Which way will 'unstable' crypto markets move next?

19th January 2018 17:42

by Gary McFarlane from interactive investor

Bitcoin is holding above $10,000 for now, currently trading at $11,920, according to coinmarketcap, up from as low as $9,400 Tuesday, around 50% below its all-time high near $20,000. Buyers who borrowed funds to buy the cryptocurrency at its peak at the end of last year will be hurting.

The pain is not over just yet, either, given that it was only three months ago that bitcoin was trading in the $5,000s, and the recovery now in play has not been particularly vigorous. Having said that, bitcoin has seen five corrections of over 70% since 2010.

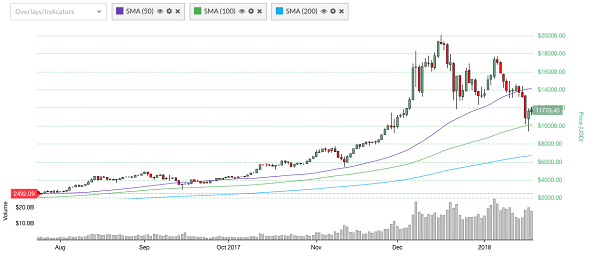

Chartists point to the 100-day moving average (green band in the chart below) as the key level of support (currently $10,000), which we identified in our last report.

The relatively unsophisticated and immature nature of the market probably means crypto-watchers should take note of how that level coincides with moves into four-figures, which would be a psychologically significant marker to trigger both profit-taking and, if there's a return to October's prices ($5,000), or heralding an infusion of a fresh tranche of buyers.

(Chart source: bitscreener.com)

The market is decidedly unstable at this juncture and is unlikely to remain at current levels for long, either pushing on to test the 50-day average at $14,500 (purple band) or declining to the $7,000 to $5,000 range at the 200-day simple moving average (blue band).

Forced sellers are likely appearing above $10,000 given first anecdotal reports of investors borrowing money to buy bitcoin first emerged in December, just as the price broke through $10,000 and trading volumes mushroomed.

Other top-tier coins have retraced, but remain far off their record highs. Ripple is up 10% today at $1.7, neo is struggling to get back above $150 and ethereum has managed to trade above $1,000.

The Financial Times reported this week that its enquires showed that 16 banks its reporter spoke to who were testing ripple technology, were not using its XRP token. That underlines the extent to which buyers of XRP are trading on hope rather than fact at the moment, and recent volatility will not have endeared banks to using the token.

The weakness of bitcoin's dead-cat bounce from below $10k means, all other things being equal, there may be further testing of the $10,000 floor that the price is currently attempting to consolidate above.

However, it is unlikely all things will remain equal for long in these fast-moving markets.

On the regulatory front, South Korea's Financial Supervisory Service is investigating reports of insider-dealing by its staff, who are alleged to have sold crypto holdings before the first news emerged of proposals - later denied in some quarters - to ban cryptocurrency trading.

The chief of the office of the prime minister, Hong Nam-ki, said: "We have confirmed that some public officials have done such an act."

In an indication of the rapid growth of crypto trading in the country, information obtained by regulators shows that six banks saw the value of the commissions they earn on crypto accounts rise 36 times, to $2.1 million.

The regulatory chill in South Korea is not slowing the pace of cryptocurrency exchange openings either. Ten are expected to open for business in the first half of 2018, according to a report on news site Business Korea. Two companies listed on the Kosdaq stock exchange are said to be among that number. Bithumb, Upbit, Korbit and Coinone are the big four exchanges in South Korea, but there are many other smaller operations.

There's a déjà vu feel about the market's reaction to plans to tighten regulations. Last year's rolling clampdown by the Chinese authorities led to selling, as did the US Securities and Exchange Commission's ruling that ICO tokens may indeed be securities.

However, it was later followed by an acceleration of bitcoin buying as market participants, following the initial knee-jerk reaction, came to interpret more regulation as a positive development.

In other crackdown news, it has emerged this week that an investigation is underway at the behest of regulatory authorities in Indonesia concerning bitcoin usage by some merchants as a means of payment on the island of Bali. That's in contravention of the country's central bank, Bank Indonesia, banning such activity on 7 December last year.

Ultimately, stricter regulation and oversight of crypto markets should be a good thing, as it makes investing less Wild West and more attractive for mainstream investors, although the volatility of the markets will keep many away. Outright bans on trading crypto would be another matter, but those fears do seem overdone until the details of plans are announced.

But the commercial imperative behind bitcoin means that even when regulators show their displeasure, there are still those willing to venture into the markets. For example, the Indian government and central bank are hostile to cryptocurrencies, having issued many notices warning citizens against trading or investing in them.

Nevertheless, an Indonesian blockchain project Pondi X, planning to open cryptocurrency ATMs across Asia, Africa and Latin America, estimates that India accounts for 10% of global trading volumes.

Also, regulators face not inconsiderable problem of how to prevent traders and businesses from conducting their affairs at locales that are crypto-friendly, of which there are many, including Japan where bitcoin is legal tender and there are 11 exchanges licensed by the government. Japan's BitFlyer exchange, for example, is one of many that accepts accounts from non-Japanese customers and crypto holdings there can be converted into US dollars.

Elsewhere, recent market turmoil notwithstanding, Intercontinental Exchange has teamed up with blockchain startup Blockstream to launch a data feed to run on its high-speed networks to supply traders, banks and asset managers with timely and high-quality information from crypto markets. The data feed with take prices from 15 different crypto exchanges.

Additionally, credit rating agency Weiss, which describes itself as the US's leading independent rating agency for financial institutions, announced that it would start grading cryptocurrencies. Its list includes bitcoin, ethereum, ripple, bitcoin cash, cardano, NEM, litecoin, stellar, EOS, IOTA, dash, NEO, monero and bitcoin gold. The Weiss Cryptocurrency Ratings will be released on 24 January.

Weiss Rating founder Martin Weiss said of the launch: "Many cryptocurrencies are murky, overhyped and vulnerable to crashes. The market desperately needs the clarity that only robust, impartial ratings can provide."

In other news, the first CBOE bitcoin futures expired on Wednesday with bears the winners. CBOE chief executive Ed Tilly said there was a "smooth operational close and the settlement process worked as designed", despite the fears of some that the cash-settled instruments may have been open to manipulation by day-traders.

In spite of the market volatility, investors' appetite for initial coin offerings (ICO), used by blockchain projects to raise funds, shows no signs of abating.

One such ICO capturing attention lately, with its public sale beginning in February, comes from CEEK, based in Miami, which is building a platform that incorporates virtual reality (VR) to hook fans up with sold-out music events and also allows the artists themselves to create their own tokens for transactions.

The company has a partnership with Universal Music Group that has granted it rights to music events from acts such as Lady Gaga, Elton John, U2 and The Killers, and its VR headset is already on sale at Amazon and elsewhere.

Another ICO, this time from UK-based BABB will let anyone from anywhere in the world open a UK bank account. The startup claims that setting up the account is as simple as taking a selfie and speaking a passphrase. BABB's global marketplace provides users with the possibility of offering banking services such as exchange rates to other network users, in addition to sending money instantly at almost no charge using the BAX token, according to the project's whitepaper.

The project's presale has sold out, so presumably its investors are not worried by the hostility of the UK banking sector towards crypto businesses which have been barred from accounts in many cases. BABB is taking registrations for its public token sale now.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.