A strong argument for buying this sticky stock

This is a solid defensive company paying a nice dividend where trading has recovered to normal levels.

30th September 2020 09:33

by Rodney Hobson from interactive investor

This is a solid defensive company paying a nice dividend where trading has recovered to normal levels.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

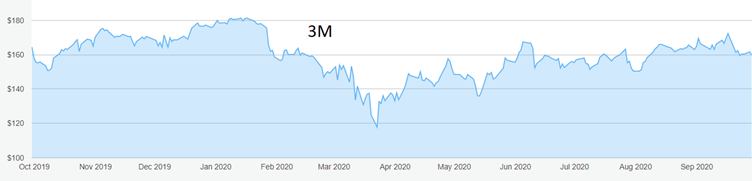

The recovery is proceeding according to plan at industrial conglomerate and Post-it note maker 3M (NYSE:MMM), but the improved trading is still not fully reflected in the share price. The opportunity to buy has not gone away yet, though it could do soon.

This is a company with a wide spread of interests across industrial products, healthcare, worker safety and consumer goods.

All was going well early in the year following a drastic reorganisation that saw jobs lost and the four parts of the business given greater autonomy across the globe rather than splitting the business among geographic regions. Sales rose in the first quarter of 2020, with healthcare benefiting from the early stages of the Covid-19 crisis.

- 3M: a defensive stock worth sticking with

- Want to buy and sell international shares? It’s easy to do. Here’s how

Then the shares were dragged down in the general stock market carnage, and a trading update on 15 June seemed to justify the sell-off. Total sales for May slumped 20% to $2.2 billion compared with the same month in 2019.

Even the Asia-Pacific region, which was past the worst of the Covid-19 economic impact, was down 15%, while Europe, still in the grips of lockdowns, declined 26%.

The main brunt of the turndown came in what was already the worst performing division, transport & electronics, which was down 30% in the second quarter, but even healthcare suffered an 11% slippage.

Source: interactive investor. Past performance is not a guide to future performance.

May proved to be the worst month, though, and the second quarter will turn out to have been the worst in 2020. For April-June net sales fell 12% to $7.2 billion but net income actually improved by 14% to $1.3 billion as 3M acted swiftly to slash costs. Chair and chief executive Mike Roman was able to claim robust cash flow despite the significant impact of the global economic slowdown.

Even more encouraging was a single-digit year-on-year rise in sales in July, indicating that some pent-up demand was feeding through, with orders being postponed rather than lost altogether.

The better news has continued. Sales were also higher than a year ago in August, and 3M is naturally now confident of reporting an improved performance for the third quarter. The August improvement was admittedly a mere 2%, but, in a coronavirus-infected year, that is better than many companies can boast. In any case, there was one fewer business day in the month, which knocked 5% off the sales figure. All being well, the third quarter should produce sales of $8.2-8.3 billion against $8 billion in 2019.

One negative aspect is that the improvement is still a bit patchy rather than across the board. The biggest gain in August was a 23% leap in healthcare. The safety & industrial and consumer divisions showed some growth, but transportation & electricals was still running 11% adrift.

Likewise, the Asia-Pacific region is still down 2%, although the previously worst-performing zone of Europe, the Middle East & Africa is now leading the recovery. Unless the Covid-19 situation gets much worse, the only way is up.

- Despite tech troubles, have US equities entered a new bull market?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The shares peaked at $250 in January 2018 and began a slow slide, but they had begun to climb back, reaching $180 at the start of this year. The low of $125 in mid-March meant they had lost half their value in just over two years, which looked overdone for such a solid defensive company.

Hobson’s choice: I recommended the shares in June when the price was $167, and I expected them to edge back up to January’s level. The second-quarter setbacks have instead pushed them slightly lower to around $160, but the advice to buy up to $180 still stands. Given the recovery to normal trading levels, the case is now more compelling and the yield of 3.7% is attractive. While this year is likely to be an exception, 3M has a record of increasing the dividend every year.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.