This top hedge fund sees global stocks beating the US through 2035

US stocks have seemed the only investing game in town for years, but a new paper warns that relying on that track record could be a mistake. Here’s why.

16th May 2025 13:18

by Stéphane Renevier from Finimize

A huge 80% of US stock outperformance since 1990 came from rising valuations, not from stronger fundamentals.

The profile for stocks now is the mirror opposite of what it was 35 years ago: US shares are now nearly twice as expensive as international ones, making future outperformance a much bigger ask.

That makes now a good time to diversify globally – the odds of better returns outside the US are finally in your favour.

US stocks have dominated global markets for the past 15 years, delivering standout returns and reinforcing the idea that America is the only investing game in town. But a new paper from AQR Capital Management warns that relying on that track record could be a mistake. Here’s why.

What's behind US outperformance?

First, a little backstory. However shiny you think the US market is now, it hasn’t always been that way. It lagged behind its global peers in both the 1980s and 2000s. It rallied hard in the 1990s, cooled off with the dot-com crash, and picked up serious steam again after the global financial crisis. And, yep, it’s mostly run at an unmatched pace ever since.

So you can think of US outperformance in two clear phases: from 1990 to 2000, and from 2009 to now. But across that full stretch, US stocks beat their developed-market peers by an average of 4.7% per year, according to MSCI data.

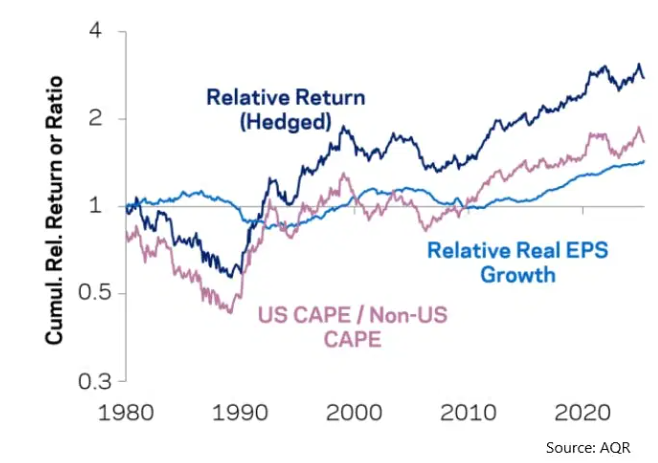

To understand why, AQR’s Antti Ilmanen and Thomas Maloney did the math on what drove US stocks outperformance. (Remember, stock returns always come down to three things: changes in valuations, earnings growth, and dividend yields). Here’s what they found:

- +3.8% of the outperformance per year came from valuation expansion – meaning investors were simply willing to pay more for US stocks compared to their international peers

- +1.1% came from faster real earnings growth in the US market

- The remaining components – including dividend yields and real interest rate differences – slightly favored non-US markets, and were a drag on the US edge

So while the US did grow earnings faster over that long period, nearly 80% of the relative outperformance came from rising valuations – not from delivering significantly better fundamentals.

So what’s the problem?

The bar for another decade of US outperformance is now sky-high.

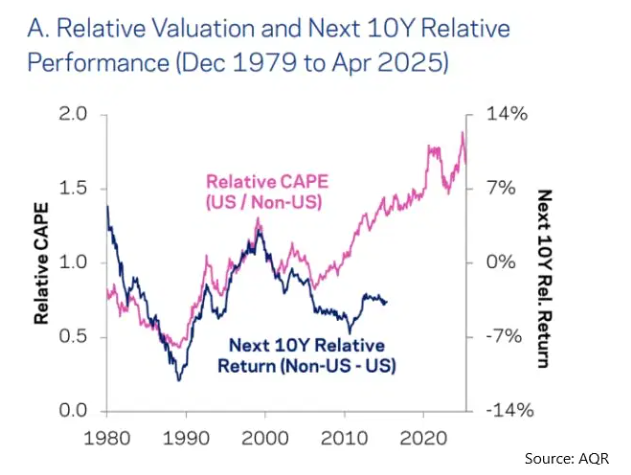

See, when it comes to decade-long returns, the most important factor is starting valuations – how pricey the stock is when you buy in. Back in the late 1980s, the US had the perfect setup: stocks were dirt cheap. The cyclically adjusted price-to-earnings ratio (or “CAPE”, a long-term valuation metric) was less than half that of international markets (pink line). And that gave US shares plenty of room to run.

And run they did. In the 1990s, US valuations rocketed relative to the rest of the world – a shift that powered a big chunk of the decade’s outperformance (dark blue line). Around the end of the decade, the dot-com crash reset valuations lower again, at least for a while. By the mid-2010s, earnings growth in America kicked into high gear just as earnings in other regions stagnated. And that widened the gap even more.

US outperformance (dark blue) closely followed shifts in relative valuations (pink), which started from a low base in the late 1980s. As that gap closed, returns surged. Stronger US earnings (light blue) added extra fuel, but was not the main driver. Source: AQR.

Today looks very different. In late 2024, America’s stocks began trading at nearly twice the valuation of those from other markets – and about four times higher than their relative level back in the early ’90s. And if that weren’t muscle enough, US earnings surged far ahead of global peers.

In other words, the starting point today is the opposite of attractive. It’s not 1990 – it’s more like late-1980s Japan. And that story didn’t end well.

What happens next, then?

US stocks aren’t necessarily headed for a crash – but with valuations near an all-time record and earnings already running hot, the odds of underperforming the rest of the world over the next decade are stacked pretty high.

There are two reasons for that:

First, relative valuations can’t stay extreme forever. They tend to swing – rising well above or falling well below average, and often overshooting on the way back. Now, that doesn’t mean US valuations will collapse overnight, but it’s fair to expect some return to more normal levels over time.

Here’s what it could mean. Say you're still optimistic and assume US earnings grow annually 1% faster than in other regions. Even then, if valuations were simply to return to parity with the international crowd, you'd be looking at a relative drag of 5% per year over the next decade – more than enough to cancel out any growth edge.

In fact, just a mild reset – for example, valuations falling a modest 10% relative to non-US stocks by the end of the decade – would still eat up most of the performance gap.

The point is, if the historical link between starting valuations and future returns holds, international stocks are set up to strongly outperform American ones over the next decade (dark blue line up) – despite how things have gone in recent years.

Rising US valuations relative to non-US stocks (pink line) have historically pointed to stronger ten-year returns for non-US markets (dark blue line). Source: AQR.

Second, suppose relative valuations stay exactly where they are – near record highs – and don’t fall at all. That’s a bold assumption, but it’s not out of the question. After all, the US does have a lot going for it: a strong entrepreneurial culture, market-friendly institutions, and many of the world’s tech mega-giants.

In this case, even if valuations hold steady, US companies would still need to deliver far stronger earnings growth just to match expected returns elsewhere. According to AQR’s December 2024 forecasts, US stocks are expected to return 4.2% per year over the next decade, while cheaper non-US markets are set to deliver 6.1% – both in “real” (i.e. after inflation) terms, on a currency-hedged basis.

To close that gap – assuming valuations themselves don’t move – earnings growth in the US would need to outpace global rivals by more than 2.2 percentage points per year. That’s more than double the historical average, and far above the 0.3 percentage point growth edge that AQR sees as likely.

In short, high valuations would leave little margin for error – and put a heavy burden on earnings to overdeliver.

Why should you care?

If you’ve been ignoring non-US stocks because American ones have had a longstanding habit of achieving strong returns – it might be time to challenge your view.

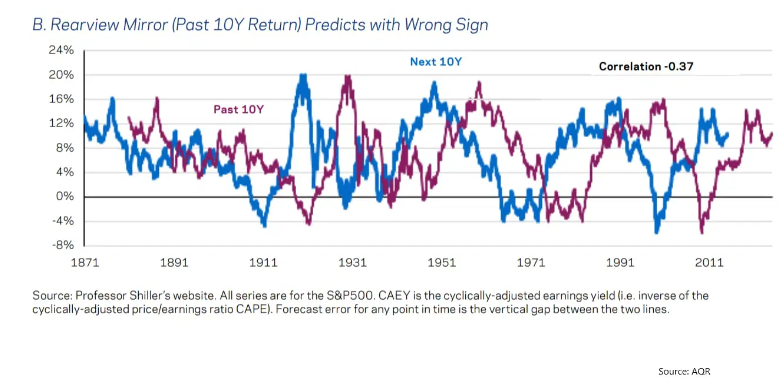

First, relying on the past to predict the future isn’t always a winning move. AQR’s research finds that both valuation changes and bursts of earnings growth tend to reverse over a ten-year horizon – not repeat. In other words, if the last decade was great for US stocks, history suggests the next one won’t be.

Using returns from the past ten years to predict the next ten has been a terrible strategy. Source: AQR.

Second, even if you’re upbeat about the US – and there are valid reasons why you might be – a lot of optimism is already priced in. And with valuations near the extremes, anything short of near-perfect execution would tend to lead to disappointment.

That doesn’t mean US stocks are doomed or can’t keep outperforming. But it does mean the odds of international stocks doing better from here might be higher than what investors’ positioning suggests.

The takeaway is clear: now’s a smart time to diversify. Broadening your portfolio to include other regions could smooth your returns – and boost your chances of hitting your long-term goals.

Stéphane Renevier is an analyst at finimize.

ii and finimize are both part of Aberdeen.

finimize is a newsletter, app and community providing investing insights for individual investors.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.