What ‘higher for longer’ means for your portfolio

Interest rates pose a big threat to the economy, financial system, and markets. So let’s look at what it means to have ‘higher for longer’ interest rates and see what you can do about it.

6th October 2023 13:57

by Stéphane Renevier from Finimize

Interest rates have been rising, and they’ve been rising fast. Now near levels not seen since before the global financial crisis, they’ve started to put pressure on bonds, stocks, and commodities.

The longer they remain high, the bigger the threats to the economy, financial system, and markets.

So it’s a good time to make sure your portfolio is diversified and boasts an ample buffer of cash.

Interest rates shot quickly to their current heights and they’re not likely to fall nearly as fast. Now hanging around levels not seen since before the global financial crisis, they pose a big threat to the economy, financial system, and markets. So let’s look at what it means to have “higher-for-longer” interest rates and see what you can do about it…

What’s going on here?

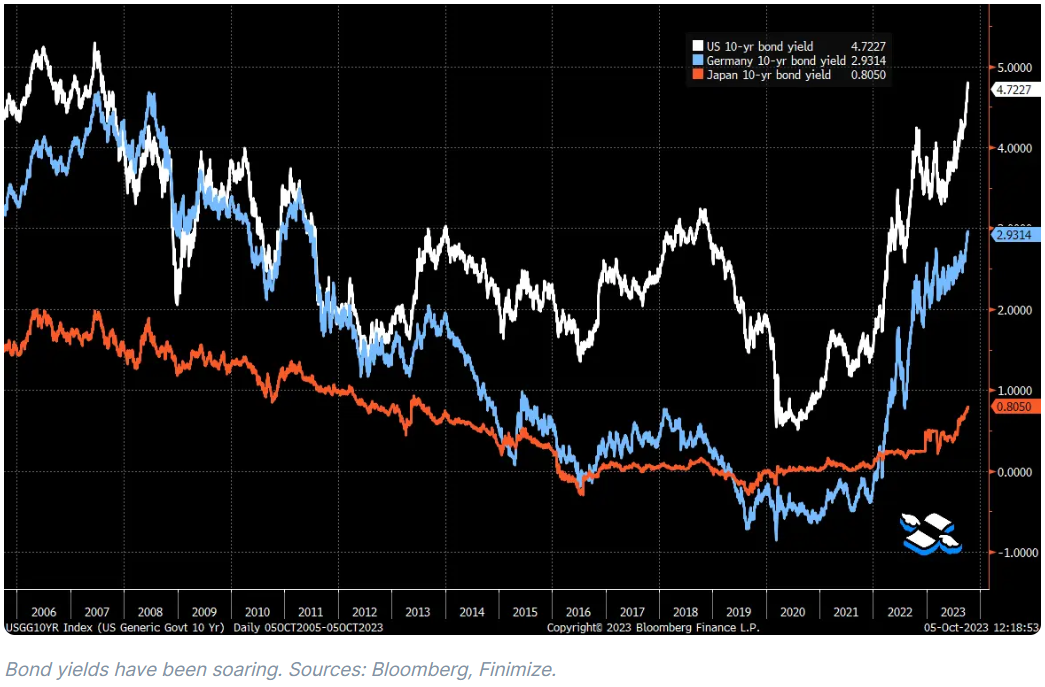

Global interest rates have been feeling some heat. A resilient US economy, stubborn inflation, higher oil prices, and strong words from the Federal Reserve (the Fed) have all shoved interest rates to worryingly lofty levels around the globe. The US 10-year yield is partying like it's 2007, having bubbled up to 4.8%. Germany’s a blast from 2011’s past at 3%. And Japan is, well, it’s still rolling up at less than 1%, but it’s high for Japan.

The rise in longer-term rates has been even more brutal, with the US 30-year yield hitting 5% for the first time since 2007. And while the curve remains inverted – meaning shorter-term rates are higher than longer-term ones – it’s been aggressively “bear steepening” lately, meaning that long-term rates have been rising a lot faster than short-term ones.

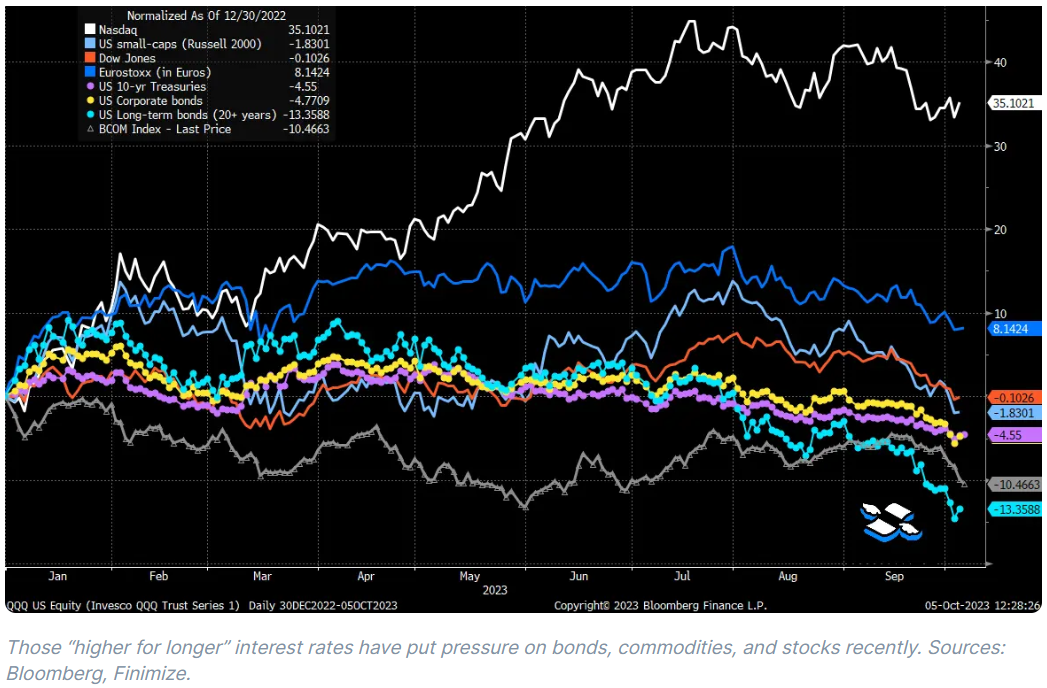

This has put all asset classes under pressure: the S&P 500 and Nasdaq are down 8% and 10%, respectively, from their previous highs. And volatility has rocketed higher. Small-cap stocks and the Dow Jones Industrial Average are now negative for the year. European stocks have given up most of their gains for the year. But it’s bonds that are really feeling the blues: 10-year Treasuries are down 4.5%, 30-year ones are down 13%, and investment-grade corporate bonds are down 4.5%. Those are big moves for such a “safe” asset class.

What’s this mean for the big picture?

Investors had their bets on the Fed nailing the perfect "soft-landing": that is, wrangling inflation into submission without crashing the whole economy into the ground. If it could manage that impossibly difficult balancing act, it'd signal a steadier path ahead for interest rates and give a bullish thumbs-up to stocks.

They’re not feeling so sure about that bet now.

On one hand, investors are waking up to the possibility that interest rates and inflation might stay higher for longer. And it's not just because of the resilient economy: hefty government borrowing is inundating the market with Treasury bonds, and concerns about the US political and economic climate are curbing demand. Toss in the potential need for further central bank hikes to combat persistent inflation and the fact that foreign entities are already pretty loaded up on Treasuries, and there's a solid case for interest rates staying elevated for quite a while.

On the other hand, investors are giving the soft-landing story a sceptical second look. The worry here is that the longer interest rates remain lofty, the greater the risk of an economic or financial hiccup. While the Fed's goal is to rein in the economy enough to curtail persistent inflation, the repercussions of such aggressive interest rate hikes can be erratic and take time to manifest, complicating predictions about the eventual impact.

And while some point at climbing yields – and especially a bear steepening of the yield curve – as evidence of a thriving economy, the actual picture may not be as optimistic. Stocks' buoyant valuations and investor hopes for a robust earnings recovery have been anchored in anticipated Fed shifts. Extended periods of high rates could jeopardize these, as they diminish the current worth of future earnings and ramp up borrowing costs, squeezing profit margins. And just to sprinkle in some history – when a bear steepening coincides with an inverted yield curve, it's typically been a red flag.

So, there’s reason to be cautious. Sure, the overall economy and, notably, the job market have held their ground impressively. But beneath the surface, there are some unsettling trends: key leading indicators have generally lagged, consumer confidence has faltered, and financing conditions for businesses have deteriorated. As for the financial cushion that many consumers built up during the Covid era, that’s nearly gone. Add rising interest payments, heftier prices at the pump and the checkout, and steeper housing prices – and it's no wonder consumers are feeling the pinch. And given that their spending fuels roughly 70% of the US economy, that's a big deal.

What’s it mean for your portfolio?

It’s not a foregone conclusion that we're headed for a deep recession, or that rates and inflation will stay elevated indefinitely. Still, you’d be wise to brace your portfolio for such outcomes. Remember, investors were optimistic about a soft landing back in 2007, too – just before the start of the global financial crisis.

So right now, it makes sense to play it cool with stocks. Valuations are higher than usual, a low earnings yield compared to bonds suggests there’s little margin of safety, and some rosy earnings expectations mean there’s a low bar for disappointment. Owning stocks in more defensive sectors (like utilities, consumer staples, and healthcare) may be a savvier call at this stage, especially since their valuations aren’t as stretched.

Regrettably, bonds could continue to face challenges too if interest rates do stay higher for longer, which could complicate your quest for diversification. As the past two years have demonstrated, bonds can be just as dicey as stocks when faced with volatility and inflation. However, there's a silver lining here: with interest rates already at elevated levels, bond yields do offer you a cushion via income. And while that may not be enough to compensate for potential defaults on corporate bonds, Treasury bonds could offer some balance if we end up in a “hard landing” situation. And if consumer demand plummets, it could drag inflation down to the Fed’s 2% target, paving the way for the central bank to reduce interest rates. And that could lead to potentially attractive capital gains for bond investors.

Owning commodities – particularly energy, industrial metals, and soft commodities like agriculture – could offer your portfolio some stability even in a nightmare scenario, given their potential to thrive in inflationary times. Just don’t expect them to be immune to a slowdown in growth. As for gold, it does tend to shine in a recession, but be careful: it's also susceptible to the sting of climbing real yields (that is, interest rates minus inflation).

The most attractive asset right now is probably cash. It allows you to pocket an attractive yield, and to do so risk-free. Plus, keeping some dry powder around will also enable you to seize opportunities that will – undoubtedly – present themselves.

Stéphane Renevier is a global markets analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.