Shares to buy, hold and sell

10th June 2014 09:12

by Rebecca Jones from interactive investor

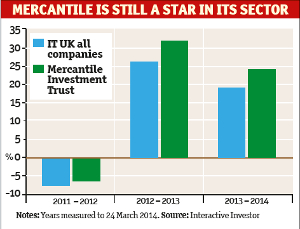

, despite being more than a century old, is still going strong, having recently returned 27.7% over one year - nearly 10% more than its sector, IT UK all companies.

Rebecca Jones quizzes manager Guy Anderson on the stocks he is buying, holding and selling.

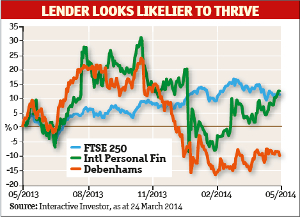

Buy - International Personal Finance

FTSE 250-listed makes up 1.05% of the portfolio. It provides small one-year loans to consumers in six markets, including Mexico and Poland, where it has its largest presence.

However, Anderson says: "The company is strong enough to adapt to or at least partially mitigate any changes in regulation."

He has so far been proved right, as IPF's shares are currently trading at 552p, nearly 100p up from the trough of last December. However, he insists it was IPF's fundamentals, rather than its share price, that prompted his decision.

"IPF really reflects what we look for: companies that are well positioned to succeed in the long term, produce high returns on capital and generate lots of cash," he says.

Anderson believes IPF's plans to expand further into Eastern Europe and refinance its balance sheet at a more favourable rate leaves it well positioned for growth and to return more cash to shareholders.

Hold - Moneysupermarket.com

Anderson is optimistically hanging on to a holding in the UK's largest price comparison website, which he admits "hasn't really done anything" since he bought it in March last year at prices that ranged from 180p to 195p.

share price, currently trading at around 180p, was hit hard when Google changed its search algorithms last June, pushing the comparison site from number one for the search terms "car insurance" and "home insurance" to fifth and sixth place respectively.

However, Anderson is confident the site can turn itself around. "It has been working hard to improve its web content, which is one of the key things Google is looking for, and it's now ranking higher. Clearly it's not there yet, but it has been improving," he says.

He is also confident that growth in mobile internet use will prove a significant boon for the company. "The move of internet consumption to mobile technology should drive brand loyalty as people rely more on the apps they have downloaded to search for products," he says.

Sell - Debenhams

Anderson bought into beleaguered retailer in March 2012 when, he says, the stock was widely seen as a "value opportunity" in its range of 77p to 83p. "There was limited UK growth, but there was scope for international expansion through the franchise model, which I found quite exciting," he says.

Anderson says that, with a typical franchise netting Debenhams £200,000 for little capital outlay, the firm's planned expansion from 65 to 150 franchises could have added £17 million to group operating profits.

In August last year he had 0.8% of the fund invested in Debenhams, but sensing that expectations were not matching reality, he began selling out in October at 108p. Following a disastrous Christmas trading period, he relinquished his position entirely in January at 77p.

"Over the past two years franchise growth has not been as rapid as I expected," Anderson says. "I think the firm is struggling because there is a bit of negative sentiment around the brand and, while it is taking steps to address this, UK performance remains disappointing."

He doubts whether management will be able to turn profitability around, not least because the firm remains "behind the curve" in terms of its web presence.