Silver just stepped out of gold’s shadow

The runner-up metal just hit an all-time high – and not because of its vintage appeal. Its steady reputation and industrial charms have been turning investors’ heads.

17th October 2025 08:32

by Reda Farran from Finimize

Gold is primarily a precious metal, but silver is both a precious metal and an industrial material, and its price reflects that dual role. And based on the gold-to-silver ratio, silver appears to be undervalued today relative to gold.

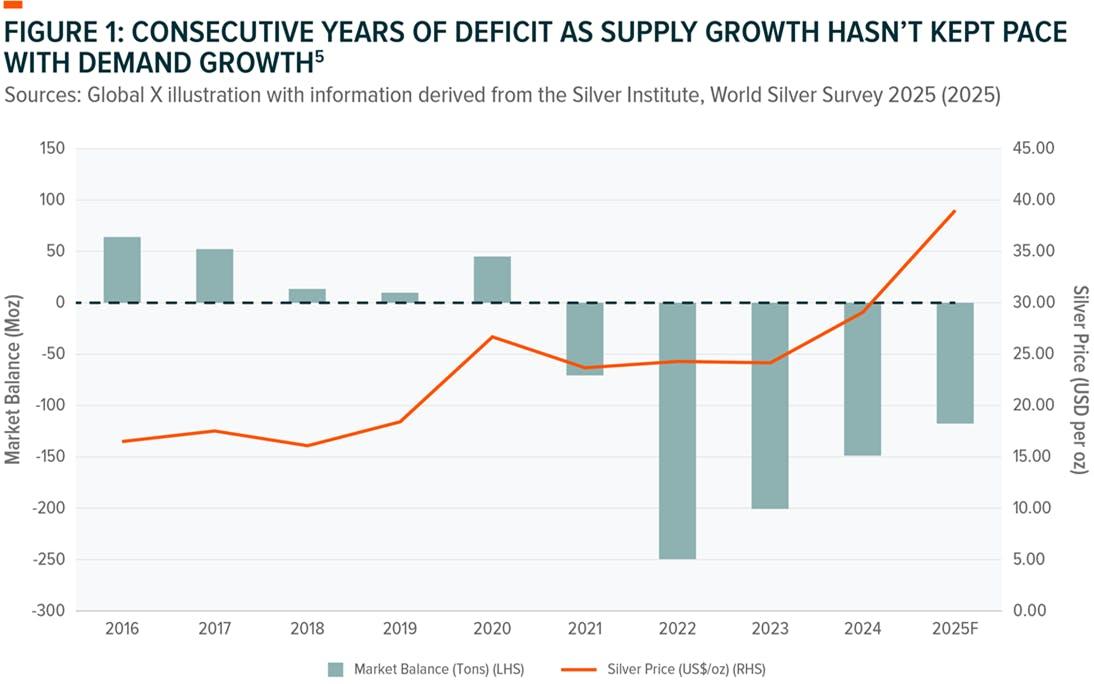

- Demand for silver is rising a lot faster than its supply – a trend that’s mostly driven by the metal’s use in the manufacturing of solar panels. The silver market’s been running a deficit for four years straight, and this year’s shaping up to be no different

- There are a few different ways to invest in silver, each with pros and cons. Besides donning jewellery, you can buy physical silver coins or bars, purchase silver futures contracts, invest in silver exhcange-traded funds (ETFs), or even pick up shares of silver miners.

Not all that glitters for investors is gold – some is most certainly silver.

The precious white metal – best known for shiny heirlooms and second-place Olympic medals – is also a staple in the industrial world. And with that kind of versatility, it manages to maintain its allure no matter what the broader market is doing.

In fact, silver just hit an all-time high – topping a record set in 1980 when the billionaire Hunt brothers famously tried to corner the market. So let’s dig into whether this do-it-all commodity deserves more than a runner-up medal – and if so, how you can grab some for your portfolio.

The price of an ounce of silver hit an all-time high this week, topping a record set in 1980.Source: Bloomberg.

First things first: where does silver come from?

You might be picturing an old-school silver mine, filled with creepy caverns, an old rail line, and teams of hard-hat-wearing workers. But that’s pretty far from the truth these days. Roughly 70% of the metal’s supply now is a byproduct of extracting other things like lead, zinc, copper, and gold. And it’s essentially produced all over the world: 43% comes from Mexico, Peru, Bolivia, and Chile. And another 28% comes from China, Poland, Australia, and Russia.

What is silver used for?

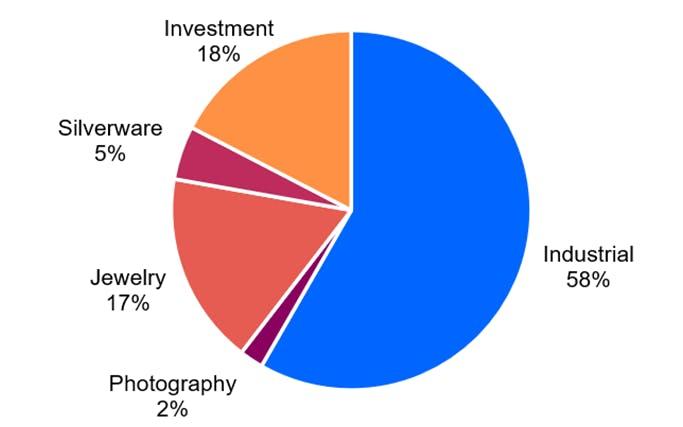

For centuries, silver has adorned luxury items like jewellery, tableware, and art, appealing to collectors for its durability and, well, its beauty. About 22% of silver's demand still comes from these more decorative, less utilitarian uses.

But luxury items are more of a side hustle. Silver’s primary occupation is in the industrial world, where it’s known for its ability to conduct heat and electricity efficiently, react to light in certain chemical states, and be stretched into thin wires or sheets without breaking.

Thanks to that triple-threat, it plays a pivotal role in some fast-growing electronics segments – solar panels, batteries, LED lighting, flexible displays, touch screens, RFID tags, cellular technology, and water purification, to name a few. And since most of those products just need a sprinkling of the metal, manufacturers rarely bat an eye when the price goes up – and they certainly wouldn’t bother seeking out alternatives.

The drivers of global silver demand in 2024. Source: The Silver Institute. Past performance is not a guide to future performance.

How does silver compare to gold?

Silver’s shine comes mostly from industry: manufacturing makes up about 58% of its yearly demand, compared with just 7% for gold.

Gold’s buyers, on the other hand, tend to be investors, central banks, and jewellery makers. So, while gold is primarily perceived as a precious metal, silver is widely seen as a precious metal and an industrial material. That hybrid nature means it moves with both economic activity and investor sentiment.

It’s worth noting, though, that because the silver market’s much smaller than the gold one, the mix of heady trades and lower liquidity in the space makes silver’s price way more volatile than gold’s.

Still, the metals often move together. Both tend to do well when bond yields fall, inflation rises, the US dollar weakens, markets grow more turbulent, or some combination of those factors.

See, when bond yields fall, so does the opportunity cost – the return you’re giving up by not investing in bonds – of holding precious metals, which don’t pay any regular income. In periods of rising inflation, investors appreciate that silver retains its value while traditional fiat currencies lose purchasing power. And like most internationally traded commodities, silver trades in US dollars. So when the greenback weakens, silver becomes cheaper to buy for many of the world’s investors, increasing international demand and pushing up the metal’s price. Finally, during periods of economic and geopolitical uncertainty, portfolio holders flock to safe-haven assets, including precious metals.

This year, for example, political and fiscal uncertainty in the US, France, and Japan has driven more investors to buy gold and silver, hedging their exposure to the US dollar, euro, and yen in what’s been termed the “debasement trade”.

How does silver’s price compare to gold’s?

Silver currently goes for around $50 an ounce – a fraction of gold’s $4,000 price tag. Both have seen dramatic rallies this year: silver’s up nearly 80%, outpacing gold’s roughly 60% gain.

The gold-to-silver ratio is, as you might’ve worked out, a measurement commonly used to compare the two metals. It indicates how many ounces of silver you need to purchase one ounce of gold, gauging their relative value and highlighting when one is potentially cheaper or more expensive than usual. Over the past 30 years, the ratio has averaged around 68. Today, it’s closer to 80, signaling that silver seems undervalued compared to gold.

The gold-to-silver ratio is currently about 80, well above its 30-year average of approximately 68. Source: Bloomberg.

What’s the supply and demand outlook for silver?

Demand for silver is rising a lot faster than its supply, mainly because the metal’s being sucked up by solar power manufacturers. Solar is forecast to make up 17% of total silver consumption this year, up from 8% in 2016. (Remember from earlier that silver’s superior electrical conductivity makes it important in solar cell technology.) What’s more, the solar industry’s newest, most efficient models use a lot more of the metal than older versions did. So with a major worldwide push toward renewable energy sources and a rapidly expanding solar industry, particularly in China and India, the need for silver has never shined brighter.

Thing is, supply isn’t keeping up. Global silver demand has outstripped supply for the past four years and has used up the surplus produced in the previous years. Recall that most of the metal comes as a byproduct of extracting other metals. And because relatively low profit margins haven’t enticed mining companies to develop new silver projects, supply will likely trail behind demand for some time.

The silver market’s been running a deficit for four years straight – and this year’s shaping up to be no different. Source: Global X ETFs.

So, how can you invest in silver?

If you want to stick close to the actual price of silver, or if you’re preparing for a doomsday scenario of complete monetary and financial system collapse, it probably would make sense to buy the physical metal. But, unless you’re happy to stash that bullion at home, that’ll leave you paying annual fees for storage and insurance. Plus, some dealers charge chunky premiums to buy and sell silver, which can eat away at your returns.

Futures contracts, meanwhile, offer the advantage of leverage. That means a small outlay gets you the exposure to the same levels of profit (or, crucially, loss) that you’d get from investing a much bigger amount straight in silver itself. Mind you, that’s also a drawback: the smallest futures contract is worth 1,000 troy ounces, so a silver price at $50 per troy ounce means you’re looking at making a bet worth at least $50,000. (Gulp.) And because futures contracts have expiration dates, you’ll constantly have to reinvest in newer, more up-to-date contracts that are typically more expensive than the spot price of silver. And all that rolling over adds up over time.

Unlike those futures contracts, silver ETFs are super easy to access: anyone with a brokerage account can buy in. They might not have the leverage of futures, but ETFs replicate silver’s price performance by either holding pretty bricks of physical silver or investing in silver futures contracts.

Thing is, that means they face the same problems as those individual approaches, either racking up storage and insurance costs or running into the hassle of constantly reinvesting funds into newer, pricier contracts. Combine that with (admittedly small) management fees, and the ETF performance will inevitably deviate somewhat from that of actual silver.

Your final option is to invest in shares of silver-mining companies. These firms have high fixed costs and variable revenue, so they’re essentially “leveraged bets” on the price of the metal. That means their share prices stand to do really well if the price of silver heads up – though the opposite is also true. Another advantage of this approach is regular income: ironically, unlike the metals they unearth, many mining stocks do pay a dividend.

The downside is that there aren’t many “pure” silver miners available – that is, those that derive a significant share of their revenue from exploring, mining, and transforming this particular metal. Most, after all, have diversified into gold and other things, so you could indirectly be affected by the prices of other commodities. What’s more, individual companies are more exposed to a range of idiosyncratic issues, including politics, environmental concerns, and operational blockage – all of which can introduce unwanted risks to your portfolio.

Reda Farran is an analyst at finimize.

ii and finimize are both part of Aberdeen.

finimize is a newsletter, app and community providing investing insights for individual investors.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.