Whitbread gets lucky with Coke bid for Costa

31st August 2018 12:33

by Lee Wild from interactive investor

Faced with a time-consuming and complex demerger of its Costa business, this big-money offer from Coca-Cola is great news for Whitbread, writes Lee Wild.

There was great excitement around Whitbread four months ago when it finally confirmed plans to demerge its Costa coffee chain. Market optimism was short lived, and the shares had done little since that initial spurt, but a shock £3.9 billion cash offer from Coca-Cola Co is massive for Whitbread.

A valuation multiple of 16.4 times Costa's cash profit for 2018 is certainly "highly compelling", far exceeding the 11.5 times 2019 forecasts and £2.7 billion valuation slapped on the business by analysts at UBS. It’s also way above rival Starbucks on 13 times 2018 estimates.

"We do not think under a demerger situation Costa would have traded near the takeout multiple (given recent trends in the UK) that has been announced and believe that the market will take the announcement in a positive manner," wrote UBS's Jarrod Castle.

It did. As Whitbread points out, this premium bid was not reflected in Whitbread's market value. It is now, as traders moved quickly to factor in the generous offer for Costa, bought by Whitbread for just £19 million in 1995.

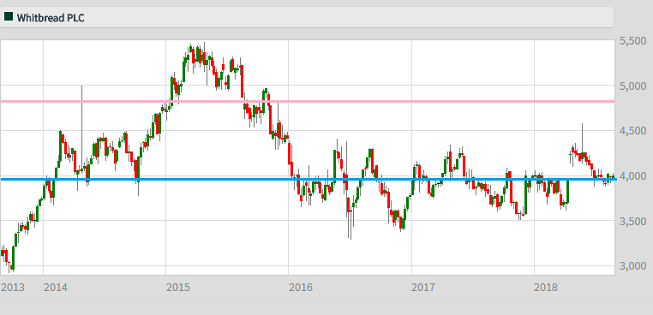

Whitbread shares were up almost 20% at one stage Friday morning to prices not seen since 2015, propelled higher also by news that shareholders would likely receive a "significant majority" of the £3.8 billion of net cash proceeds.

The deal will go through some time in the first half of 2019, which leaves shareholders, including activist hedge fund Elliott Advisors, to decide whether to keep hold of the shares or bank considerable profits.

Source: interactive investor Past performance is not a guide to future performance

First-quarter results published in June showed a 0.3% like-for-like decline in UK accommodation, or 0.9% if you include food and drink sales. Whitbread blamed a weaker London market and strong comparisons versus the previous year. However, include new rooms opened and accommodation revenue grew by 4.3%, and we heard that forward bookings had improved.

UBS, which has had no love for Whitbread shares previously, has price target of £43 and implied enterprise value (EV) of £49 - Costa £15, Premier Inn £36 and central -£2 billion. Implied EV of Costa at the sale price is £20.75.

Over at Barclays, the analyst "mechanically value Costa at £ 3.9 billion and keep [their] 10x EBTIDA multiple assumption for Premier Inn [which] implies a fair value of 5,035p".

"In our Blue Sky scenario if we value Costa at £3.9 billion and then value Hotels and Restaurants on a yield of 4.5%, the remaining leased hotels on 8.5x FY18e EV/EBITDA, and the remaining leased restaurants on 6.5x EV/EBITDA our fair value would be c. 5,900p."

A simplified structure will help the remaining business, which will include 75,000 rooms in almost 800 Premier Inns hotels across the UK, Germany and Middle East. There's also a small chain of London-based healthy-eating quick service restaurants.

Premier has done well in recent years and believes there is still plenty to go for, predicting an increase in market share from 9% in 2016 to over 12% in a couple of years' time. It's already committed to opening up over 20,000 extra rooms through further growth in the UK and expansion in the much larger German market.

Ahead of an update on strategy at a capital markets day early next year, shareholders sitting on fat profits may be tempted to put that money to work elsewhere.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.