What’s the outlook for three industry sectors in the eye of the corona storm?

In his FTSE Sector Watch column, Richard Hunter assesses prospects for different industry sectors.

29th May 2020 11:37

by Richard Hunter from interactive investor

In his FTSE Sector Watch column, Richard Hunter assesses prospects for different industry sectors.

Housebuilders

What has changed?

As the lockdown was announced, the UK housebuilders were quick to defer their dividends, while at the same time inevitably preparing for completion delays and cancellations as well as a slowdown in new sales in the traditionally busy spring and summer house-viewing seasons.

Sales offices were closed, and a debate quickly emerged as to whether non-essential construction workers should be allowed to head to building sites. Meanwhile, companies reported that they would be only undertaking essential works, such as ensuring that partly built homes were safe and secure to avoid putting paid customers in a vulnerable position.

What is the outlook?

There were further warnings to the sector as an economic Purchasing Managers’ Index showed a slide to just 12.9 in April, down from 36 in March and representing a bigger decline than during the global financial crisis. In rather more positive news, some housebuilders subsequently announced that a resumption of work at their construction sites would take effect from mid May.

While there will inevitably be a drag on prospects until some kind of normality is restored in the UK, previous tailwinds could return to benefit the sector in due course. In particular, historically low interest rates, ample mortgage availability and the general housing shortage all playing a part, as well as incentives such as the government’s Help to Buy scheme.

- What does coronavirus mean for your retirement plans?

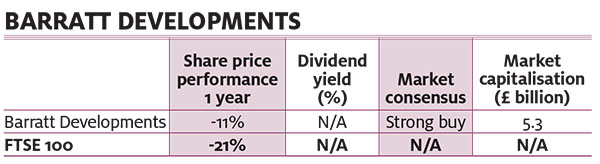

Barratt Developments

Rising house and land prices have helped housebuilders to make significant shareholder returns in recent years. However, while Brexit and Bank of England predictions for house price falls of potentially 30% did not hinder returns, Covid-19 has.

As such, in cancelling the interim dividend, the company pledged to “consider dividends at the time of announcing the full-year results in September, taking into account the position on Covid-19.” Some customer cancellations were suffered, with build completions compared to last year now under severe threat.

But, with interest rates even lower and Covid-19 potentially passing as quickly as it came, prospects for Barratt could improve equally quickly.

Banks

What has changed?

Largely seen as the cause of the global financial crisis of 2007/08, the banks are now being seen as a large part of the solution to the pandemic crisis of 2020. Indeed, many have announced easing measures for customers. Barclays, for example, has approved over 238,000 mortgage and loan payment holidays, with six million customers currently seeing the benefit of no personal overdraft or business banking charges.

The recent first-quarter reporting season for banks in general showed a universal chorus of sharply lower profits, largely due to markedly higher impairment provisions.

What is the outlook?

The impairment figure itself is based on a combination of factors, including the sharp contraction in UK GDP, rise in unemployment and continuance of interest rates at historically low levels which turn the screw further on margins. It also factors in losses on loans, both on the existing book and on new lending.

Even for the numbers showing lending and deposit growth, there is an element of credit lines being drawn down by corporate customers being translated into cash balances, as individual companies look to shore up their own capital and cash flow requirements. In addition, Lloyds for example has been making additional loans through the recently introduced government schemes.

- What would negative interest rates mean for mortgages and savings?

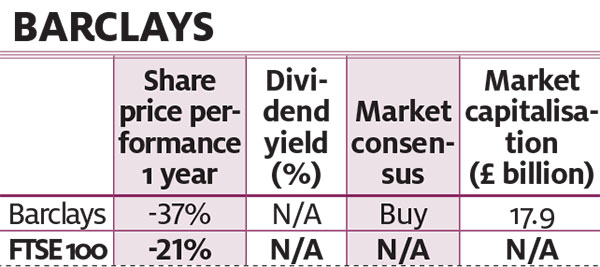

Barclays

Prior to the impact of the outbreak, the bank had started the year well, and its actions since anticipated the issues yet to come. The increase in its credit impairment figure from £450 million to £2.1 billion included £1.2 billion of a directly related coronavirus reserve. Meanwhile, the dividend payment holiday freed up some additional capital, and a rise in group income of 20% allied to stable operating expenses resulted in a much-improved cost/income ratio of 52%.

The strongest challenges are yet to come. Even so, Barclays seems to be in good shape and therefore well-prepared to make its contribution to keeping the wheels of the UK economy oiled.

Oil majors

What has changed?

Demand and supply for oil are strikingly out of kilter. On the one hand, aircraft standing idle, vastly reduced travel and manufacturing shutdowns have all contributed to serious demand destruction. Moves by the oil-exporting countries have thus far failed to resolve the issue of oversupply, to the extent that even storage of physical oil is becoming more difficult. As such, and extraordinarily, a recent oil futures contract price for West Texas Intermediate (WTI) went negative for the first time ever.

At the time of writing, Brent Crude remains down 56% in the year to date.

What is the outlook?

The oil majors have needed to take drastic financial action. BP is aiming to complete $15 billion of divestments, shoring up the capital position, while also aiming to reduce cash costs by $2.5 billion. Capital expenditure is also to be reduced by 25% this year, including the delay of some exploration activities.

One particularly noticeable – and challenging – aim for 2021 is that BP is looking to reset its breakeven level allied to the oil price. In 2019, this stood at $56 per barrel. The company’s target is to reduce this to just $35 per barrel by 2021.

- Oil explainer: the key drivers that cause the oil price to move up and down

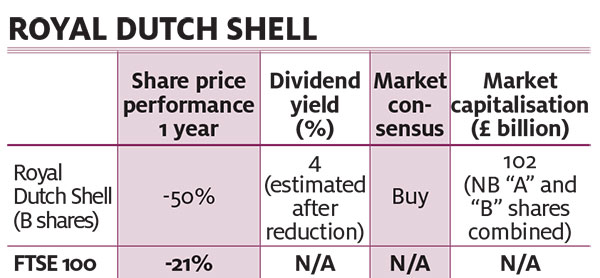

Royal Dutch ShellShell’s historic reduced dividend was a blow to income-seeking investors, but could be seen as positive on two levels. Firstly, the move was financially prudent (and understandable, given a 28% fall in revenues and a 46% drop in replacement profit), with the dividend now at a level the company believes to be sustainable. Secondly, even at the lower level, the implied dividend yield is still likely to exceed the FTSE 100 average.

This rebasing should free up some $9 billion over the next year. At the same time Shell is looking to reduce operational and capital expenditure by a similar amount, while expected divestments will add further leeway, together creating a war chest of nearly $30 billion.

Shell is still profitable and paying a dividend. Some of the sheen may have been lost from the company’s relatively bombproof reputation as a core portfolio constituent, but it remains well-regarded nonetheless.

Share prices/figures above as at 5 May 2020 – sources ProQuote/Digital Look. Richard Hunter is head of markets at interactive investor, Money Observer’s parent company.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.