Why Dunelm crashed 13% to eight-month low

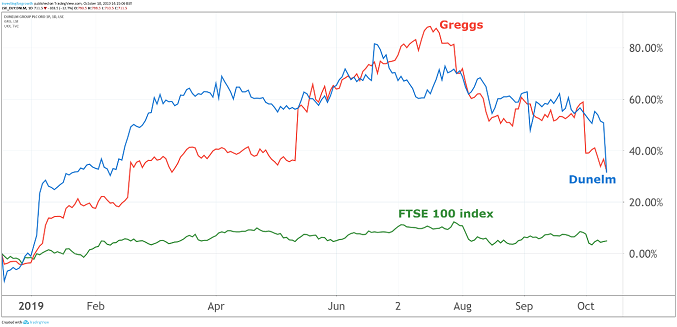

Once one of the UK's star stocks, Dunelm shares are 'doing a Greggs' and heading the wrong way fast.

10th October 2019 15:46

by Graeme Evans from interactive investor

Once one of the UK's star stocks, Dunelm shares are 'doing a Greggs' and heading the wrong way fast.

After a run of profit upgrades, it was perhaps inevitable that the recent stock market success of homewares retailer Dunelm (LSE:DNLM) would hit a bump in the road.

Shares slid 11% today as Dunelm reported mixed trading in September, when the warm weather probably played a part in keeping shoppers away from shops.

But it's a measure of the company's recent progress that first quarter like-for-like sales growth of 6.4% should be met with such disappointment. While the figure had been 15% higher in the previous quarter, Dunelm is now up against increasingly stiff year-on-year comparisons.

The question now for investors is whether the company's strong trading over the summer months will be as good as it gets for the share price. The stock peaked at 980p in June, but is now down 24% to 725p and at its lowest point since February.

Source: TradingView Past performance is not a guide to future performance

The performance at Dunelm is similar to fellow FTSE 250 stock Greggs (LSE:GRG), which was recently punished by the City after failing to maintain its recent run of profit upgrades.

While Dunelm has recently been trading with a forward one year price/earnings multiple of 16.2x, there are good reasons to justify this premium rating over the wider retail sector.

The most significant is its strong record of cash generation, which will tomorrow lead to the payment of a special dividend of 32p a share.

There's also plenty for the company to go for at a trading level, particularly online as it prepares for the launch of a new digital platform in the 2020 financial year. Only 17% of total sales came from Dunelm.com in September's annual results, but this ratio continues to improve after growth of 34.7% in the first quarter. Like-for-like store sales rose 2.9%.

Analysts at Stifel said online revenues were significantly ahead of their expectations, adding that the group looks well-placed ahead of the peak trading season. They said:

"Amid the minefield that is the non-food retail sector, it is a relief to be greeted by Dunelm's consistency."

Given the uncertainties posed by Brexit and the early stage of the financial year, Stifel has left its full-year earnings per share forecasts unchanged: "Our 960p target price reflects the strong generative nature of the group," the broker added.

Other self-help factors boosting the Dunelm performance have included product innovation and greater use of in-store technology, as well as acceleration of sales from click & collect. Its advertising campaign has included slots on ITV's This Morning.

The weather has also been in its favour, with this summer's cold and wet conditions more beneficial for home retailers than last year's heatwave.

Peel Hunt, which reiterated a target price of 1,000p, is leaving forecasts unchanged even though it said its forecast for annual 15% online growth and a 0.4% decline in store like-for-like sales looked conservative. The broker said:

"Coming into the cooler weather of October, we expect further strengthening, notwithstanding any wider consumer uncertainty."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.