Threat of new Covid outbreaks knock investor sentiment...

25th August 2021 14:57

by Jemma Jackson from interactive investor

...but two-thirds are doing nothing with their investments, poll finds.

Investor sentiment has been knocked by fears of a new wave and more contagious strains of Covid-19 – but few are prepared to make any changes to their portfolio, a new poll by interactive investor, the UK’s second-largest DIY investment platform, finds.

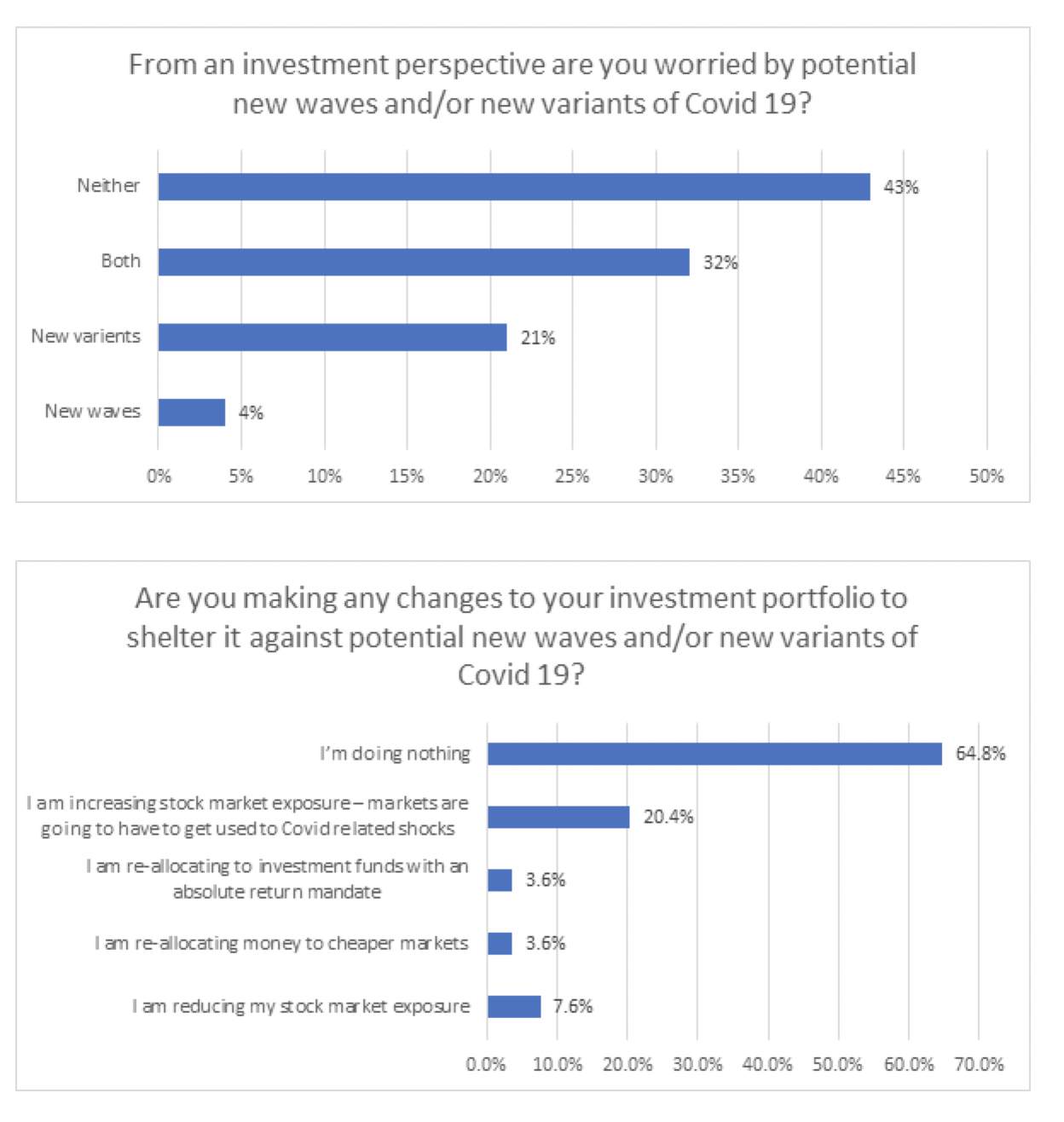

In a poll of 1,617 interactive investor website visitors between 17 and 23 August 2021, 57% of respondents expressed concern over the impact further Covid-19 outbreaks would have on their investment portfolio.

More than a fifth (21%) said the advent of new variants worried them most, only 4% cited a new wave, while almost a third (32%) said both are major concerns from an investment perspective. However, 43% believe neither are of concern.

Despite worries over the pandemic, almost two-thirds (65%) of respondents said they are choosing to do nothing with their investments, while a fifth (20%) are increasing stock market exposure in the belief that markets will need to get used to Covid-related shocks, and 8% are reducing their market exposure.

In addition, despite targeting positive returns regardless of the market environment, only 4% of respondents said they are reallocating money to funds with an absolute return strategy, and the same percentage said they are shifting funds to perceived cheaper markets.

Geopolitical biggest threat over five years

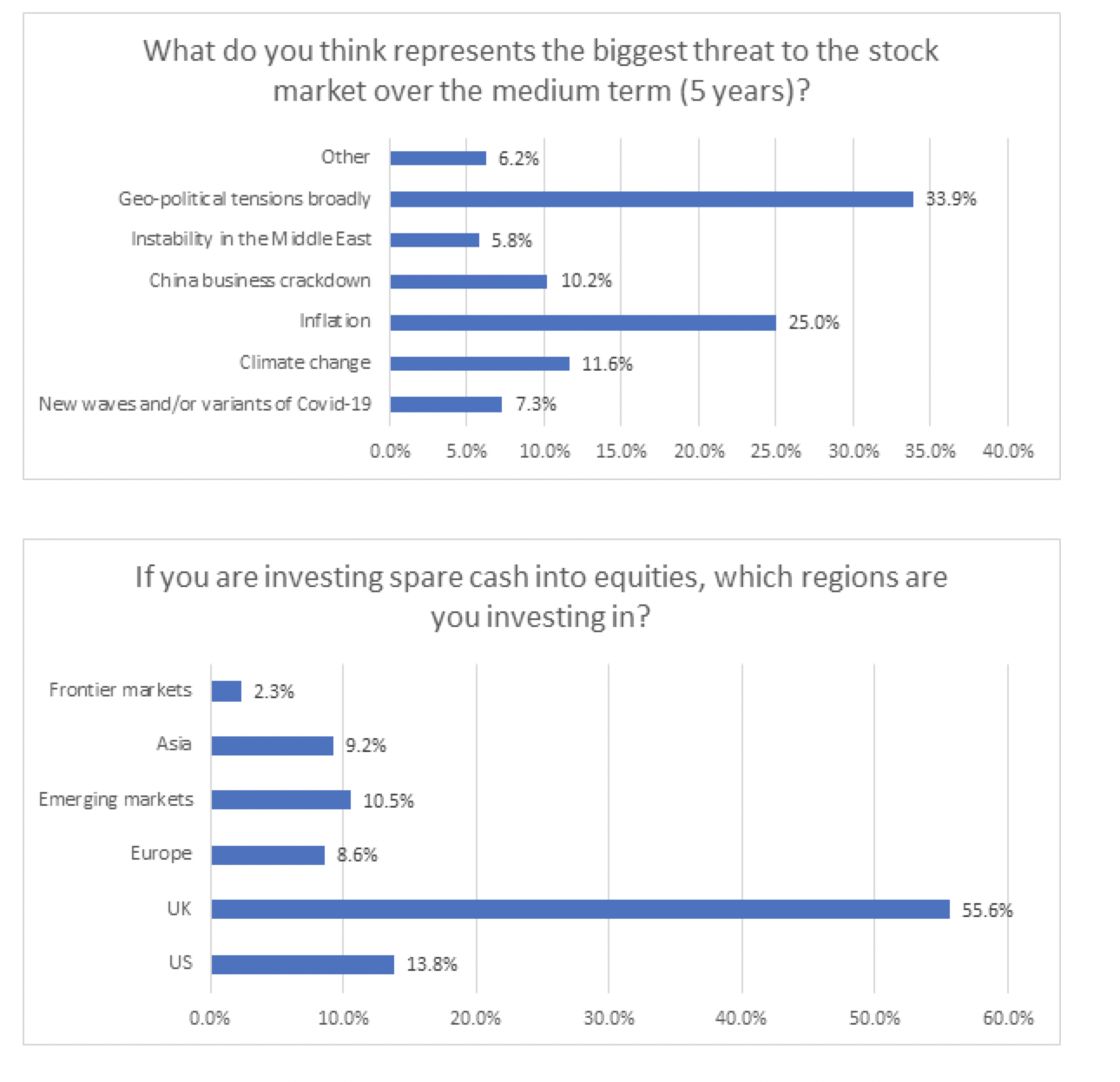

The survey suggests that the coronavirus crisis appears to be a short-term concern among investors. Only 7% of the sample view new waves and/or variants of Covid as the biggest threat to stock markets over the next five years.

Geopolitical tensions (34%) are considered the biggest threat to the stock market over the period, ahead of inflation (25%), climate change (12%) and China’s crackdown on private businesses (10%).

Amid the furore in Afghanistan following the Taliban takeover, instability in the Middle East was cited by 6% of respondents.

For those increasing their stock market exposure, the UK was the most-favoured region (56%), followed by the US (14%) and emerging markets (11%).

Lee Wild, Head of Equity Strategy, says: “A new phase of the pandemic this summer, where restrictions in the UK have been removed and we return to something approaching normality, seems to be reflected in the attitude of investors.

“While many remain worried about the virus, only a small number are reducing stock market exposure because of potential new waves and/or new variants of Covid-19. And Covid is the least of their worries, miles behind geopolitical events and inflation, and trailing concerns about China and climate change. We’ve already seen local flare-ups caused by mass events such as festivals and sporting events, but the big test will come in a few months’ time when more people return to work and colder weather forces us inside.

“Many companies, especially those in the leisure and entertainment industry, have only just begun rebuilding revenues damaged by lockdowns. They will be hoping that this year’s successful vaccination programme can prevent a repeat of 2020.”

Myron Jobson, Personal Finance Campaigner, interactive investor, says: “The autumn and winter months of the year are shaping up to be wrought with uncertainty - with concerns over inflation, worries that the US Federal Reserve start of tapering economic stimuli that have helped stocks, China's heavy-handed interference in markets and the Covid pandemic weighing on markets.

“The dilemma facing investors in volatile markets is whether to stick or twist. Cash offers a great deal of peace of mind in volatile markets as its value doesn't fluctuate, something that is particularly important to those approaching retirement. But over the long term, the buying power of cash is usually eroded by rising price inflation, so it's only truly suited as a short-term home for your money.

“Ideally, even when markets are rough it is still worth keeping your money invested. History has shown that investing can yield better results than cash savings over the long term. Nervous investors can drip feed investments monthly to help smooth out the inevitable bumps in the market, buying fewer shares when prices are high and more when prices are low – a process known as pound-cost averaging.”

Notes to editors

1,617interactive investor website visitors completed the poll between the afternoon of 17 to morning of 23 August 2021.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.