Two-thirds of investors think FTSE 100 bosses overpaid, poll shows

With unemployment expected to soar, the debate over executive pay is set to resurface.

30th September 2020 12:40

by Myron Jobson from interactive investor

Following details of Tesco CEO Dave Lewis’ pay packet, and with unemployment expected to soar, the debate over director pay is set to resurface.

interactive investor snap poll: as Tesco CEO steps down, two out of three investors think FTSE 100 bosses are overpaid.

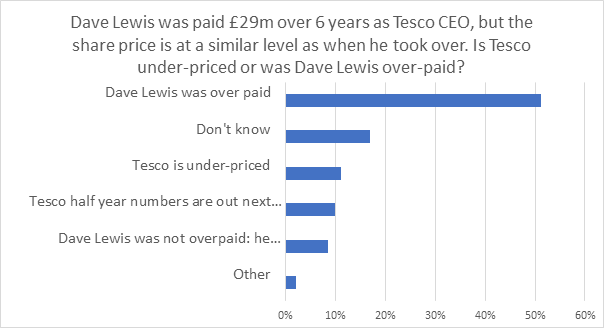

- Just over half (51%) believe that Tesco CEO Dave Lewis’ pay packet of £29 million over the past six years was too much, when compared to the company’s share price performance.

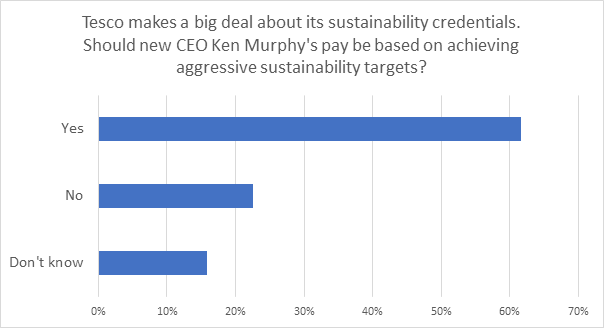

- More than 60% think that the new CEO’s pay should be based on achieving aggressive sustainability targets to reflect the big deal Tesco makes of its sustainability credentials.

With UK unemployment at its worst in nearly two years and set to soar in the months ahead, the issue of FTSE 100 chief executive pay is likely to come under growing scrutiny.

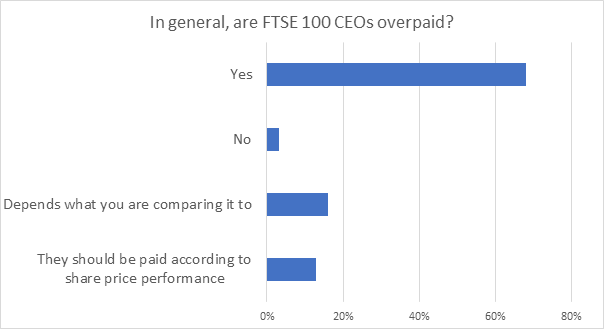

In an online survey among interactive investor website visitors (attracting 827 responses between 29-30 September), the UK’s second-largest direct to consumer investment platform found that more than two in every three investors (68%) believe FTSE 100 bosses are overpaid. However, 16% felt that it depends on what you are measuring it against and 13% of respondents feel that it should be paid according to share price performance.

In addition, just over half of private investors (51%) believe that outgoing Tesco chief Dave Lewis was overpaid, with £29 million in remuneration over six years.

Looking ahead, as the incoming CEO Ken Murphy takes charge, 62% of interactive investor customers said that they believe Murphy’s pay packet should be based on achieving aggressive sustainability targets.

Lee Wild, head of equity strategy at interactive investor, says: “The debate around director pay, and specifically some very high CEO salaries, acquires greater significance with UK unemployment at its worst in nearly two years and set to soar in the months ahead. Of course, quality does not come cheap, and many directors are rightly rewarded for their skills in what is a competitive marketplace. However, the spotlight will increasingly fall on those where the pandemic is not enough of an excuse to explain chronic financial and share-price underperformance.

“That almost two-thirds of investors now that think director pay should be linked to achieving aggressive sustainability targets is hugely significant. Many industries are moving in the right direction, but there is far more to be done, and there’s a sense that many companies are dragging their heels. Introducing a link between executive salaries and better green credentials might sharpen the mind at boardroom level.”

Just over one in 10 (11%) respondents believe that Dave Lewis was not overpaid, and that Tesco shares have instead been under-priced. Even fewer (9%) believed that, because he returned £2.8 billion in dividends during his tenure, the CEO was in fact value for money.

Some customers reasoned that his reorganisation of the business has helped it respond to the threat by discount supermarkets such as Lidl or Aldi, and that he did well to return to dividend payments.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.