A stock with limited downside, greater upside potential?

After a dire few years, a fresh scandal has attracted the interest of our overseas investing expert.

11th September 2019 10:23

by Rodney Hobson from interactive investor

After a dire few years, a fresh scandal has attracted the interest of our overseas investing expert.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

It's been an up and down year so far for US industrial and business conglomerate General Electric (NYSE:GE). There are likely to be more nervy moments before 2019 is out but there could be better times coming for shareholders who are prepared to be patient and play the long game.

Nothing is likely to be quite so dramatic as the accusation last month that the company has been running "a decades long accounting fraud". The accuser was accounting expert Harry Markopolos, who warned securities regulators about the Bernard Madoff investment scheme years before it was exposed as a Ponzi operation, so naturally investors took notice.

Markopolos claimed that GE would need to bolster reserves in its insurance arm by $18.5 billion immediately plus a further $10.5 billion in the future and that it should have booked billions of dollars in losses in its oil and gas division.

He compared GE's insurance policies to that of AIG (NYSE:AIG), which ultimately needed a $189 billion government bailout after failing to set aside sufficient reserves.

GE shares promptly slumped from $9.30 to $8 in two days of trading as the news leaked out through a website and was then picked up by the Wall Street Journal. That drop of 14% brought an angry response from GE executive Steve Winoker:

"We operate with absolute integrity and stand behind our financial reporting. We remain committed to providing accurate, complete and timely financial information."

He pointed out that GE had added $15 billion to statutory reserves last year to cover future claims in addition to claims already incurred.

His hand was strengthened as it emerged that Markopolos was working with an unnamed hedge fund short selling GE's shares and will receive a share of the proceeds if the fund makes a killing.

Chief Executive Lawrence Culp said in a statement:

"This is market manipulation – pure and simple."

The shares edged higher as investors recovered their nerve but at around $9 they remain below their previous level.

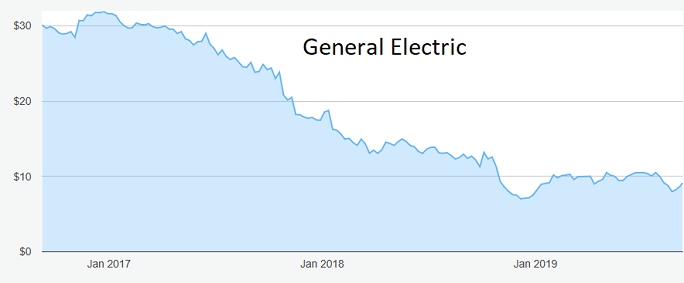

Source: interactive investor Past performance is not guide to future performance

GE could well have done without this distraction, as the group's financial performance has been mixed. The year got off to a bad start with a warning in March that it expected results for 2019 to be below market expectations with earnings per share, excluding special items, of 50-60 cents against previous forecasts of 70 cents.

At that point Culp was fairly bullish, speaking of "complex but clear" challenges that would be faced head on, leading to an improved financial position and a significantly better performance in the following two years as headwinds diminished. A lot of his comments were pure managementspeak, so a great deal has to be taken on trust, though his promise to reduce leverage was a step in the right direction.

First quarter figures seemed superficially to justify Culp's optimism as revenue and earnings beat analysts’ forecasts but there was a boost from the early booking of some significant items and the effect will balance out over the full year.

Sure enough, revenue dipped slightly in the second quarter, weighed down by a 22% drop in the power division.

GE actually posted a pretax loss from continuing operations in the second quarter, which meant profits for the first half slipped from $1.51 billion to $1 billion. That did not stop Culp from claiming "steady progress on our strategic priorities" with solid growth in the top line. Once again, he stuck to full year guidance.

The shares slumped from $31 to $7 over the course of 2017 and 2018 but seem to have stabilised despite last month's incident.

Hobson's choice: Buy below $10 if you believe the promise of solid progress over the next two years. The downside looks limited and the potential upside is much greater.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.