Why high earners must get savvy about tax breaks

Exclusive research finds those earning over £150k now pay considerably more tax than a decade ago.

18th February 2019 13:02

by Kyle Caldwell from interactive investor

Exclusive research finds those earning over £150k now pay considerably more tax than a decade ago.

Exclusive research for Money Observer has revealed how much more tax those earning more than £150,000 now pay compared with a decade ago.

The research, complied by Wealth Club, highlights the importance of higher earners being savvy in making use of tax breaks such as ISAs, venture capital trusts (VCTs) and enterprise investment schemes (EIS).

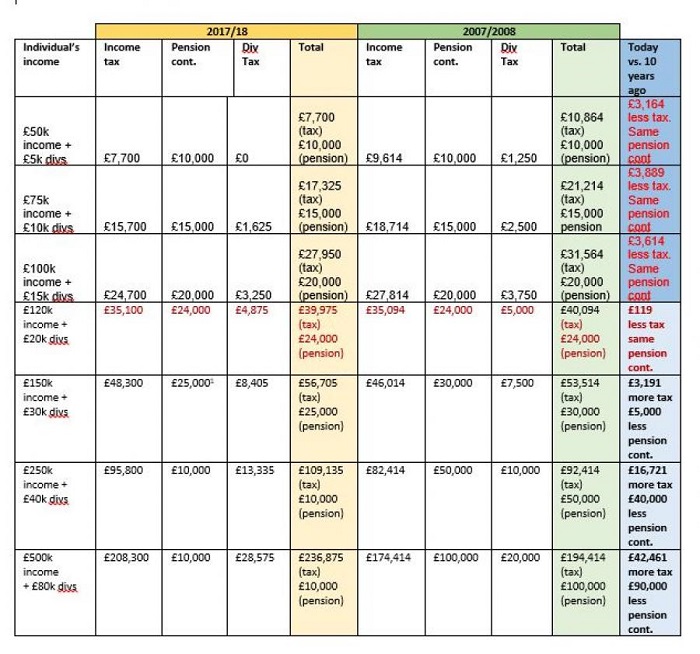

Wealth Club crunched the numbers for various income bands and applied an annual gross personal pension contribution of 20%. It also added dividend payments that rise in line with an individual's income, with the dividend income taxable (not inside an ISA wrapper).

As the table below shows, those in the £50,000, £75,000, £100,000 and £120,000 income bands are paying less tax compared with a decade ago, owing to income tax band increases and uplifts in the personal allowance (which has jumped from £5,225 in the 2007-08 tax year to £11,500 for the 2017-18 tax year). In addition, there has been no negative impact to pension contributions for those in this income band range.

But, for those earning £150,000 or more, the picture is markedly different. Those who earn this amount are, under the assumptions used in the calculations, paying £3,191 more tax, as the table shows. Those who earn even more are worse off.

Pensions have also become less flexible, as the annual allowance has been cut back sharply since the 2011-12 tax year. At one time, it stood at £255,000, but it was reduced to £50,000 from the 2011-12 tax year and to £40,000 from 2014-15.

Moreover, those with an income above £150,000 now have further restrictions on how much they can save into their pensions. Under the taper system introduced in the 2016-17 tax year, the £40,000 annual allowance is reduced by £1 for every £2 of income above £150,000, with a maximum reduction of £30,000. Therefore, anyone earning more than £210,000 can pay only £10,000 into a pension each year.

In addition, the dividend tax allowance has become less generous, and now stands at £2,000.

Alex Davies, founder and chief executive of Wealth Club, says:

"The reality is that those who earn over £150,000 have been squeezed, which is why VCTs and EIS are becoming more popular. They are one of the last relatively simple and tax-efficient investments for wealthier investors."

VCTs offer an attractive 30% initial tax relief on investments of up to £200,000 a year. Due to a recent rule change, VCT investments have become riskier, as managers are now required to invest in earlier-stage companies, mainly those that have been trading for less than seven years. In addition, the investable universe for VCTs has become more limited, with investments in management buyouts excluded and in asset-backed firms restricted.

EIS schemes invest in even younger companies, so are riskier than VCTs. Those who invest for a minimum period of three years also benefit from 30% tax. Capital gains tax from other investors can be deferred using EIS, while inheritance tax liabilities can also be trimmed.

To see a larger version of this table, please click here.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.