Sustainable and responsible investment: how has it fared during market crises?

Evidence is mounting that sustainable and responsible investment funds are weathering the 2020 bear mark…

22nd April 2020 17:19

by John Ditchfield from interactive investor

Evidence is mounting that sustainable and responsible investment funds are weathering the 2020 bear market conditions better than many of their peers. John Ditchfield considers the arguments.

Since the 1970s, there have been four periods during which global equities have fallen more than 10% in five days; the 1987 crash, the 2008 global financial crisis, the 2011 eurozone crisis, and the first few months of 2020.

Each of these events has occurred in very different circumstances and brought its own specific challenges. The bear market of early 2020 is no exception, with a severe downturn caused by an emerging understanding of the economic consequences arising from the coronavirus.

This is leading to the effective hibernation of the world’s largest economies, and an extremely rapid slowdown in economic activity. Despite this, there is growing evidence that companies with robust attention to ESG (environmental, social and governance) criteria and sustainability issues have been better at weathering the current storm than their peers.

The evidence explored

Sustainable investing covers a broad range of styles and approaches, with consideration of ESG ratings, negative screening, positive selection based on a range of themes, and focus on positive social and environmental impact being some of the principal methods.

In order to get a picture of how the sustainable investing market has performed overall this year, I compared the MSCI SRI indices, designed to represent the performance of companies with good ESG ratings, with their conventional unscreened equivalents, and found that every single one had outperformed.

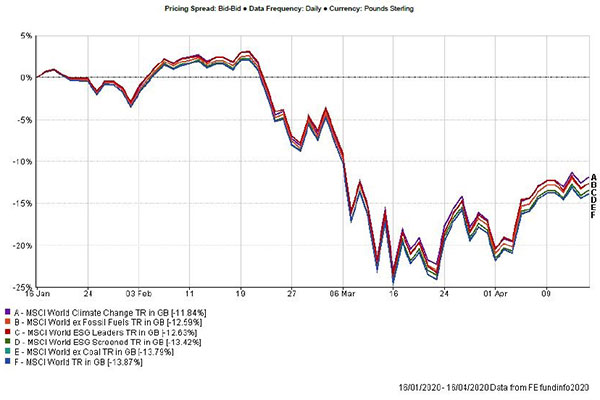

The same applies when it comes to other responsible and sustainable versions of the MSCI World index, with versions incorporating ethical screens such as armaments and tobacco and others with a climate change focus all outperforming the standard benchmark, as the chart below shows.

Sample of MSCI World indices vs ESG screened versions

Source: FE Analytics

Of course, examining indices alone excludes the potential value-added of active management, and it comes as no surprise that all the global equity funds highly rated on sustainability, strategy and investment process by Impact Lens have held their ground better in recent times.

Other investors have found a similar trend. For example, Morningstar found that nearly three-quarters of sustainable equity funds ranked in the top half of their performance category from the start of January to early March.

Why might this be?

What it is it about sustainable and responsible investing that has led to this relative outperformance? Can it be put down to sector or style bias? Or are companies with a more robust focus on ESG simply doing better?

When it comes to economic sectors, sustainable funds’ avoidance of the oil and gas industry has played out well in the current crisis, with reduced demand and excess supply causing the oil price to drop precipitously. Responsible investment portfolios also tend to have low exposure to consumer products and the industrials sector, and have a higher proportion of investments in financials and in healthcare.

By their nature, sustainability funds tend to look further into the future than other products, and portfolios are often more growth-orientated, with greater emphasis on businesses able to respond to major macroeconomic changes, such as the shift away from fossil fuels.

Above and beyond these sector- and style-related trends, however, we are seeing signals that companies better able to adapt to social and environmental challenges are performing better. Investors increasingly believe that companies with good attention to social issues, such as sick pay and remote working, are better prospects than those focused on profit alone.

Thus, an analysis of share prices in France throughout February and early March found that companies who integrated “sustainable development goals” in their strategy could also be more resilient in a bear market, with the average share price of sustainability leaders Schneider Electric, Legrand and Danone outperforming the wider market.

What about previous crises?

Sustainable and responsible investing has ballooned over the past few years, with retail sales of ethical funds reaching a record high of £1.1 billion in 2018. Back in 2008, the market was a lot smaller, so establishing any dominant pattern is more difficult. While my research into this period did detect some very minor outperformance of the FTSE4GOOD indices, there was not enough to call it a trend, although ethical funds did hold on to assets better than other types of fund in 2008.

Of course, 2008’s bear market was itself the result of poor transparency and governance across the financial services industry. Today, we see companies across the board operating with far greater awareness of ESG issues than in 2008, providing sustainable funds with a much larger investment universe of companies, and leading to better products all around.

What about future crises?

With so many unknowns in terms of health, the global economy and financial markets, it is hard to project the trajectory for sustainable funds over the next few months. However, there are clear signals that investment strategies that take more than profit alone into account fare better when times are tough.

It seems inevitable that the current crisis, caused as it was by an existential shock, will only lead to more emphasis on the likely financial impacts of major global issues such as climate change and health, themes that many responsible funds have at their core. Let’s hope that by the time the next major bear market occurs, all investment funds are taking sustainability seriously and are better able to manage a downturn.

John Ditchfield is chairman of Impact Lens and head of responsible investment at Helm Godfrey.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.