A stock in one chart: Carillion dividend risk

13th October 2016 11:09

by Phil Oakley from ii contributor

Former City analyst Phil Oakley believes the fortunes of many companies can be summed up in a single financial chart. This week it's .

Investors are rightly starting to worry about pension fund deficits again. The fallout from the EU referendum has pushed the interest rates on bonds even lower. This is bad news for companies with final salary pension funds, as low interest rates make it more expensive to meet their promises to pay pensions to their workers in the future.

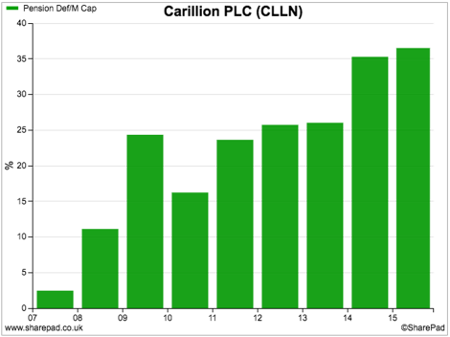

For construction and support services company Carillion and its shareholders, its final salary pension scheme is proving to be a big problem. At the end of 2015, the liabilities of the scheme were £406 million more than the value of the assets in it.

This deficit equates to 37.7% of Carillion's current market capitalisation of £1,078 million, which is the biggest deficit on this measure in the FTSE 350 index.

At its half-year results in August, the company revealed that the deficit had increased to £509 million - or 47% of its market capitalisation.

Carillion is trying to plug the hole in its pension fund and put £47 million of extra cash into it in 2015. This is £47 million that wasn't paid to shareholders - and has to be paid before they get a penny - which equates to an additional yield of 4.4% at the current share price.

The worry is that if interest rates stay low and asset values fall then £47 million a year won't be enough to plug the deficit quickly enough.

If it isn't and cash payments into the fund have to increase then Carillion's dividend - which cost £78 million in 2015 - may have to be cut. In fact, the share's current forecast dividend yield of 7.7% is implying that the stockmarket thinks this might happen.

The ii view

Two years after Carillion failed to buy larger rival , margins have declined and there are serious concerns about the dividend. Net borrowing is higher than expected - a weak pound hurts, as Carillion's private placement borrowing is denominated in US dollars.

A yield of 8% implies little confidence in the shares currently, and don't be fooled by a low PE, they rarely trade double-digit multiples. Technical support at 240-245p must hold.

Read more from Phil Oakley here. Financial charts are a feature of SharePad, the web-based service from ShareScope. Voted UK's Best Investment Software 2015. For a limited period, you can get a three month subscription to SharePad for just £25.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.