Which supermarket and retail shares should be on your shopping list?

In his FTSE Sector Watch column, Richard Hunter examines the prospects for supermarkets, which have bro…

23rd July 2020 12:31

by Richard Hunter from interactive investor

In his FTSE Sector Watch column, Richard Hunter examines the prospects for supermarkets, which have broadly prospered through the pandemic, and retailers, which haven’t.

Supermarkets

What has changed?

The pandemic has not been a guaranteed slam-dunk for the supermarkets as many assumed it would be. However, managed correctly, the ‘benefits’ of the pandemic can be significant, as some of the supermarkets have demonstrated.

For example, changes in consumer behaviour have been of particular benefit to Sainsbury’s in regard to online sales, where the group has a strong and established presence. In the supermarket’s latest quarterly report, grocery sales online surged by 87%, with the click-and-collect service enjoying a 13-fold increase.

At the same time, Argos, which became an online-only retailer for the period, continued to prosper. An increase in sales of 10.7% was driven by demand for garden goods, PCs, gaming and home office furniture, among other products. Orders were also fulfilled by its click-and-collect presence, either in stores where there is an Argos outlet or at collection points in Sainsbury’s stores. Meanwhile, home delivery sales increased by 78%.

The fact that the supermarkets have long been more than just grocers has been of great benefit to them.

What is the outlook?

If the pandemic marks a sustained change in consumer behaviour, those supermarkets with well-honed digital capabilities could fare well. Even within stores, Sainsbury’s’ ‘smart shop’ self-service option, for example, is beginning to contribute a significant proportion of purchases made. In addition, the possibility that shoppers might lean more towards the click-and-collect option in future could play directly into supermarkets’ hands in a way few general retailers could emulate.

Stores with a convenience store operation have also been trading well in the pandemic. Despite deserted city centres weighing them down, strong sales in neighbourhood locations have picked up much of the slack.

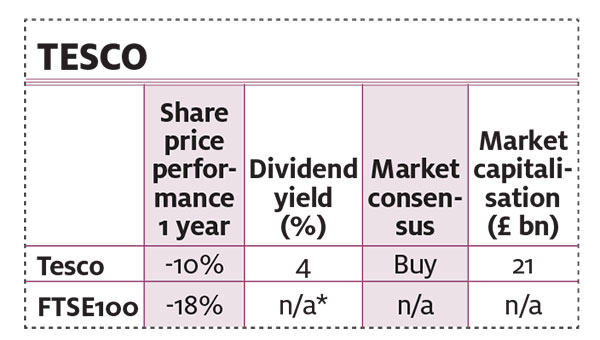

Tesco’s full-year results in April mentioned a 30% uplift in sales amid panic buying. An update at the end of June made a more measured assessment, with like-for-like sales showing an increase of 8%, proof that Tesco is maintaining its dominant position. Within this quarterly number, online sales rose by 48% (and 90% in May) as the group was galvanised into action, increasing its capacity to 1.3 million orders a week, compared with 600,000 previously, at a minimal cost of £4 million. As a result, sales totalling £2 billion are projected for this channel over the full year.

What’s more, Tesco has not been resting on its laurels strategically. Its acquisition of Booker increasingly appears to have been an astute move, the tie-up with Carrefour will provide further firepower and the disposal of Tesco’s Asian unit, when agreed, should add a further £8 billion to the coffers. Tesco has decided that its Polish unit is surplus to requirements. Its sale is progressing and is expected to raise some £180 million.

It has not all been plain sailing, however. Tesco’s latest estimate of incremental costs, due to the additional financial strain of distribution, the employment of 47,000 extra staff and the payment of sick pay to a significant number of staff, is £840 million. This remains within the company’s earlier guidance of between £650 million and £925 million, putting into sharp focus the fact that additional sales plus business rates relief of around £530 million are not one-way traffic.

That said, the company remains the preferred play in the supermarket sector, with the market consensus making Tesco shares a firm buy.

Retailers

What has changed?

For some retailers, measures have been taken to mitigate the effects of the substantial stock ‘bulge’ they have been carrying – spring and summer ranges have been particularly affected. But a combination of write-downs, the hibernation of stock for future sale (albeit at significantly lower prices) and a reduction in future purchasing commitments should all help cushion the blow.

City centre stores and shopping centre outlets are still suffering a severe lack of footfall, especially at weekends. This has been partly offset where retailers have an out-of-town presence in retail parks, where consumers are browsing less and more likely to buy items immediately.

The pandemic has provided proof, if it were needed, of the vital importance of an online offering.

What is the outlook?

For some retailers, such as Marks & Spencer, the pandemic may unwittingly have provided the catalyst needed for them to overhaul their slumbering businesses.

At M&S, the direct impact of the pandemic may have been felt mostly in its stores and largely, therefore, on its clothing and home lines. But the crisis has also galvanised the company into a rethink of its entire business as it scythes through layers of unnecessary processes and costs in anticipation of the way consumers may shop when the current economic shock eases.

Such rethinks will prove pivotal in the near future as retailers in general ponder how the mix of physical and online shopping will evolve, and the implications that could have on companies with significant store portfolios.

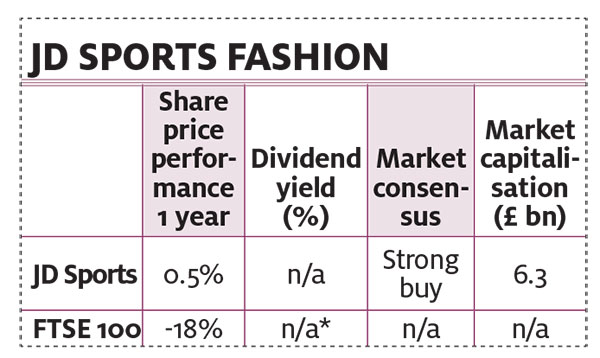

JD Sports’ meteoric rise may have come to a grinding halt as a result of the pandemic, but it remains an attractive proposition. Full-year numbers in July showed that the company had been on something of a winning streak, with its international aspirations rising and its revenues up 30% over the period.

Historically, UK retailers have a poor track record in trying to crack the US market. However, there are encouraging signs that JD Sports might succeed in the US, where its Finish Line business has reported an operating profit of £98 million on increased store and online sales of 9%. The US, which now accounts for 26% of group revenues (UK 42%, Europe 26%), is becoming an increasingly important market for the group, and further expansion is planned.

That said, these results cover the period to 1 February and therefore shed little light on the firm’s current situation. JD Sports referenced pandemic ramifications throughout the release without attributing any numbers to the financial impact, save that it is likely to be material. At the same time, the situation regarding the purchase of rival Footasylum continues to occupy management, with JD Sports likely to appeal for a judicial review of the currently prohibited merger.

The company has, however, been able to continue trading throughout the pandemic because of its strong online offering. If JD Sports can regain the pace and scope of its previous expansion, the market consensus on the shares as a strong buy could well be maintained.

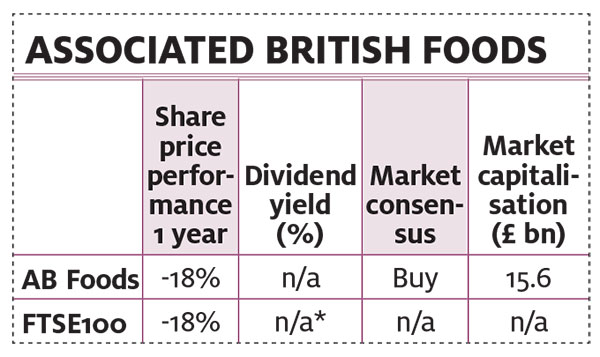

A trading update in early July revealed that AB Foods was greatly relieved to have its ‘jewel in the crown’ restored, with the early signs being that Primark was picking up largely where it left off.

Primark delivers two-thirds of group operating profit. The group had previously advised that the closure of the entirety of its store estate would lead to lost revenues of £650 million a month, and that cost mitigation measures had reduced cash outflow to £100 million a month. The reopening of stores in the UK on 15 June meant that 90% of the store estate was back up and running, and the group described initial trading as “reassuring and encouraging”.

Overall, however, the pandemic has left a financial stain that cannot be erased from this year’s trading. Primark’s revenues in the third quarter declined by 75% and by 27% on a cumulative basis, with a decline of 39% and 13% respectively at group level. Primark’s adjusted operating profit for the year as a whole is now expected to be in the region of £300-£350 million, compared with £913 million in the previous year.

There is a question mark over whether the initial euphoria of renewed retail therapy will continue amid a period of economic recession and a potentially slow recovery.

- Share prices/figures above as at 15 July 2020. *FTSE 100 yield is not currently reliable because of continuing dividend cuts among constituents. Sources: ProQuote/Digital Look.

Richard Hunter is head of markets at interactive investor.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.