These star stocks are the future for money

A track record of beating profit forecasts grabs the attention of our overseas investing expert.

30th October 2019 09:57

by Rodney Hobson from interactive investor

A track record of beating profit forecasts has grabbed the attention of our overseas investing expert.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

The big two global payments processors have high credit scores from investors, but the ratings are entirely justified as the future for money is plastic.

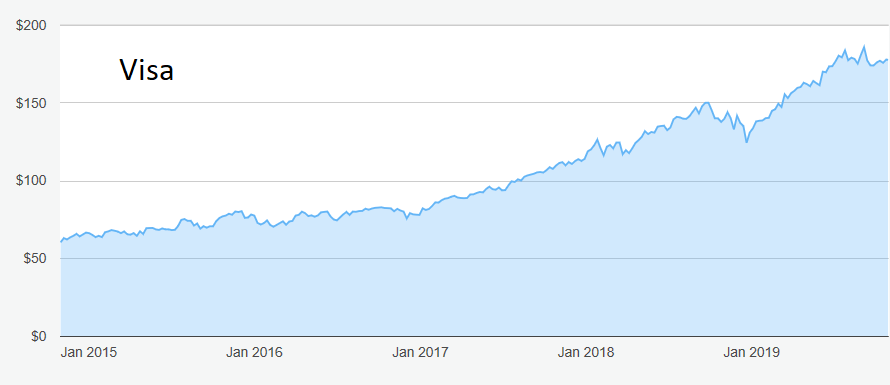

Latest results from plastic cards giant Visa (NYSE:V) show why the stock is so highly rated. The shares are not cheap but, after pausing for breath over the past few months, they could be on the rise again soon.

Visa's financial year runs to the end of September and the group reported strong sales, profits and cash generation in its fourth quarter. Revenue shot up 13%, taking annual growth to 11%. Underlying earnings per share rose 21% to $1.47, raising annual growth to 18% at $5.44. The figures beat analysts' forecasts, marking three years of topping expectations in every quarter.

Source: interactive investor Past performance is not a guide to future performance

Some of this growth has been organic, through expanding partnerships with several large clients around the world and establishing new ones. Visa has also been busy with bolt-on acquisitions added at a steady pace but not so many as to stretch management too far.

The latest of four such buys was London-quoted cross-border payments specialist Earthport for £247 million. Visa saw off a spoiler offer from arch rival Mastercard (NYSE:MA), though this inevitably meant paying more than intended. Fortunately, Visa had to raise its initial offer only once before Mastercard threw in the towel. The deal was approved this summer by the UK's Competition and Markets Authority, by which time Visa already had acceptances for 71% of Earthport shares.

Visa shareholders have been rewarded with consistently rising dividends over the 12 years that the company has been publicly listed. The 20% leap in the fourth quarter took the payout to 30 cents a share. Strong cash flow – top side of $12 billion over the past 12 months alone – means that Visa has also been able to indulge in a large-scale programme of share buybacks, which has been a major factor in the sharp rise in earnings per share. Almost $8 billion was spent on buybacks in the past financial year and a quarter of the 3 billion shares in existence at the flotation have now been cancelled.

The policy of buying back shares and raising the dividend is almost certain to continue for the foreseeable future given that the trend towards credit and debit card payments in place of cash and cheques is sure to continue.

Visa shares were little more than $60 five years ago. Despite a sharp dip in the final four months of last year, they have plateaued at around $180 this year. The peak of $185.74, reached on 6 September, could be topped soon given that Visa is forecasting earnings per share growth in the mid-teens for the current year to next September. Its record so far suggests that it will not fall short.

Visa's hefty price/earnings (PE) ratio of 34 and its tiny yield of 0.56% look like a real turnoff, but investors should bear in mind that the rapid growth of profits is likely to continue. The only real alternative on the same scale is Mastercard, where the PE of 42 is even more demanding and the yield even lower at 0.48%.

It, too, reported sharply increased revenue and profits in the latest quarter and it has also benefitted from strategic acquisitions. Likewise, it keeps generating cash to raise the dividend and fund share buybacks.

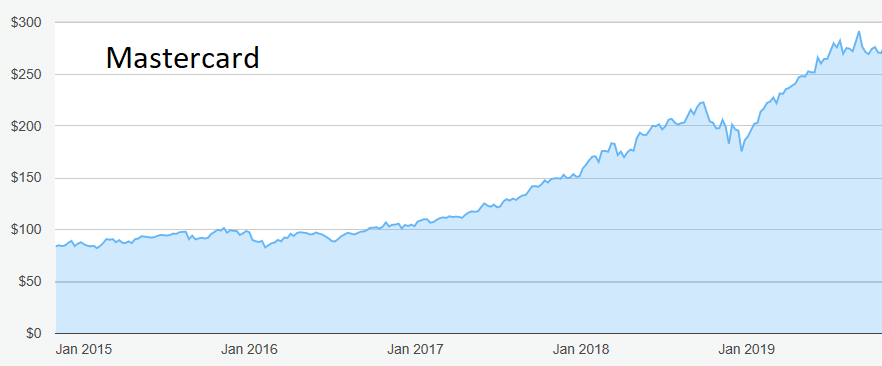

Source: interactive investor Past performance is not a guide to future performance

Mastercard shares have followed a similar pattern to Visa's over the past five years, nearly trebling from $84 to a peak of $222 in September, but its bounceback from the year end slide has been much more pronounced and the shares have since set a new high at $292.

Hobson's choice: Buy Visa at up to $185. Currently, you should have no difficulty getting in below $180. I believe Mastercard is worth considering below $290.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.