Why the government pursuing inflation is not something investors should worry about

It is unlikely inflation would help to reduce the UK government's debt burden.

30th June 2020 11:10

by Tom Bailey from interactive investor

It is unlikely inflation would help to reduce the UK government's debt burden.

Governments around the world have opened the fiscal taps to try and protect against the economic fallout of Covid-19.

In the case of the UK, this has meant a budget deficit at levels not seen since the Second World War. As a result, the UK’s debt to GDP ratio has now risen to over 100%, for the first time since the 1960s.

While this ratio will come down once GDP starts to pick up as lockdown measures are eventually eased, there is concern in some corners about what this large build-up in debt will mean for the economy and for government policy.

Some fear it will result in a new round of austerity, with the government pursuing a combination of spending cuts and tax hikes.

Others, however, note that the government knows such policies would be unpopular and will likely avoid them. Instead, some fear, it may go down the route of encouraging or turning a blind eye to inflation to lessen the public debt burden. Inflation, after all, reduces the real value of debt.

But those who are concerned about government-fuelled inflation need not worry. Principally, it is unlikely to pursue inflation-based debt relief simply because such a solution would not work very well.

First, the government itself is not immune from inflation. State welfare costs are often indexed to inflation, with the state pension’s triple-lock being the most obvious example. That means that higher inflation costs result in a higher welfare bill.

The government is affected by inflation in other ways too. The state, after all, is also a consumer of goods and services, so it too pays cost increases. For example, an increase in prices will increase the cost of labour and material inputs for government construction projects. Higher inflation means a higher bill for the public sector.

But most importantly, the structure of the UK’s stock of debt means it is highly questionable how successful a policy of inflation would be.

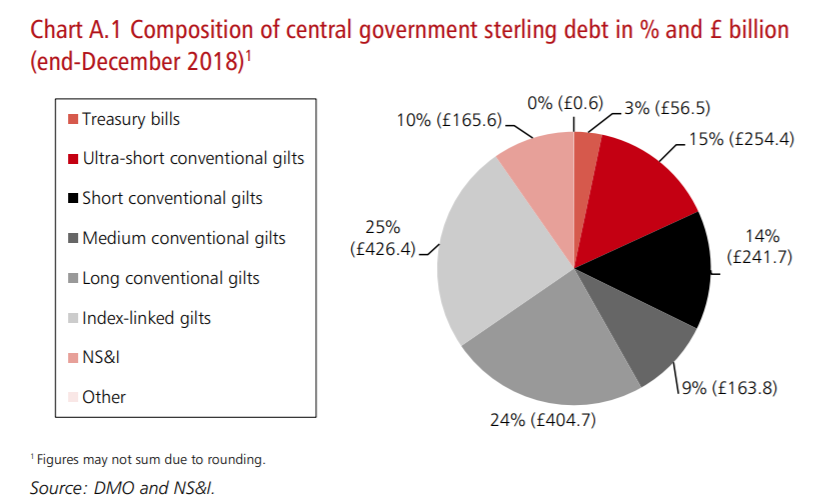

First, according to the Treasury’s 2019-20 Debt Management Report, 15% of the UK’s debt stock is ultra-short conventional gilts. This means they will mature within the next three years. Unless the UK starts to run a budget surplus, those bonds will have to be rolled over – in other words, the government will pay off those bonds by issuing new bonds.

When the governments issue new bonds, the market usually demands a yield that provides a return above expected inflation rates. So higher anticipated inflation means the market will demand higher interest rates on new gilts issued.

It stands to reason, then, that if inflation in the UK were to start increasing at any meaningful rate, the debt-servicing costs of the UK government would likewise go up.

Source: Debt Management Report 2019-20

But on top of that, the UK has a large stock of index-linked gilts (25%). These bonds, first launched in the 1980s, are explicitly designed to protect their investors against inflation. When inflation rises, both the capital and the coupon rise with it.

This makes the prospect of inflating away any such debt impossible. Again, inflation would merely increase the government’s debt-servicing costs.

Covid-19 has brought forward many new economic risks. Among these is the prospect of an end of the era of great moderation and a return to higher inflation.

Commentators have identified several factors that could result in higher inflation, as we explored in the latest edition of Money Observer.

Time will tell whether those raising the alarm about inflation turn out to be correct or not. However, anyone expecting inflation in the UK to come about from the government pursuing a policy of inflating away their debts will be sorely mistaken.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.