Stock market rally poll: too much too soon, or only the start?

After a recovery almost as impressive as the crash, you tell us where you think shares are heading next.

10th June 2020 09:37

by Jemma Jackson from interactive investor

After a recovery almost as impressive as the crash, you tell us where you think shares are heading next.

Earlier this week, the S&P 500 made up all of this year’s losses – for now at least. It is now flat on the year, which represents a jump of some 45% since its nadir in March. Meanwhile, the FTSE 100 is now around 30% up on its March low – although it still has a mountain to climb before it breaks even this year.

With huge uncertainty around coronavirus, even when global economies are at various stages of easing lockdown, is this equity market rally too much, too soon?

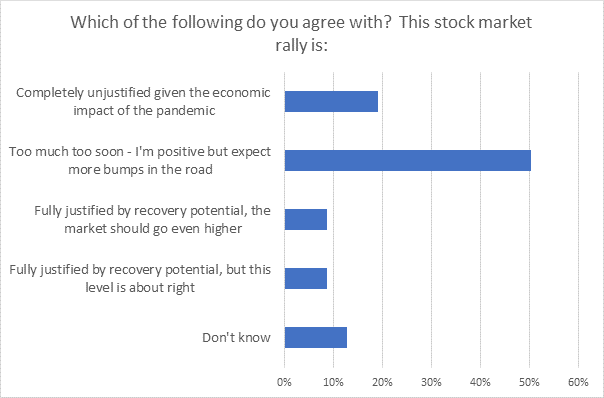

A poll of 1,212 interactive investor website visitors between 4.30pm on 8 June 2020 to 10.30am on 9 June 2020, suggests that 50% of investors think that, while they are positive on markets, the rally is "too much, too soon" and they expect more bumps in the road.

Almost a fifth (19%) think that the stock market rally is completely unjustified given the economic impact of the pandemic. A bullish 9% think that the rally is fully justified by recovery potential, and should go even higher, but a further 9% temper this by saying that while the rally is fully justified by recovery potential, current stock market levels feel about right. Some 13% said they don’t know.

Lee Wild, Head of Equity Strategy, interactive investor says: “The swift recovery in share prices across global stock markets continues to raise eyebrows, even among veterans of multiple crashes, catastrophes and recessions. There are reasons for optimism, of course, not least the decline in Covid-19 infections, but the full economic consequences of the pandemic are still to be felt. It’s why the difficulty of so many investors to reconcile economic recession with booming share prices is quite understandable.”

Richard Hunter, Head of Markets, interactive investor says: “US markets kicked into overdrive as the assumption of a prolonged recession was immediately brought into question.

“The economist and market analyst consensus had been that another eight million jobs would be lost and that the unemployment rate would rise to 19.5%. How wrong they were. In the event, 2.5 million jobs were added, with the unemployment rate dropping to 13.3% from a previous 14.7%.

“The figures poured fuel on the fire of a swift return to economic normality, with mention of a “V” shaped recovery – a sharp contraction followed by an equally sharp comeback – being seen as a possibility. The major US indices responded in kind and, extraordinarily, two of the three have recouped previous losses and more."

Hunter adds: “Meanwhile, a quicker than expected return to work in some of the key industries has added to what was already increasingly bullish sentiment, as investors chose to look through what will be a woeful second quarter reporting period when the season starts in July, with eyes focused instead on the eventual recovery.

“Apart from the extraordinary monetary stimulus, there have also been concerted efforts by governments to apply fiscal help to individuals and companies in an effort to mitigate economic losses.

“The sum of these coordinated actions is virtually unique in dealing with what has been an equally unique global lockdown. In the US, there are additional political pressures for the economy to rebound quickly ahead of the upcoming Presidential elections. Yet at the same time, this market rebound could yet be derailed.

“Concerns around the eventual cost and impact of Covid-19 remain and these have now been joined by questions over valuations. It is difficult to foresee that investors will completely ignore the negative company earnings which will prevail in July, while in any event, even at these surprisingly improved levels, US joblessness remains well above the peak of the 2008/2009 financial crisis.

“In the meantime, any number of factors could change the mood. A downward revision to the NFP numbers, an escalation of tensions both internally (civil unrest) or externally (trade spat with China), a second spike of the pandemic, corporate bankruptcies or delays to a vaccine could all play a part.

“In any event, one set of economic data should not and cannot be taken in isolation. This leaves investors at a fascinating but potentially dangerous inflection point. Were these job numbers truly a harbinger of a fiercely sharp recovery on the economic global stage, or are there factors which have yet to land which will change the way the economy behaves?

"Only time will tell, but in the meantime investors can expect more bumps in the road as the “new normal” – whatever that may be – emerges.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.