Trusts vs funds: why it’s vital to take the rough with the smooth

20th July 2022 14:11

by Jemma Jackson from interactive investor

Research from interactive investor explores how funds and investment trusts compare through a difficult environment, as well as looking at longer-term performance.

- Funds outperform investment trusts amid recent choppy markets, but trusts prove their power over the longer term

It has been a tough year-to-date for markets, with private investors having to navigate a range of challenges, not least biting inflation, higher interest rates, and the looming risk of recession.

New research from interactive investor, the UK’s second-largest investment platform for private investors, explores how funds and investment trusts compare throughout this difficult environment, as well as looking at longer-term performance.

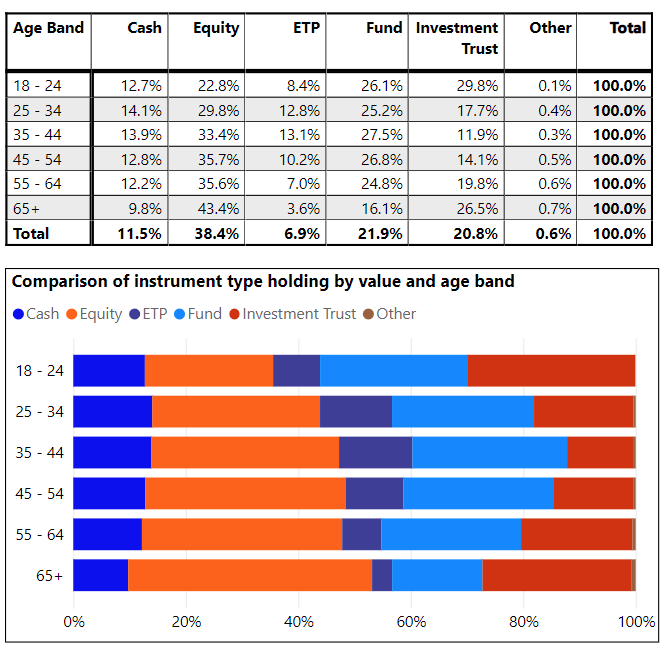

According to the latest interactive investor Private Investor Performance index, at the end of June 2022 customers had, on average, roughly the same amount invested in funds (22%) as investment trusts (21%). But their performance can vary according to the market conditions, and private investors need to be aware of this.

interactive investor compared AIC and IA sector returns over 20,10, and 5-year periods, as well as year-to-date. All data is up to 30/06/2022.

Investment trusts the clear winner over 20 years – but the year-to-date has been a drag

While there are sector variations, the headline data is that investment trusts tend to outperform significantly over the very long-term, and underperform during periods of clear volatility, such as the year to date. In between those two points, the results can be mixed, demonstrating why it can be worth having a mix of the two.

The underperformance of investment trusts over the challenging year to date, and outperformance over the very long term, is primarily due to the fact that investment trusts can gear (borrow) to enhance returns. This is great in a rising market, but a drag when markets fall.

For example, over the year-to-date, the private investor dominated AIC Global investment trust sector is down 23%, versus down 15% for the IA Global funds sector. It’s a similar story for the flagship UK All Companies sectors, with the average investment trust down 27% year to date versus 13% for the average fund, illustrating a variety of strategies.

Performance is much closer in the investment trust and fund UK Equity Income sectors and the UK Smaller Companies investment trust sector has outperformed its equivalent funds sector, although each are nursing losses.

But over 20 years, interactive investor research shows that it is investment trusts that have come out as the clear winner. Apart from the UK Smaller Companies sector, where funds have outperformed, trusts on average, beat their fund counterparts across every other comparable fund sector which ii looked at.

The AIC Global investment trust sector, dominated by private investors, returned, on average, 440% compared to 329% from the IA Global sector over 20 years.

The biggest difference was in the Asia Pacific sectors – where the AIC investment trust Asia-Pacific sector delivered 1,174% over 20 years companies to the 553% return for the IA funds Asia Pacific Excluding Japan sector.

The European Smaller Companies investment trust sector almost doubled the performance of its fund equivalent over 20 years.

Past performance is absolutely no guide to the future.

The medium to longer term

Over the last 5 years, funds in the retail investor focussed IA Global sector outperformed their AIC investment trust counterparts, returning an average of 41% compared to 24% for investment trusts. Similarly, funds also beat trusts over five years in the UK All Companies sector, returning 11% compared to 1% from investment trusts in the AIC sector. Over the same period, the IA’s Europe Excluding UK sector also outperformed trusts – returning 17% compared to 14%.

Nevertheless, when looking at cumulative returns over 5 years, the standout performer for trusts has been the AIC Asia Pacific sector – returning 111% compared to 30% from funds in the equivalent IA sector.

Over 10 years, the differences between funds and investment trusts are generally more subtle, although the AIC UK Equity Income investment trust sector, also heavily retail focussed, has significantly outperformed its IA fund equivalent, up 135% compared to 98% for funds.

Past performance is absolutely no guide to the future.

Funds versus trusts – which have fared best amid the torrid time for markets? Data to 30 June 2022

Sector | YTD Cummulative % | 5 Year Cummulative % | 10 Year Cummulative% | 20 Year Cummulative % | ||

IA Global | -14.7 | 41.1 | 168.2 | 329.1 | ||

AIC Global | -23.3 | 23.9 | 147.9 | 439.6 | ||

IA UK All Companies | -12.9 | 10.7 | 95.5 | 234.9 | ||

AIC UK All Companies | -26.6 | 0.9 | 91.1 | 279.7 | ||

IA UK Equity Income | -5.8 | 11.3 | 97.5 | 239.7 | ||

AIC UK Equity Income | -7.3 | 18.3 | 134.7 | 320.2 | ||

IA UK Smaller Companies | -24.6 | 19.7 | 162.8 | 477.6 | ||

AIC UK Smaller Companies | -20.5 | 22.8 | 151.4 | 424.8 | ||

IA Europe Excluding UK | -17.0 | 16.7 | 147.5 | 307.4 | ||

AIC Europe | -26.2 | 13.8 | 168.3 | 467.2 | ||

IA European Smaller Companies | -25.9 | 15.0 | 171.9 | 557.8 | ||

AIC European Smaller Companies | -32.3 | 20.9 | 284.7 | 989.6 | ||

IA Asia Pacific Excluding Japan | -6.4 | 30.3 | 128.4 | 553.3 | ||

AIC Asia Pacific | -17.2 | 111.1 | 284.0 | 1,173.6 | ||

Source: Morningstar. All data is up to 30/06/2022. Total Return (GBP) is used for IA sectors and Market Return (GBP) is used for AIC Sectors. Data is size weighted. Past performance is no guide to the future.

Keeping an open mind when it comes to your investments

Dzmitry Lipski, Head of Funds Research, interactive investor, explains: “It’s interesting to compare performance, but investors need to be aware that the investment trust industry is smaller than the funds industry – so has fewer competitors in the field. Even so, it’s very clear that over the very long term and during volatile periods, there can be some clear differences in the way each behaves.

“This data illustrates loud and clear that investors should keep an open mind, and they don’t have to choose between funds and trusts – you can have a mix of both.”

Kyle Caldwell, Collectives Specialist, interactive investor, adds: “Investment trusts are powering many of our customer portfolios, but it is important to take the rough with the smooth.

“In a rising market, they have some fantastic tools to boost performance, such as gearing (borrowing) to enhance returns. They can also be a great way to access alternative assets, because of their unique, ‘closed ended’ structure, which helps managers take a long-term view of the market.

“But those same benefits can quickly turn against you when markets fall. Investors should not panic - if you believe in the long-term potential of the stock market, investment trusts are the ultimate active investment.

“Having a fixed pool of assets means that investment trust fund managers don't have to sell their holdings to release money back to investors looking to liquidate their investments when markets dip. Instead, investors can sell their shares on the stock market and the share price takes the strain.”

Breakdown of average ii customer portfolios across various age groups – as to 30 June 2022 (Source: interactive investor Private Investor Performance Index)

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.