US stock market outlook 2021: boom or doom?

American tech stocks were the stars of 2020, but will a new Democrat president keep markets onside?

29th December 2020 12:26

by Rodney Hobson from interactive investor

American tech stocks were the stars of 2020, but will a new Democrat president keep markets onside?

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Crisis? What crisis? The collapse in share prices on the New York Stock Exchange and Nasdaq in February and March no longer looks to have been the start of a much-expected correction after a decade-long bull market. Rather, it now has the appearance of a sharp but short-lived dip in a bull market that is continuing into its second decade.

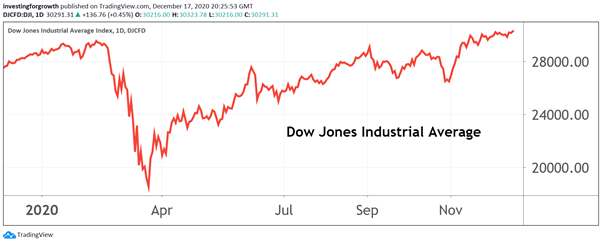

The Dow Jones Industrial Average has topped 30,000 points for the first time to stand 500 points above its February peak. It is hard to believe now that the index slumped to 18,592 in mid-March. The S&P 500 Index, a wider stock-market measure, has followed a similar pattern with an even wider swing.

Source: TradingView as at 17 December 2020. Past performance is not a guide to future performance

President Donald Trump’s steadfast refusal to acknowledge the scale of the Covid-19 pandemic has carried a huge cost in human lives – but it has minimalised the economic impact. With the exception of New York City for a short period in the spring, America has avoided the shutdowns that have left European economies struggling.

Meanwhile, the other great imponderable for the US, whether Trump could succeed in overturning the 2020 presidential vote, has been resolved. The gap in electoral college votes won by the two candidates was simply too wide and the college has duly confirmed the inevitable. There is no reasonable prospect of Congress overturning the vote, although technically that is possible.

Source: TradingView as at 17 December 2020. Past performance is not a guide to future performance

The one political uncertainty still outstanding is the outcome of the vote for two senators to represent Georgia, a Republican state that nonetheless voted for Democrat presidential candidate Joe Biden this time. The Democrats need to capture both seats when the result is announced in January to leave the Senate equally balanced, giving the Democrat Vice-President the casting vote as Speaker.

That would give the Democrats control of both houses of Congress as well as the presidency. A more likely outcome, though, is that the Republicans retain control of the Senate, which should be a bonus for investors as it will constrain President Biden from pushing through the more extreme measures that the left wing of his party wants.

- What Bill Ackman thinks will happen to stocks in 2021

- Will 2021 be a year of RECOVERY for global stock markets?

- Want to buy and sell international shares? It’s easy to do. Here’s how

The US works best when Republicans and Democrats seek the middle ground that has proved elusive over the past four years. This plays to Biden’s strengths. As Speaker of the Senate himself for eight years as President Barack Obama’s Vice-President, he has perfected the art of political compromise to keep the wheels of government moving.

In any case, the indications are that Biden will seek a more conservative pathway than many commentators feared. His appointment of the highly respected former head of the Federal Reserve Bank Janet Yellen as Treasury Secretary suggests that he will follow a prudent approach to economic policy.

Two policies he will certainly follow. First, he has made clear his desire to promote a green agenda. This will distance him from Trump, who withdrew the US from the Paris accord on climate change, and he can make a dramatic start by rejoining the Paris accord on his first day as president, an act that does not require the consent of Congress.

Second, he will aim to create more low-skilled, low-paid jobs without destroying the skilled, well paid posts that contribute to tax revenue. It will be a difficult juggling act.

Trump, a man who has taken irony to new levels, actually called a press conference to claim credit when the Dow topped 30,000. The euphoria on the day was, in fact, based on the realisation that Biden’s victory was not going to be overturned. Wall Street, at least, believes that it can live comfortably with a Biden presidency.

In fairness to Trump, one must accept that Biden inherits an American economy in far better shape than on the last occasion when the presidency passed from Republican to Democrat. In November 2008, Obama took over after the financial crash that saw financial institutions and the housing market in a state of collapse.

It took a massive dose of quantitative easing to get the economy going again 12 years ago. While Biden will not need to indulge in extreme economic policies, some help for the economy is required, help that Trump would have had difficulty arranging given that he has denied the scale of the epidemic in the US.

- The best and worst-performing stock markets of 2020

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

A relief package will need to be agreed with Congress, but there is every reason to believe that from February onwards there will be cash available for businesses and workers hardest hit.

The delay in providing it will have some impact. The recovery in the US economy is proceeding but it has slowed with fewer jobs created in November. Unemployment, although still falling, remains well above last year’s level.

So the US may well see an economic slowdown in the first quarter of 2021 before relief measures spark a recovery in the second quarter, when the roll-out of vaccinations will provide a further boost.

The US led the Western world back up in 2008 and is in prime position to do the same again. As 12 years ago, it will just take a little time.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.