Why gold is (kind of) the world’s new reserve currency

There are very good reasons why the gold price remains near a record high. Here’s how you can use gold, especially if your portfolio is built around US assets.

4th July 2025 09:55

by Theodora Lee Joseph from Finimize

Trust in the US dollar has been wobbling – and central banks have been quietly swapping their greenbacks for gold.

Gold’s appeal isn’t just about price – it’s about independence, neutrality, and safety in a politically unstable world.

Even a small slice of gold in your portfolio can add resilience when the usual safe havens stop feeling so safe.

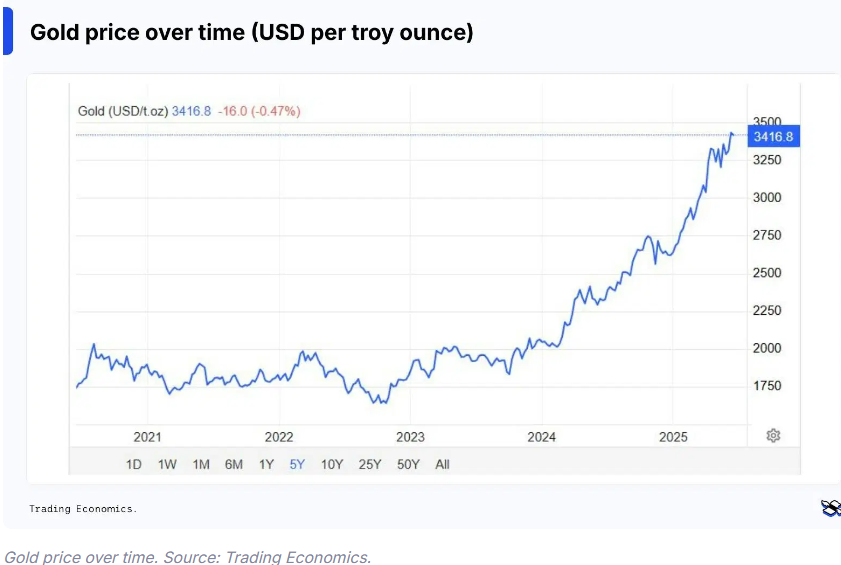

You start to feel like a broken record when you talk about gold hitting all-new highs. I mean, it just seems to keep happening, week after week. And that’s partly because central banks – which used to sell gold – are now buying it, hand over fist. In fact, the shiny yellow metal now makes up about 20% of global central bank reserves, its highest share in 40-plus years.

But this isn’t just about price: it’s about trust. For decades, the investing world put its faith in US assets – mainly, the dollar and Treasuries – as the ultimate safe havens. That trust has started to crack though. Last year, something unusual happened: US stocks, bonds, and the dollar all dropped at the same time. Gold, meanwhile, rose.

That tells us something important: people aren’t just rethinking gold. They’re rethinking what safety means in a world that’s changing – fast. If your portfolio is built around US assets – and most are – it’s time to pay attention.

How the dollar became king

You can think of a reserve currency as the world’s go-to money. Countries use it to trade with each other, settle debts, and stash away savings for a rainy day.

Since World War II, the US dollar has filled that role. It’s been the global default currency – used to price oil and other commodities, settle contracts, and fill the vaults of central banks everywhere. About 60% of global foreign exchange reserves are still held in US dollars. Around 80% of world trade is done in greenbacks. That’s a lot of trust.

It begs the question, why the dollar? And the answer is pretty simple: for most of the past century, the US offered something unique – a huge economy, a strong military, stable politics, and financial markets that were deep and open. Even during major crises, people trusted the US system. The dollar didn’t just work – it felt safe.

Today, most global trade – from oil to coffee – is priced in dollars. And around 60% of the world’s currency reserves are in US dollar assets (mostly US Treasuries, not actual greenbacks). For years, those US government bonds paid reliable income, and investors trusted they’d always get their money back.

Of course, that trust wasn’t doled out automatically – it was earned. But now, it’s beginning to fracture. Enormous deficits, rising debt, political gridlock, and heavy-handed sanctions have made some countries question whether they want to keep so many eggs in the US basket. And that’s part of the reason why gold is having a comeback.

Why the dollar’s grip is loosening

For a long time, the world trusted the US dollar without question. But that’s being tested now from three key directions.

First, geopolitics. The world isn’t as US-led as it used to be. China has been growing more powerful. Russia has been challenging Western rules. And many other countries have been forming new trade and security ties that don’t revolve around the US. That makes relying on the dollar feel more risky. In 2022, America froze Russia’s dollar reserves after the invasion of Ukraine. Many countries understood the reasons why – but the move nonetheless raised eyebrows. If the US can freeze one country’s reserves, what’s to stop it from doing the same to others? Even US allies took notice.

Second, economic policy. America has been using its huge economy more actively as a tool of strategy – launching trade wars, slapping tariffs on imported goods, and restricting exports of sensitive technology. And it’s not just a Republican thing: Democrats have done it too. But for global investors and governments, this adds a layer of uncertainty. It makes the financial system feel more politicized, less neutral.

Third,structural concerns. The US has been spending far more than it earns. Debt has been climbing. Political battles in Washington have been getting sharper. And the country has been losing some of its manufacturing base. All of that raises questions about whether the country can manage its finances over the long run – and whether the dollar will hold its value.

And let me be clear: the dollar’s not going to fade to black overnight – it’s still the most widely used currency in the world. But more and more countries are looking to spread their bets.

Why gold is making a comeback

Gold has always been a paradox – glittery, but often overlooked. It generates no income, pays no dividend, and has no CEO. But in moments of global uncertainty, it becomes uniquely powerful.

Unlike money printed by governments, gold is outside the system. It can’t be frozen, inflated, defaulted on, or hacked. It doesn’t rely on trust in a central bank, a political party, or a trade agreement. It just is – rare, simple, and enduring.

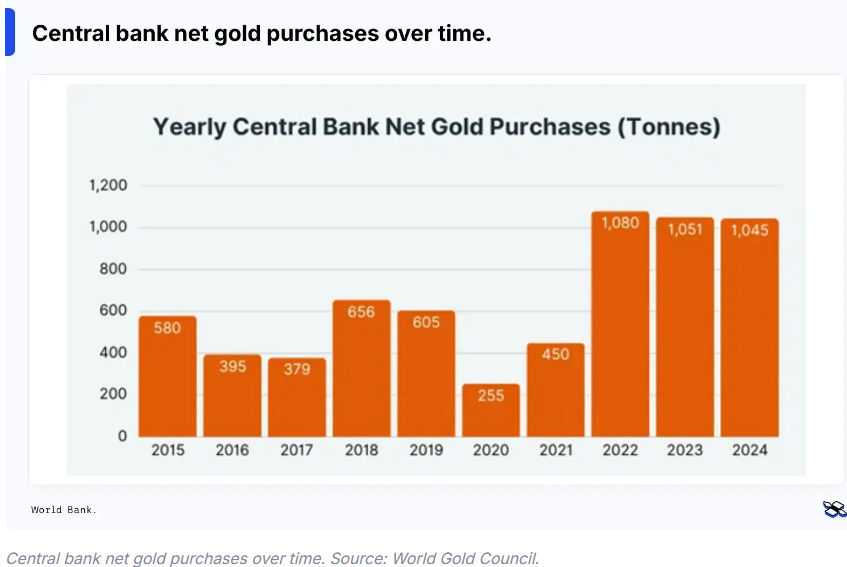

That’s why central banks around the world are hoarding it. Since 2022, they have bought more than 1,000 tons of the metal annually– the most in over half a century. Countries like China, India, Turkey, and Singapore are all building up their gold reserves. Not because they think the world is ending – but because they want something solid they can count on, no matter what happens.

This wave of buying isn’t purely about inflation (though gold’s a known hedge for that). It’s about safety. Gold is one of the few assets that can’t be weaponized. It can’t be turned off, sanctioned, or manipulated. And when trust in financial systems seems to be fading, that’s a powerful advantage. And unlike traditional fiat currencies, its supply grows slowly – at just 1.7% a year on average.

Gold might be old-fashioned – but that’s exactly what some investors are looking for.

Could gold become the new reserve currency?

Gold’s not fast, it’s not digital, and it’s not practical for modern banking. So no, gold won’t replace the dollar as the world’s everyday currency.

But that misses the point.

Gold doesn’t need to become a currency to dominate reserves. Its role isn’t to grease the wheels of commerce, but to anchor the balance sheets of countries and institutions. As trust in the dollar erodes, economies are no longer asking what they can replace it with, but what they can balance against it. And gold is the top candidate – not because it’s perfect, but because it’s neutral, credible, and independent. And because the gold market is pretty small (roughly $12 trillion in total value, compared to over $30 trillion in US Treasury debt alone), even modest reallocations can drive huge price swings. The idea here isn’t that gold becomes all-powerful, but that it becomes… necessary.

What this means for your portfolio

Most retail portfolios have a heavy tilt toward America’s assets – meaning, US stocks, bonds, dollars. And that’s worked great in a world where the dollar was unchallenged and markets were calm. But things can change (and in some ways, they already have). If trust in the dollar continues to fade, individual portfolios that are built around it could take a hit.

That’s where gold can help. It often moves in the opposite direction of the dollar, especially during times of stress. It holds its ground when inflation, political risk, or financial instability start to bite. And it doesn’t behave like stocks or bonds – which makes it a great diversifier.

You don’t need to go all-in on the metal, like Scrooge McDuck. Even a 5% to 10% allocation in your portfolio can make a real difference – helping cushion losses in rough markets and reducing your dependence on any single system.

And there are lots of ways to invest. Physical gold gives you full control, though it comes with storage costs. Gold ETFs are easier to trade and manage. Gold mining stocks can offer more upside, but they’re also more volatile – so they’re best in smaller doses.

Another smart move is to diversify your currency exposure. If your whole portfolio is priced in US dollars, any weakness there will hit you hard. But by owning assets in other currencies – like the Aussie dollar, Canadian dollar, Swiss franc, or even the Chinese yuan – you give yourself more balance. Some global bond funds and local-currency emerging market debt can also offer income without tying everything to the US.

The goal here isn’t to run from risk – it’s to build a portfolio that can handle it.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of Aberdeen.

finimize is a newsletter, app and community providing investing insights for individual investors.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.