Why did bitcoin just crash?

interactive investor's award-winning crypto analyst explains what's behind the latest market sell-off.

27th September 2019 16:52

by Gary McFarlane from interactive investor

interactive investor's award-winning crypto analyst explains what's behind the latest market sell-off.

Bitcoin has confirmed the fears of bulls and the hopes of shorting bears, with the price collapsing briefly below $8,000 this week to a three-month low.

The top digital currency is currently trading at $8,150, but yesterday saw an intraday print of $7,712 on the Coinbase exchange.

Theories abound as to why now for the drop, with the most obvious explanation sitting in plain sight – the growing weariness of bulls at repeated failures of attempts to hold above $11,000.

The charts don't lie and the descending triangle tells the tale of weakening price support.

And this weakening was taking place against a background of thinning trading volumes, enabling relatively small trades to have an outsized influence on the overall market.

Not so obvious, however, is the reason behind the timing of this particular reversal.

As previously observed in past reports, the possibility of a drop into the $8,000s was always on the cards if support at $10,000 gave way.

(BTC/USD 1-day candles chart, Coinbase. Courtesy TradingView)

Could the bitcoin selling worsen going into the weekend?

Market watchers are divided, with some predicting a fall below $6,000.

Peter Brandt, an influencer with an army of Twitter followers and many years’ experience as a commodities trader and chartist, warned bulls last weekend that a drop was coming.

“One thing I have learned from 45 years of trading: Markets have a tendency to do what the most number of market participants least expect and don't want to happen,” commented Brandt.

Brandt identifies a head and shoulders pattern to predict the bearish reversal, as seen in his chart below:

He thinks the price is in danger of revisiting $5,725.

That’s something of a turnaround from previous estimations when bitcoin was breaking new 2019 highs when it began its parabolic run-up in June.

Bakkt bitcoin futures and Bitfinex liquidations to blame

Other commentators have been pointing to a variety of explanations for the fall: the supposed cooling of the trade war, the travails of Facebook's Libra, the displacement impact of US equity markets again touching all-time highs and an easing in the tempo of the Hong Kong rebellion and yuan/$ devaluation.

All of the above may have had some influence on sentiment and certainly underscores the challenge to the notion of bitcoin as a faithful store of value or more radical still, a safe-haven asset.

Leaving the technicals to one side and the macro, a couple of culprits have been identified –the launch Bakkt bitcoin futures on 23 September and the goings on at major crypto non-regulated derivatives venues Bitfinex.

There was something of the déja vu about the recent setback, as it comes at the same time as the much-anticipated launch of trading in Bakkt bitcoin futures.

It's been a slow start. Only 72 contracts were traded on the first day, which is essentially a statistically insignificant amount by value.

Each Bakkt contract is one bitcoin in size. Compare that to the launch of the Chicago Mercantile Exchange’s bitcoin futures in December 2017 in which more than 5,000 contracts were traded. CME contract size is five bitcoins.

Institutions were expected to pile into the market but that has happened, or not yet.

However, to have expected a flood at the outset was probably unrealistic in the first place.

Market participants will be aware of how the launch of bitcoin futures by the CME (and the CBOE a week earlier) coincided with the end of the bull market, so are we seeing history repeat itself?

Probably not. The market has to some extent matured qualitatively since then, with much better onboarding options for institutions, with Baakt perhaps one of the most impressive offerings with its institutional grade custody service, the futures product and plans to drive retail adoption.

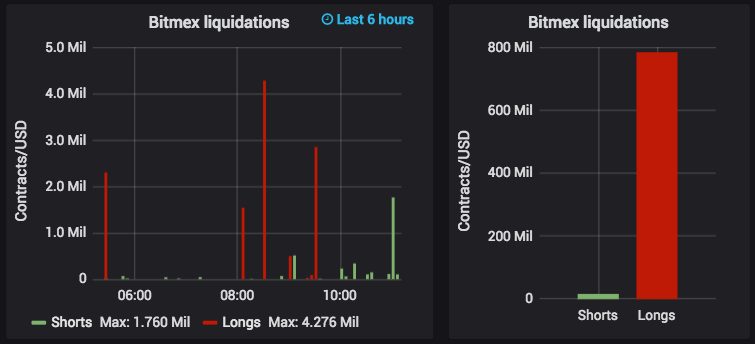

The trigger for the meltdown may have been the liquidation of hundreds of millions of dollars’ worth of long positions on Bitfinex.

The exchange allows customers to trade on leverage and gave the green light to 100x leverage on 3 September.

(Source: datamish)

Next bitcoin rally requires S&P 500 to rally too says Wall Street analyst

But the violent selling of the past few days, with bitcoin haemorrhaging $1,000 in the space of 30 minutes a couple of days ago, suggests that the level of institutional involvement may have been exaggerated.

Certainly, that's the view of Thomas Lee at Wall Street analyst firm Fundstrat.

He thinks bitcoin is still very much a retail story and predicts it will not tap new highs until the S&P 500 breaks to the upside.

Lee remains bullish on both equities and bitcoin, despite talk of a looming recession and signs of stress in the financial system in the US with the repo market seeing worrying behaviour last week with interest rates at one stage spiking to 10%, way above the Fed Fund Rate range (1.75-2.00%).

Lee tweeted:

"The downturn in #bitcoin followed the risk-off selloff in #equities.

- reinforces our ‘unpopular’ opinion bitcoin does not do well in a 'trendless macro' environment.

- New highs needed in S&P 500 before $BTC can blast off.

Why? We think crypto is retail and thus, risk on"

Repo blues and "anti-fragile" bitcoin

The repo market is where banks borrowing overnight to cover any temporary shortfalls from their day to day business activities, and shadow banks (such as hedge funds) put up US Treasuries as collateral in return for cash on the promise of repurchasing the next day.

Another Wall Street veteran, this time Caitlin Long, contrasted bitcoin with the opaque world of the repo markets, with the lurking risks therein in what should theoretically be the safest of markets, given it is dominated by trade in US Treasuries.

She tweeted:

"At a systemic level, the traditional financial system is as fragile as Bitcoin is anti-fragile."

She explained further:

"An anti-fragile system is one that becomes stronger and more resilient as a result of shocks, not weaker. This describes Bitcoin, whose network security grows as the system's processing power."

On that, the network hashrate of bitcoin (a measure of the amount of computing power devoted to verifying transactions) is at an all-time high after a brief wobble a few days ago.

The 'anti-fragile' argument might strike readers as an unlikely analysis of the situation given the price volatility of bitcoin. Many holders of the crypto are feeling somewhat bruised, if not fragile, at this juncture.

She continues, in her article for Forbes, and it is worth quoting at length: "Here I distinguish between price volatility and systemic volatility. Bitcoin’s price is highly volatile, but as a system it is more stable.

"In stark contrast to the traditional financial system, bitcoin is not a debt-based system that periodically experiences bank run-like instability. In this regard, Bitcoin is an insurance policy against financial market instability."

Altcoins bleeding out

Elsewhere in the crypto market there has also been blood on the carpet, with sizeable losses across the piece, despite a teasing rally that petered out prior to the latest bitcoin pull back.

Second-placed coin Ethereum is down 23% on the week, notwithstanding an improving tech upgrade path coming into view. After recapturing $200, ETH is back down to $166 today.

Top 10 coins Bitcoin Cash and Bitcoin SV – both forked from the original bitcoin blockchain – are each 32% lower on the week.

As far as Anthony Pompliano is concerned, the crypto evangelist and founder of Morgan Creek Digital, he's buying the dips.

He went further on CNBC where he argued not only that the bitcoin network was strengthening, but that the US dollar should be immediately tokenised by the US government.

Venezuela to hold bitcoin and Ethereum on central bank balance sheet?

He also picked up on the rumours circulating that the Venzuelan government has a stash of bitcoin and Ethereum it may be about to put onto the central bank balance sheet.

In a tweet he said:

"PREDICTION: Venezuela will eventually admit they created state-sponsored Bitcoin mining facilities. They have cheapest electricity in world, just showed up w/ unaccounted for Bitcoin, & it would be non-censorable revenue source for them. Eventually every country will be miners."

Electroneum mobile top-ups expands to Turkey

In other news from around the industry, UK-based project Electroneum (ETN) has just expanded into Turkey with its mobile top-ups service, following a similar move in Brazil.

A press statement said:

"After continuing to demonstrate there is great global interest for mobile phone top-ups with crypto, Electroneum has enabled tens of thousands of ETN users in Turkey to instantly and easily top-up Turkcell, Vodafone and Turk Telekom airtime and data via the Electroneum mobile app through a third-party provider."

Olivier Acuña head of PR at Electroneum, adds:

"Turkey tops the list of countries with more people using cryptocurrency than any other country worldwide. About 20% of the population told Statista they use or own crypto."

Look out for a forthcoming interactive investor crypto podcast with Richard Ells, chief executive of Electroneum.

Perhaps because of that news, the coin has been one of the better performers this week – the token has only lost 10% of its value this week. The token is 4.7% higher today at $0.004136.

Electroneum's unique selling point is the the ease with which it can be mined on mobile devices.

Smartlands tokenised student accommodation success

The Smartlands platform we reported on earlier this year, which was offering digital securities in Nottingham student accommodation to investors, has successfully reached its target funding of £1 million.

It is now considering tokenising more than 30 other assets, starting with mid-range technology start-ups.

Smartlands chief executive Ilia Obraztsov told interactive investor: "With a proven marketable business case, state-of-the-art legal framework and a sophisticated technology automating full lifecycle of the digital ownership on the blockchain, as well as investments with fiat and crypto, we aim to expand globally and tokenise $1 billion of real economy assets by 2024.

"We have a pipeline of over 30 projects – most lucrative and illiquid asset classes such as private equity, real estate, agriculture SMEs and precious metals."

"We are now open to sell an equity stake in our holding company [Smartlands Holding] and use the raised capital to further develop our global investment and digital banking ecosystem."

Knabu – from self-custody to a clearing bank for crypto firms

Although there are plenty of crypto projects that are struggling, there is still all to play for in terms of which will emerge as real disruptors with revenues and market shares to show for it.

For example, a London-based project called Knabu is doing some interesting work.

interactive investor spoke to Hakim Mamoni, chief technical officer at Knabu and Suren Ravindra, chief product strategy officer, about Knabu's newly launched business-to-business 'smart deposit box' self-custody solution to mitigate the risks associated with storing crypto assets.

Now Knabu (knabu.me) is branching out – it is building a clearing bank aimed at crypto businesses shut out of the banking system because of the lack of regulatory clarity and perceived security risks.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.