What's worse than Brexit? Six bigger investment threats

Surveying the global risk landscape, we name six bigger investing threats shrewd investors can't ignore.

12th July 2019 16:39

by David Prosser from interactive investor

Surveying the global risk landscape, we name six bigger investing threats shrewd investors can't ignore.

Politics is a parochial pursuit – on both sides of the argument. It's easy enough to characterise those overcome by Brexit fervour as narrow-minded and insular: their desire for a more extreme form of departure from the EU than any referendum campaigner ever envisaged speaks for itself.

Yet those who describe the potential for a no-deal Brexit as the most serious threat in our time to the UK's economic prosperity are just as blinkered in their own way: there are any number of scarier risks that presage more substantial damage.

Certainly, there is much to be fearful about in the event of the UK crashing out of the EU. The Bank of England's forecasts of a worst-case no-deal impact of a 5% contraction of the economy within a year, or a 3% dip if disruption can be managed, should not be shrugged off. Nor should the Bank's expectation that the UK economy will be 8% smaller by 2035 than if no-deal is averted.

Misplaced fears and hyperbole

Yet the Bank's prediction of recession if the UK voted to leave in June 2016 was simply wrong. This is not to say Brexiteers are right to accuse Bank of England governor Mark Carney of being the boy who cried wolf. My point is rather that there are two good reasons why a no-deal Brexit should not be what is keeping us awake at night.

First, despite the hyperbole of the Conservative Party leadership fight, the parliamentary arithmetic remains an implacable barrier to no-deal: MPs will just not allow it to happen. Second, even if the European Union were to refuse to grant the UK an extension to Article 50, or a second referendum resulted in public backing for no-deal, there are still more terrifying monsters to contemplate.

Those monsters can be divided into a couple of different tribes. It is right to worry about the impact of sudden shocks to the system, expected or otherwise: add, for example, an explosion of political populism, a natural disaster or an outbreak of war to the list of possibilities on which Brexit also sits. Equally, however, there lurks a series of structural issues with the potential to cause so much damage that we should not overlook them despite their insidious nature.

In the latter category, the UK's abysmal performance on productivity is the biggest worry of all. Over the three decades before the global financial crisis, productivity growth averaged 2.3% annually; in other words, the average UK worker in 2007 would have produced twice as much, working the same number of hours, as 30 years previously. Since the crisis, productivity has flatlined, growing at just 0.4% a year; the average worker today produces only 1% more than in 2007.

There are competing explanations for this reversal, but one very likely factor has been the collapse in business investment seen since the crisis. Investment remains depressed amid the Brexit uncertainty, torpedoing hopes that emerging technologies such as robotics and artificial intelligence could rescue productivity in years to come.

That should really worry us. Research from the economics team at KPMG suggests that a return to historic levels of productivity would produce an economic gain large enough to more than compensate for the downside loss from a potential no-deal Brexit (note too that it does not expect no deal to tip the UK into recession).

Skills gap headache

The UK's yawning skills gap is another structural issue with the potential to fundamentally undermine the ability of the economy to grow. Put bluntly, the UK is not educating and training enough people in the right ways to ensure it has a workforce capable of competing in today's global economy, let alone the marketplace of the future.

If that sounds like one of those softer issues to be dealt with over time – and policymakers have certainly kicked the can down the road – look at the data. The Learning and Work Institute puts the cost to the UK economy of failing to hit even basic targets for improvements in literacy, numeracy and educational achievement at £20 billion a year by 2030. That's ahead of many estimates of the cost of Brexit.

Which other structural concerns should cause us sleepless nights? Consider the UK's outsized trade deficit compared to its competitors, its outlier status on income and wealth inequality and its systemic underfunding of public services and infrastructure. Each of these is eating away at our economic foundations.

Then there is the country's over-reliance on its financial services sector, which has already cost the economy dearly. The Institute of Fiscal Services calculates the UK is 14% worse off than it would have been had it continued on its pre-2008 path of growth without the financial crisis. That's significantly more than other, less-exposed economies have suffered – and well ahead of even the worst-case estimates of Brexit-related loss.

In which case, we should worry more about the risk of another financial crisis – courtesy of Chinese indebtedness, perhaps, or the shadow banking world? – rather than the impact of Brexit. That brings us neatly to the second gang of monsters that should scare us even sillier than Brexit.

Do not underestimate the likelihood of a major shock that sends the UK economy into freefall. The academic Nassim Taleib argued in 2009 that supposedly rare "black swan" events are becoming more frequent. He blamed the dynamic instability of the world economy in a time of global connectedness, excessive complexity and unprecedented leverage – all of which are more acute today than a decade ago.

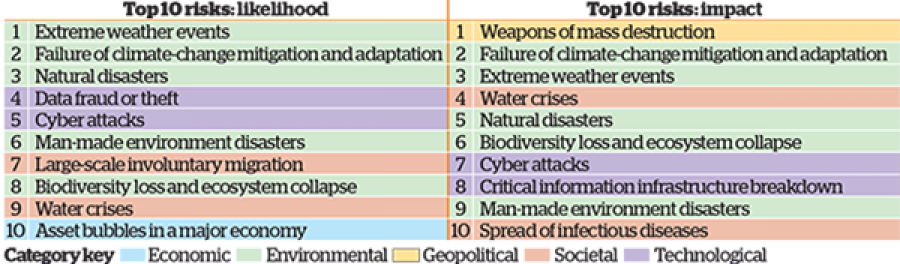

The World Economic Forum's latest assessment of the global risk landscape underlines the breadth of shocks that now have the potential to assail all economies, the UK's included (see table below).

The global risks landscape 2019

Source: World Economic Forum Global Risks Perception Survey 2018/19.

Two things in particular are striking about the WEF's analysis. First, the conventional financial risks that have traditionally worried economists, including those of the WEF itself, do not figure prominently.

While the WEF once worried about asset price collapses, oil price volatility, fiscal crises and systemic financial failures, its biggest worries today include climate change, extreme weather events and the use of weapons of mass destruction.

Second, the correlation between the risks the WEF believes would be most serious were they to come to pass and those which it judges most likely is frightening.

Threats beyond the economy

The broader picture here is that the biggest threats to any economy, including the UK's, have fundamentally changed in nature. Financial dislocation naturally concerns investors – but crises spawned by geopolitical failures are now both more likely and more worrying.

The most obvious example is the increasing likelihood that the world's response to human-made climate change will fall short, now that the US has withdrawn from the Paris agreement. Analysis on climate change risk in the Carbon Disclosure Project, based on submissions from 215 of the world's 500 largest companies, suggests these businesses are anticipating £800 billion of extra costs if tough targets on arresting the crisis are not met – including £250 billion worth of complete asset write-offs.

A major international conflict could be even more costly. Leaving US v China aside, research by the Federation of American Scientists estimates the cost to the global economy of full-blown conflict between the US and Iran at $1.8 trillion (£1.3 trillion) in the first three months of such a war alone.

These, then, are the risks to the UK economy that should be the stuff of our darkest nightmares. And while it may feel callous to talk about the economic impacts of genuine human tragedies such as war and climate catastrophe – or even the failure to properly educate citizens – these impacts will be very real.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.