Should you back the US in an election year?

In a forward-thinking piece, David Prosser discusses how an acrimonious election looks certain to shape …

13th March 2020 12:40

by David Prosser from interactive investor

In a forward-thinking piece, David Prosser discusses how an acrimonious election looks certain to shape markets in 2020, and highlights funds set to shine if Donald Trump wins a second term.

This piece was written in February, before the impact of the coronavirus on global markets.

And so it begins. With near-perfect synchronicity, Donald Trump won his impeachment battle just as the state of Ohio was announcing the delayed results of the first Democratic primary. The US presidential election campaign is under way, even if we only know for now which Republican candidate will be on the ballot paper.

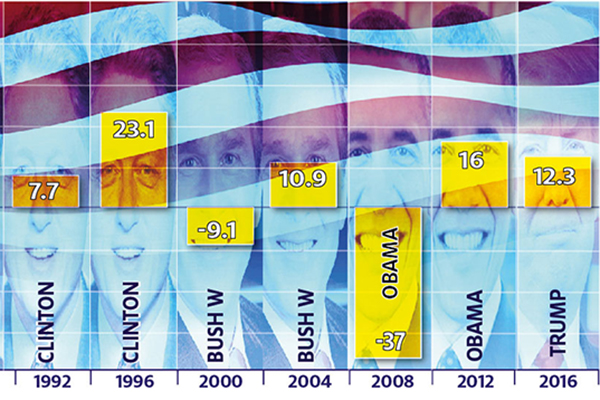

Political uncertainty is supposed to be bad for stockmarkets, but a presidential election year has invariably proved something to look forward to for US equity investors. In 19 of the 23 campaigns since the launch of the S&P 500 index in 1926, the market rose over the course of election year. US equities have delivered an average return of just over 11% in election years, against 10% the rest of the time.

- Infographic: total return from S&P 500 in election years since 1928

Will 2020 bring more of the same? Trump certainly hopes so. He regards the strong performance of the US stockmarket as one of the stand-out achievements of his presidency and made much of it in his recent State of the Union address. Expect him to keep talking the market up.

“Presidents can’t normally control the S&P, but this one is having a good go at it,” says Darius McDermott, managing director at Chelsea Financial Services. “His tweets about interest rates and trade deals move markets.”

But there are no guarantees. After all, following a super-strong run, US equities can hardly be deemed good value. On a cyclically adjusted basis, the S&P 500 currently trades on prices of 29.5 times earnings, some 40% above the long-term average – suggesting a correction is coming sooner or later.

There are plenty of reasons to fear it will be the former, not least because Trump himself is running out of fuel with which to keep the fire burning. The temporary tax cuts he offered US companies at the beginning of his presidency – via an effective amnesty for corporations bringing profits back onshore from overseas subsidiaries – had a huge effect, but this will not last forever. And new tax reductions aren’t in his gift now that the House of Representatives is controlled by the Democrats.

Jason Hollands, managing director at Tilney Wealth Management, says: “A lot of the cash repatriated to the US found its way into US share buybacks; last year, US corporations buying their own shares were the single biggest source of demand for US stocks. This has helped push US equity valuations to levels well above the longer-term trend. So will markets manage to make progress as buybacks taper down?”

That progress may be all the more difficult if the US economy begins to falter. While the president understandably points to a good record on growth and to positive data, such as an all-time low for unemployment, there is some anxiety that the US’s fortunes are about to take a turn for the worse.

Domestically, activity appears to be slowing in both the services and the manufacturing sectors, but the bigger problem is the US’s exposure to a struggling global economy, which is on target for its worst performance in a decade during 2019 and 2020, according to the International Monetary Fund. This is why the US Federal Reserve felt it had no choice but to lower interest rates last September – after a series of calls from the president urged it to do so.

Mixed signals

There is also potential for an unforeseen ‘black swan’ event. In 2008, the worst election year on record for US equities, share prices plunged 38% courtesy of the global financial crisis. Trump no doubt began 2020 confident that it was in his power to head off a disastrous escalation of the trade war with China, but he won’t feel as sanguine about the potential impact of the Covid-19 coronavirus.

Against these downside risks, economists were pleasantly surprised by better-than-expected earnings statements from leading US companies over the fourth quarter of 2019. And while the Fed’s target interest rate of between 1.5% and 1.75% is low by historical standards, it still leaves room for several further rate cuts, unlike its counterparts in Europe.

For these reasons, Ben Willis, head of portfolio management at independent financial adviser Chase de Vere, thinks the US bull run may still have further to run. “Given the recent strong economic data, the US-led market cycle looks set to continue for this year at least,” Willis says. “This is likely to be the key battleground for Trump and the Democrat candidate – whoever that turns out to be.”

Political currents

What about after the election? Hollands says: “As it stands today, markets would probably favour another Republican win, certainly if the Democrats end up choosing a radical candidate such as Bernie Sanders as their nominee.”

Hollands points out that all the Democrat contenders favour higher taxes, while individual proposals such as Sanders’ plans for price controls on drugs and a rapid transition to renewable energy could worry particular sectors of the market. Elizabeth Warren’s anti-Wall Street reputation causes nervousness in the banking sector, where she favours the restoration of the Glass-Steagall Act to prevent banks from engaging in both retail and investment banking.

So much, of course, is uncertain. Joe Biden’s candidacy began with a whimper in Ohio but may yet fizzle into life, and stock market investors would probably feel less uncomfortable with his more moderate agenda. Equally, Michael Bloomberg’s late entry into the race makes him an unknown quantity, but Wall Street might be expected to welcome one of its own.

In any case, the election may simply delay the inevitable, given those heady valuations. Willis says: “If Trump does manage to win a second term, we could see a further brief rally in US markets based on bullish sentiment, in a case of ‘better the devil you know’. But whether this can be sustained – and for how long – will be down to the shape of the US economy post-election and whether the US corporate earnings cycle has peaked.”

Move forward with caution, in other words. With Trump continuing to act as cheerleader-in-chief to the market, there is optimism that 2020 will not be the exception to the rule that US equities prosper in election years.

McDermott says:“We don’t expect this year to be quite as good as 2019, but it could still see decent returns.” But beyond the election, even if Trump wins, it’s harder to make the case that US stocks will continue to defy gravity.

In which case, it may make sense to reassess asset allocation models sooner rather than later. Hollands says: “The US wouldn’t be my top destination for an investment this year; I think the UK is a better opportunity.”

Six equity funds set to shine if Trump wins a second term

If you’re betting on Trump keeping the bulls cheering this year, which funds offer interesting opportunities?

Darius McDermott has two suggestions. “Lazard US Equity Concentrated invests in no more than 20-25 companies, from fairly small to very large,” he says. “We also like AXA Framlington American Growth, which is more diversified and has a growth bias; the manager looks for innovative companies, unique brands and companies with intellectual property.”

By contrast, Jason Hollands advocates the passive approach. “Active managers have a low success rate in beating the market in the US, so there is a strong case for investing via a low-cost index fund such as Vanguard’s S&P 500 UCITS ETF,” he suggests.

“Or for those concerned about US valuations, an alternative is the Invesco FTSE RAFI US 1000 UCITS ETF. This is a factor fund that provides exposure to the 1,000 largest US companies but then weights them on a basket of fundamental factors, reducing exposure to bubble-like stocks.”

Both experts think smaller, more domestically focused US companies may be less exposed to global economic woes. “I would consider dovetailing any passive exposure to large companies with a small- and mid-cap stocks specialist such as the Hermes US SMID Equity fund,” says Hollands. McDermott adds: “LF Miton US Opportunities has a greater emphasis on medium-sized companies than most of its peers and holds capital-light businesses with strong reinvestment opportunities capable of compounding over time.”

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.