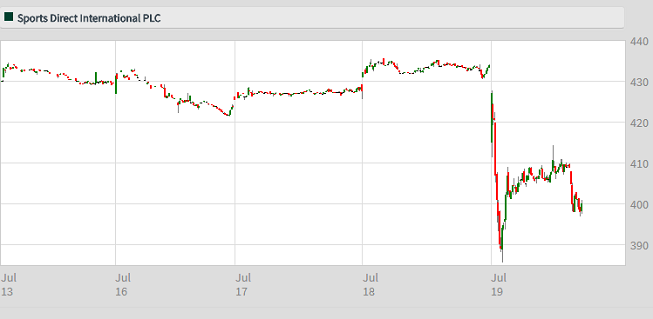

Sports Direct sell-off following results

19th July 2018 13:55

by Lee Wild from interactive investor

After a stunning performance over the past year, Lee Wild, head of equity strategy at interactive investor, analyses latest full-year results and a significant share price slide.

Sports Direct has overcome some serious hiccups and its shares now trade at prices not seen for over two years. Its resurgence began a year ago when 'pantomime villain' Mike Ashley appointed his first finance director since 2013 and predicted profits would actually rise this year, not fall again as most expected.

He was right. In the year ended 29 April, the company made underlying EBITDA of £306.1 million, up 12.2% from last year on revenue up 3.5% at £3.36 billion. Strip out a range of benefits and sales were up 0.7%.

There’s little doubt it’s still tough for the high street retailers, and revenue fell at both the UK and European sports retail chains, but the firm's 'elevation strategy', which includes its 'Selfridges of sport' idea, is going better than expected.

The numbers bear this out. Pumping money into flagship stores helped increase UK profit by 6.5%, while Europe turned a £22 million loss into a profit of £14 million. If the concept works as well as these results suggest, plans to open another 10-20 new generation Sports stores this year gives room for optimism.

Source: interactive investor Past performance is not a guide to future performance

Opening new Flannels stores and driving online sales also gave a boost to the so-called Premium Lifestyle division which generated an extra £48.5 million of sales during the period, 42.7% more than last year. Profit there rose 43% to £6.3 million.

A 72.5% plunge in reported pre-tax profit to £77.5 million has been well-flagged, mainly the result of a disastrous investment in Debenhams, plus tough comparisons with the previous years when Sports made money selling stakes in Dunlop and JD Sports Fashion.

Source: interactive investor Past performance is not a guide to future performance

Sports Direct shares are up 50% in the past year and at a level which has historically been difficult to breach. Given they're up 10% in the past couple of weeks, it's unsurprising that sellers have emerged following the results. While the numbers are at the top end of expectations, the shares now look expensive, and traders will have demanded even more to justify further buying at these prices.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.