TUI smashes Thomas Cook, while Saga buys growth

27th September 2018 12:04

by Lee Wild from interactive investor

Both these high-profile companies are in the travel game and each has its own demons to deal with. Lee Wild, head of equity strategy at interactive investor, analyses latest results.

TUI

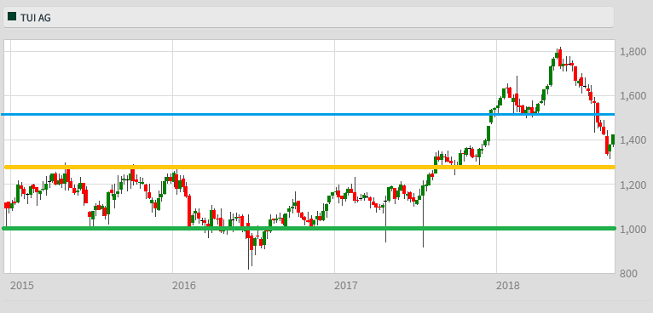

TUI has lost 20% of its value since May, the hot summer keeping holidaymakers at home, increasing competition and heavy discounting through August and September. Thomas Cook's profit warning a few days ago was a massive red flag for TUI, but concerns have been misplaced.

TUI doesn't expect any surprises for the rest of 2018, which should mean a fourth consecutive year of double-digit growth in underlying profit. That’s significant and the kind of growth that Thomas Cook can only dream of.

It's early days for winter bookings, but it's still good to hear that most markets are up on last year. However, Scandinavians are only just recovering from the hot summer, and are clearly in no mood to book ahead just yet. That's clearly an area to watch carefully.

It's no surprise to see a much weaker Turkish Lira double TUI's foreign exchange hit to €70 million. FX and any further increase in the oil price will raise costs on the unhedged portion of its currency and fuel exposure.

Source: interactive investor (*) Past performance is not a guide to future performance

Saga

It's been months since we last heard from Saga, and it needed a strong set of numbers to maintain confidence in the recovery since last December's grim profits warning.

Half-year pre-tax profit is down 3.7% at just under £107 million, but that's partly a consequence of investment needed to rebuild the business. Crucially, winning a lot more car and home insurance work has catapulted customer numbers back to levels seen before the profit warning. It's also good to see lower costs, and Saga is throwing off enough cash to keep paying the 3p interim dividend.

But Saga is facing challenges across all its businesses right now. Travel profit is flat at best, and it will not be easy offsetting a likely weather-related hit to home insurance business and lower motor premiums during the second half.

Source: interactive investor (*) Past performance is not a guide to future performance

*Horizontal lines on charts represent previous technical support and resistance. Blue diagonal line on Saga chart represents recent uptrend.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.