Wealth tax on breakfast? Why you don’t need to settle for it on your platform costs either

Imagine there's a wealth tax on breakfast. If you earn more, you pay more. People would complain.

13th February 2020 14:13

by Jemma Jackson from interactive investor

Imagine, for a moment, that there is a wealth tax on breakfast. If you earn more, you pay more for your cup of coffee and your morning croissant. Ultimately, someone would probably start to complain.

Yet, this is what happens – without any controversy – with investment platform charges.

Imagine the scene: you have just enjoyed a meal at a restaurant with a friend. You both ordered the same thing, but you earn more than your friend and have more money in your bank account. Should you be expected to pay more than your friend?

78% of UK adults would not, according to a poll from interactive investor*, the UK’s second largest direct to consumer investment platform, using Opinium Research.

But why should investment platforms be any different? The platform service is the same regardless of your wealth. Yet investors with larger pots may end up paying far more for their investment platform costs if they are being charged a percentage fee, rather than a fixed fee.

Moira O’Neill, Head of Personal Finance, interactive investor, says:

“If you’ve saved and invested hard, percentage charges can amount to a significant wealth tax that can add up considerably over the years, compromising long-term growth and financial freedom along the way. That’s not to say flat fees are a panacea for everyone - beginner investors or those with smaller pots won’t find them competitive. But it’s important to know the implications because as the years roll by and your assets grow, flat-fee charging structures can really come into their own.”

A lost decade paying percentage fees?

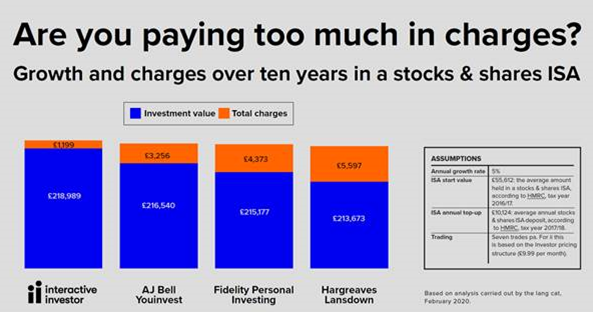

Independent analysis by financial services consultancy the lang cat for interactive investor this month suggests that investors with larger pots could be paying over four times more and be more than £4,000 worse off with ii’s largest competitor, which charges percentage fees, over the course of a decade.

The lang cat assumed an investor with an ISA pot of £55,612 (the average stocks and shares ISA pot, according to HMRC), and with annual top ups of £10,124 (the average annual top up, according to HMRC). Investors would have paid £1,199 in charges with interactive investor compared to £5,597 with our largest competitor (**see notes to editors for methodology).

Moira O’Neill continues:

“Compounding – where the growth on investments goes on to generate its own growth, creating a positive snowball effect – is a big part of how investments gain value over time. But, the more that initial growth is eaten up by charges, the less is left to grow. And whilst the financial services industry loves to talk about the compounding of investment returns over the years, you rarely hear providers talking about the compounding impact of charges – and they can be significant.”

Percentage fees versus fixed fees

Percentage platform fees mean that as the value of an investment pot rises, so does the charge (and vice versa if the pot size decreases). A flat fee means that platform costs are fixed, meaning that as your assets grow, the slice taken from your platform provider stays the same.

For those with larger pot sizes, the flat fee structure can be very cost effective, whereas for those with smaller pot sizes, and for those just starting out, a percentage fee may be more cost effective – in the near term at least.

Source: Opinium Research surveyed 2,004 UK adults between 17 and 21 January 2020.

** The average amount held in a stocks and shares ISA is £55,612, according to HMRC, which informed the starting point:

- Not everyone tops up their ISA but, where they do, the average amount is £10,124 pa (HMRC).

- Again, not everyone changes their investment choices after setting up an ISA, but many do with seven trades each year (either buying or selling an investment) a fair benchmark.

- All scenarios use interactive investor’s Investor price plan (£9.99 per month) with 12 free trades each year (one a month)

- Annual growth of 5% is assumed (but in reality, it is far from guaranteed).

- Assumes 100% investment in funds in the Investor price plan.

- Costs calculated over a 10-year period

- Contributions assumed to be wholly invested on the first day of the month, with additional funds used to cover costs, this is represented by the net investment value after the end of the period

- Trades were assumed to be conducted on the first day of the month

- Costs for percentage-based platform fees calculated on the value of the portfolio at the end of the previous month, after returns have been applied

- Costs not to include any initial set-up fees or temporary offers, such as a lower charge in an initial period of being a customer or discounts because of transfers

- Where yearly/quarterly maximum fees existed, i.e. for holding shares – if the charge per year/quarter exceeds the yearly/quarterly maximum fee, then the maximum fee to be spread out across the year and applied monthly.

- The research does not consider inflation.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.