Why Goldman Sachs stock should come good soon

The new chief has made a reasonable start, there's short-term upside potential and shares are good value.

24th July 2019 12:25

by Rodney Hobson from interactive investor

The new chief has made a reasonable start, there's short-term upside potential and the shares are good value.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Investment bank Goldman Sachs (NYSE:GS) recently reported better than expected second quarter profits but that has not been reflected in an upturn in the share price.

Finally the shares have started to move upwards but there is still a buying opportunity for those who believe that, despite the financial crisis 10 years ago, large banks generally bounce back smelling of roses whatever happens.

Goldman gained notoriety as the "giant squid" with tentacles into everywhere. That should be an attraction for investors, though, as it is a reflection of the investment bank's strength and wide range of business across the globe. David Solomon, who became chairman and chief executive last year, has made a reasonable, if so far unspectacular, start. Much depends on how he steers Goldman through the current choppy waters of global economic uncertainty.

Financial figures so far this year have admittedly been mixed, showing lower earnings - but not as big a fall as analysts expected.

Earnings fell 6% from the previous second quarter to $2.42 billion while net revenues slipped 2% to $9.46 billion, although that figure was well ahead of the average $8.8 billion forecast. Earnings per share were $5.81 against expectations below $5. In other words, Goldman Sachs is coping reasonably well in tough markets.

The main setback was in investment banking, where revenue fell 9%, weighed down by "significantly lower net revenues in debt underwriting", although even this fall was not as bad as analysts had predicted.

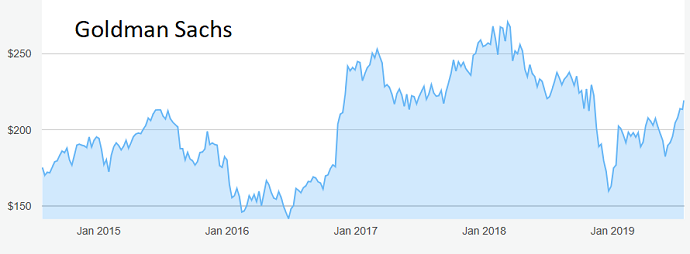

Source: TradingView Past performance is not a guide to future performance

Revenue also eased in investment management and institutional client services, where Goldman Sachs said business executed on behalf of clients in fixed income, currency and commodities "continued to operate in an environment characterised by generally low levels of volatility and low client activity".

On the positive side, the investing and lending unit reported a 16% year-on-year jump in revenues to $2.53 billion, the highest quarterly performance in eight years. Also, all sections fared better than in the first quarter, when group net revenue slumped 13% and the investment side was disappointing.

The latest results were issued just after Goldman passed the first stage of the US Federal Reserve's annual stress test to ensure money lenders can sustain a major economic recession.

Solomon says he is sufficiently encouraged by results for the first half of the year. He promises to continue to invest in new businesses and in attracting a broader range of clients.

He says:

"Given the strength of our client franchise, we are well positioned to benefit from a growing global economy. Our financial strength positions us to return capital to shareholders, including a significant increase in our quarterly dividend in the third quarter."

Reports suggest that he plans to merge four separate units that invest in private companies, real estate and other unlisted ventures to create a new private equity business with assets of $140 billion as a smaller rival to KKR and Blackstone.

The shares slumped from a peak of $270 in March last year to a low of $160 just before Christmas. The previous floor was set at $140 three years ago.

They now trade at around $219 and are highly unlikely to slip back below $200 unless there is some seriously bad news. The short-term potential upside of at least $30 looks more likely to happen.

The yield is admittedly a little disappointing at an historic 1.5% but the promise of a decent increase in the dividend in three months' time gives a prospective figure above 2% and the price-earnings ratio is particularly undemanding at 8.9.

Hobson's choice: Buy below $225 for the long term. Even if there is some weakness in the share price over the next three months Goldman should come good soon.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.