Tax gap at record low – but government may still ramp up efforts against tax avoidance

Figures published by HMRC show that the shortfall for the 2018/19 financial year was 4.7%.

10th July 2020 13:08

by Tom Bailey from interactive investor

Figures published by HMRC show that the shortfall for the 2018/19 financial year was 4.7%.

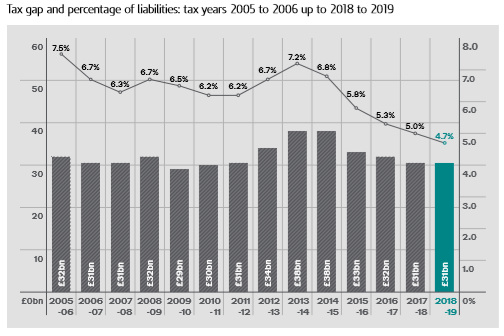

The tax gap – the difference between the amount of tax that should be paid and what has been paid – is at the lowest levels since records began.

Figures published by HMRC show that the shortfall for the 2018/19 financial year was £31 billion. That represents a tax gap of 4.7%.

The tax gap has several causes, including honest mistakes, aggressive accounting to legally avoid tax and outright tax evasion.

While the tax gap is at historic lows, Tom Selby, senior analyst at AJ Bell, points out that the total sums are still relatively large. He says: “Although HMRC has been successful in reducing the ‘tax gap’ to record lows, a financial black hole of £31 billion remains eye-watering by any standards.

“To put that in context, the missing cash roughly equates to the entire budget of the Department for Transport and the Department for Business, Energy and Industrial Strategy in 2018/19…combined.”

Selby argues that with the government ramping up public spending to mitigate the economic fallout of Covid-19, the government may look at this shortfall as a way to reduce the deficit. He notes: “With Covid-19 placing a huge strain on public finances, HMRC will be under even greater pressure to close the UK tax gap in 2020/21 and beyond.”

Dawn Register, partner in tax dispute resolution at BDO, makes a similar point, arguing that the missed tax liabilities “could be a crucial ‘Covid-19 fighting fund’ to help raise tax revenues, without the need to actually increase tax rates”.

According to Selby, efforts to reduce the gap will likely focus on people legally getting around tax obligations, known as tax avoidance. He says: “These efforts will likely focus on people breaking or bending the rules to artificially reduce the amount of tax they pay.”

However, as Register points out, this account for just 4% of the tax gap. In contrast, over 30% of the gap is put down to evasion and “criminal attacks”.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.