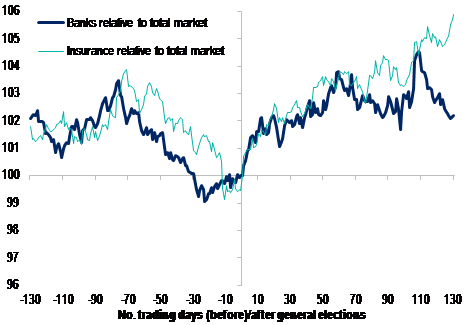

One sector to watch, according to Rathbones, is financials. Smith says that while banks and insurers repeatedly underperform in the run up to an election, they repeatedly outperform after the results become known.

Good news for fund managers who, like Neil Woodford, have recently piled into . If Smith is right, they can expect a nice uptick in performance after 9 June. Same could be said for Martin's decision to dip his toe into Aldermore.

Average sector performance around general elections

Source:Rathbones/Datastream

All in all, consensus is that investment and economic landscapes are unlikely to change significantly post-election, solely as a result of who wins, unless Labour gets in.

However, as always, there will likely be opportunities. Worth keeping an eye on that banks sector to see if that Trend (above) bears out again.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.